Europe plans to launch a blow to the crypto market

September 21, 2020 @ 15:15 +03:00

Over the next few years, the crypto community will face major changes in the legal sphere. Monetary authorities needed time to analyse a new sector. According to Reuters, the EU authorities will introduce new rules to regulate the crypto sector by 2024. In general, we won’t hear any calls for bans, but the rules themselves can be formulated in such a way that they can negate most of the existing cryptocurrencies’ competitive advantages.

The emergence of crypto legislation will be a fertile ground for launching a digital Euro. Probably, in this setup, the EU authorities will simply modernise their banking system by absorbing the advantages of digital currencies and eliminating the undesirable aspects. As a result, cryptocurrencies, which were created to oppose the traditional banking system, gave officials the technology for total financial control. The global course to de-anonymise the financial life of citizens means a complete transition to cashless forms of payment. Thus, EU citizens will receive instant and relatively cheap payments in exchange for a complete loss of anonymity.

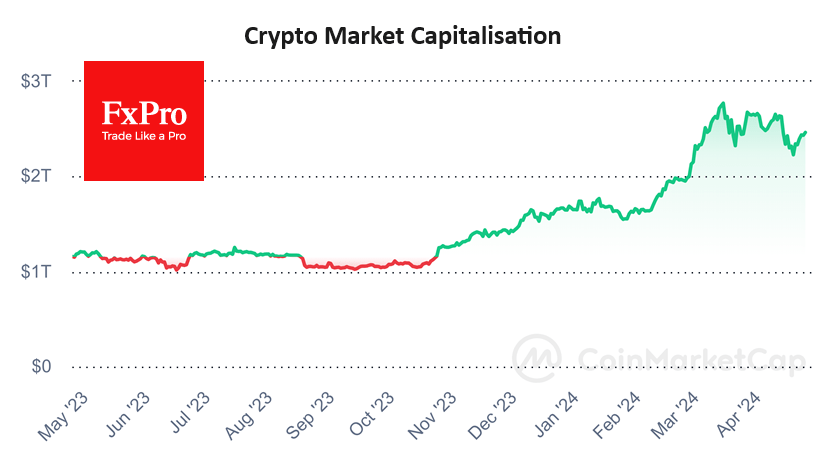

How will this affect Bitcoin and other cryptocurrencies, including stablecoins? The sector is in desperate need of retail money, small p2p payments in the EU could increase the capitalization of digital currencies. But a digital Euro crypto wouldn’t be a partner of existing cryptocurrencies; the monetary authorities will simply try to lead the pack.

The shadow sector, which has become the original impetus for the cryptocurrencies development, will be forced to look for ways to move away from control, and there is no doubt that such solutions will be found. The main vulnerability of cryptocurrencies is the need to convert them into fiat money; this is the stage where the owner is identified.

The likely solution will consist of multi-level de-anonymisation cycles with access to national currencies through developing countries, where technological solutions in the financial sector are rapidly developing but regulation is still weak. African countries are likely to become the new global crypto offshore jurisdictions, as well as a developing part of the Asian region.

The FxPro Analyst Team