FxPro: Trade wars and protectionism helps cryptocurrency in the long run

January 08, 2019 @ 13:25 +03:00

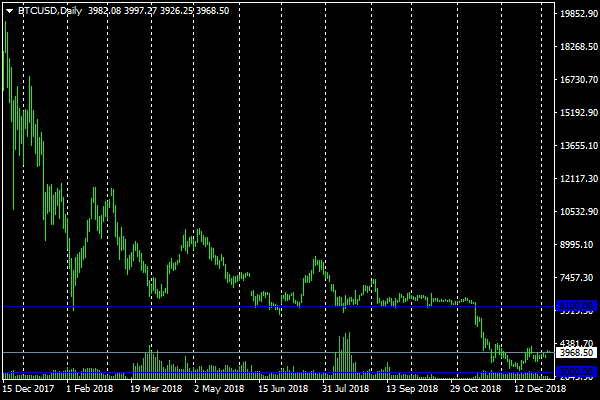

For cryptomarket the holidays passed without any significant upheavals. Unlike last year, cryptocurrency did not attract meaningful demand. Bitcoin continues to fight for the threshold $4k. Short-term impulses of growth or decline cause a similar altcoins dynamics. As of the morning of January 8, the BTC is losing just over a percent and is trading at around $4,000. The biggest altcoins lose 2-4%.

Market bulls are pinning their hopes on the launch of the Bakkt cryptocurrency platform, they are waiting for the SEC decision on the VanEck application to launch Bitcoin ETF, as well as BTC futures from Nasdaq. Positive decisions can provoke a significant inflow of liquidity, while new postponements or refusals can reinforce negative sentiments and strengthen bearish trend.

The uncertainty surrounding the cryptocurrency sector regulation, the absence of significant trading or business ideas for large participants are decisive for current sluggish market.

In the longer term, gloomy global economic and geopolitical prospects may have a positive effect on demand for cryptocurrencies. The policy of trade wars, protectionism, technological isolation and increasingly tight control over financial flows may well become a pillar for the growth of interest in digital assets, as it was 10 years ago after disappointment in the common financial system.

It is unlikely that in the near future digital currencies will pass through a full cycle of circulation within network without the need to go to fiat, but such targeted actions of governments against globalization clearly form the foundation for the cryptocurrencies demand.

Alexander Kuptsikevich, the FxPro analyst