Institutionals are slowing crypto’s rise

February 15, 2023 @ 13:10 +03:00

Market picture

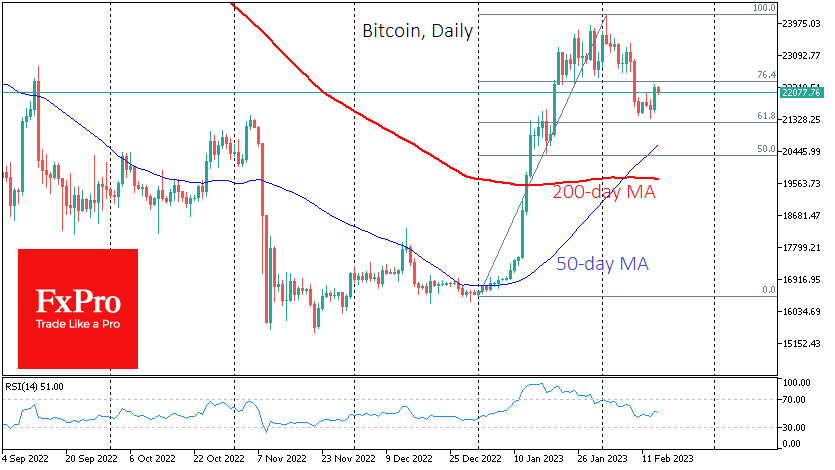

Bitcoin has gained 1.5% in the past few hours to trade at around $22,000. The total market capitalisation of cryptocurrencies rose 2.3% to $1.03 trillion. In line with the Nasdaq100, bitcoin outperformed, falling less and strengthening more.

Once again, we are entering a phase where institutions are the brakes rather than the fuel of crypto’s growth. This balance of power is a sure sign of retail investor optimism. However, this sentiment could quickly fade if the sell-off in equity markets continues.

The local technical picture suggests that bitcoin has most likely reached its upside correction targets from the beginning of the year, paving the way to the upside. However, it is worth keeping a close eye on the traditional markets, as a reversal to the downside could send the crypto back into sell-off mode.

Paxos announced that it would stop issuing Binance USD (BUSD) stablecoins as of 21 February due to the SEC’s designation of the asset as an unregistered security. Capital outflows from BUSD exceeded $360 million.

The capitalisation of Binance USD has fallen below $16 billion. Against this backdrop, Tether’s share of stablecoins has surpassed 51%. According to Nansen, traders also withdraw funds from Binance at the highest rate in three months.

News Background

The Aave Lending Protocol community will consider a proposal to freeze the use of Binance USD (BUSD) as collateral amid pressure from the SEC on Paxos.

According to Bloomberg, the US Securities and Exchange Commission (SEC) will make it much harder for cryptocurrency hedge funds to operate. Private equity firms and pension funds could also fall under the restrictions. The new rules will make it more difficult to become qualified custodians which are responsible custodians of crypto assets.

Crypto investor platform Bakkt has decided to suspend its retail application and focus entirely on corporate clients.

Changpeng Zhao, head of Binance, described Dubai (UAE), Bahrain and France as bitcoin-friendly countries and urged cryptocurrency entrepreneurs to consider relocating there.

The FxPro Analyst Team