Luna Foundation bought $1B in Bitcoin

March 28, 2022 @ 15:40 +03:00

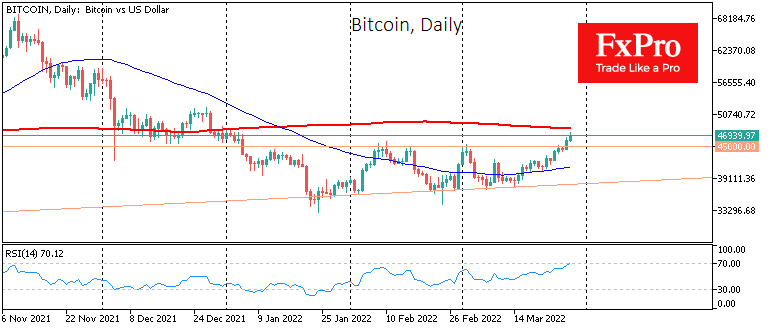

Bitcoin rose 9.1% over the past week, ending it at around $46,100. Ethereum added 9.5%, while other leading altcoins from the top ten rose in price from 3.2% (XRP) to 27.4% (Cardano). The exception was Terra (-0.4%).

According to CoinGecko, the total capitalization of the crypto market increased by 9.9% in a week, to $2.14 trillion. The Bitcoin Dominance Index added 0.2% to 40.6%.

The Cryptocurrency Fear and Greed Index rose 11 points to 60 in one day, moving into greed territory.

Bitcoin rose for the second week in a row against the backdrop of strengthening stock indices. On Sunday, BTC broke through strong resistance around $45,000, which reversed its downward movement several times in February and early March. The technical picture favours further gains as Bitcoin climbed above the 100-day moving average (MA) for the first time since early December and heads towards the 200-day MA ($48,200).

A possible driver of the uptrend in BTC are rumours about the intentions of the non-profit organization Luna Foundation Guard (LFG) to invest in bitcoin. On March 27, it became known that LFG bought more than $1.1 billion worth of coins to ensure the stability of the Terra USD (UST) algorithmic stablecoin.

The best dynamics among altcoins was demonstrated by Cardano against the backdrop of the announcement of ADA staking by the Coinbase crypto exchange.

Meanwhile, well-known crypto critic Peter Schiff again criticized the cryptocurrency, comparing it to a financial bubble and calling it stupid for people to save their savings from inflation by buying BTC. According to Schiff, cryptocurrencies have no real value and are backed by people’s trust in the same way as fiat currency.

The FxPro Analyst Team