New buying the dip in Bitcoin

December 23, 2022 @ 13:43 +03:00

Market picture

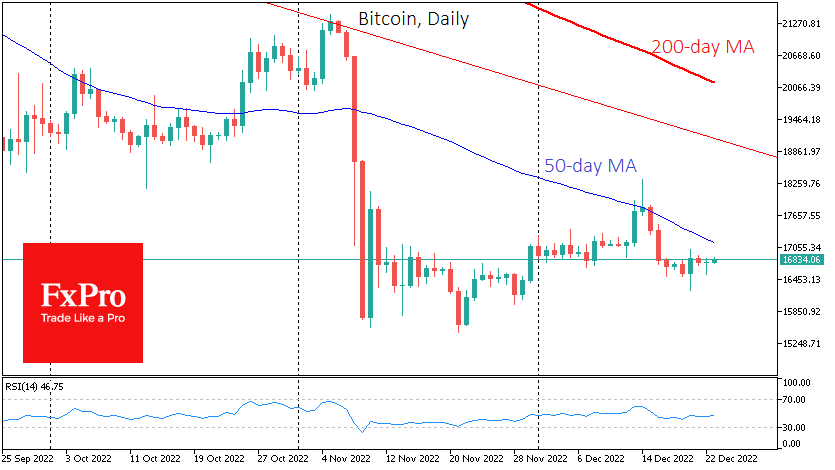

Bitcoin’s chart remains a horizontal straight line with several pulsations down and up over the past five weeks. The rate remains near $16.8K as the intraday dip of 1.6% to the $16.55K area was quickly redeemed at the close of trading in the US.

Total crypto market capitalisation remains near $810bn – one-third of levels one year ago. The market may need a real disaster, such as strict regulation for further declines. And without such news, current levels remain attractive for buying on Bitcoin declines. So many individual projects carry existential risks (which Bitcoin doesn’t), and it takes building a broadly diversified portfolio of 100 or 500 coins to spread the risk across the portfolio.

Meanwhile, the 50-day moving average in BTCUSD has fallen to $17.1K. The bulls’ task of giving a broad trend signal to break the bearish trend is getting easier. But the market needs more liquidity and faith in long-term potential amid this year’s problems with cryptocurrencies and fears of regulation.

News background

According to a survey by Accenture, an IT consulting firm, only 20% of its clients invest in cryptocurrency. Of those who have already purchased digital assets, 28% are set on holding them long-term. Some 16,000 respondents took part in the study.

The US Securities and Exchange Commission (SEC) recognised the token of the bankrupt FTX exchange as a security. FTX management manipulated the price of the FTT token by buying it in large volumes on the open market and inflating the price.

In Brazil, bitcoin could be used as a means of payment and as an investment asset. The law that gave it to the country’s president signed that status.

The FxPro Analyst Team