New Bitcoin FOMO: investors are looking for takeoff points

July 31, 2020 @ 15:01 +03:00

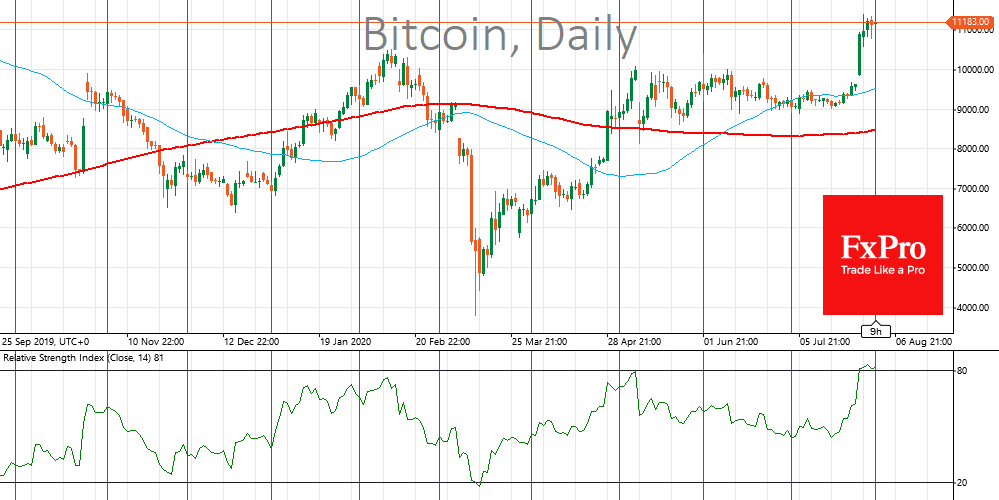

This week was the first since the March collapse that the crypto market attracted so much attention and hopeful prospects. Bitcoin is currently stuck at around $11K with a price high of $11,400. In the last seven days, the benchmark cryptocurrency has grown by 15%. The top 10 altcoins also showed an 11-20% increase over the week. The total capitalization of the crypto market grew by $39bn to over $300bn, where it stabilised about a year ago.

The Crypto Fear & Greed Index is in “extreme greed” mode, indicating that the first digital currency is in the overbought zone. However, in the current market situation, any asset can defy gravity for no apparent reason.

During the working week, all major institutional platforms published data on record growth in the demand for investment products related to Bitcoin. Bakkt platform (futures on Bitcoin with physical delivery) published record growth in the number of contracts on July 28th to 11,506, which could have contributed to the increase in Bitcoin’s price to $11,400. At the beginning of the week, the CME institutional exchange announced 25,493 futures contracts, a 55% increase in daily trading volume to $1.32 bln. Grayscale Investments crypto fund announced a $1 bln increase in assets under management in less than two weeks. Bitcoin (BTC) and Ethereum (ETH) are certainly attracting the most attention of investors at the moment.

Ethereum (ETH) is growing less on the ground of the speculative institutional funds’ inflow and more on the fundamental internal factors. This can be considered as a more reliable basis for future growth. Ethereum founder Buterin proposed to accelerate the transition to ETH 2.0 by launching a simplified client network. Besides, decentralized financial applications (DeFi) are showing record activity with a 4-fold increase to $4 billion so far this year. These funds are blocked within the platform, which creates a natural balance between supply and demand in favour of the token’s price growth.

For Bitcoin, the confusion of market participants about prospects has become a divergence point. The first cryptocurrency showed its “variable correlation” ability by switching from the stock market to the performance of precious metals. It had done so in the past, but now this process is more pronounced. The crypto market is relatively small in its current state, so a change in the direction of institutional investors’ funds may well cause a sharp turn in the correlation. Against the backdrop of rising prices and demand from institutional investors, we are witnessing new forecasts about the “sky-high” prospects for Bitcoin. Still, one should remember that the launch of futures in December 2017 was the starting point for the crypto winter, and all hopes for institutional funds should be considered in this light.

The FxPro Analyst Team