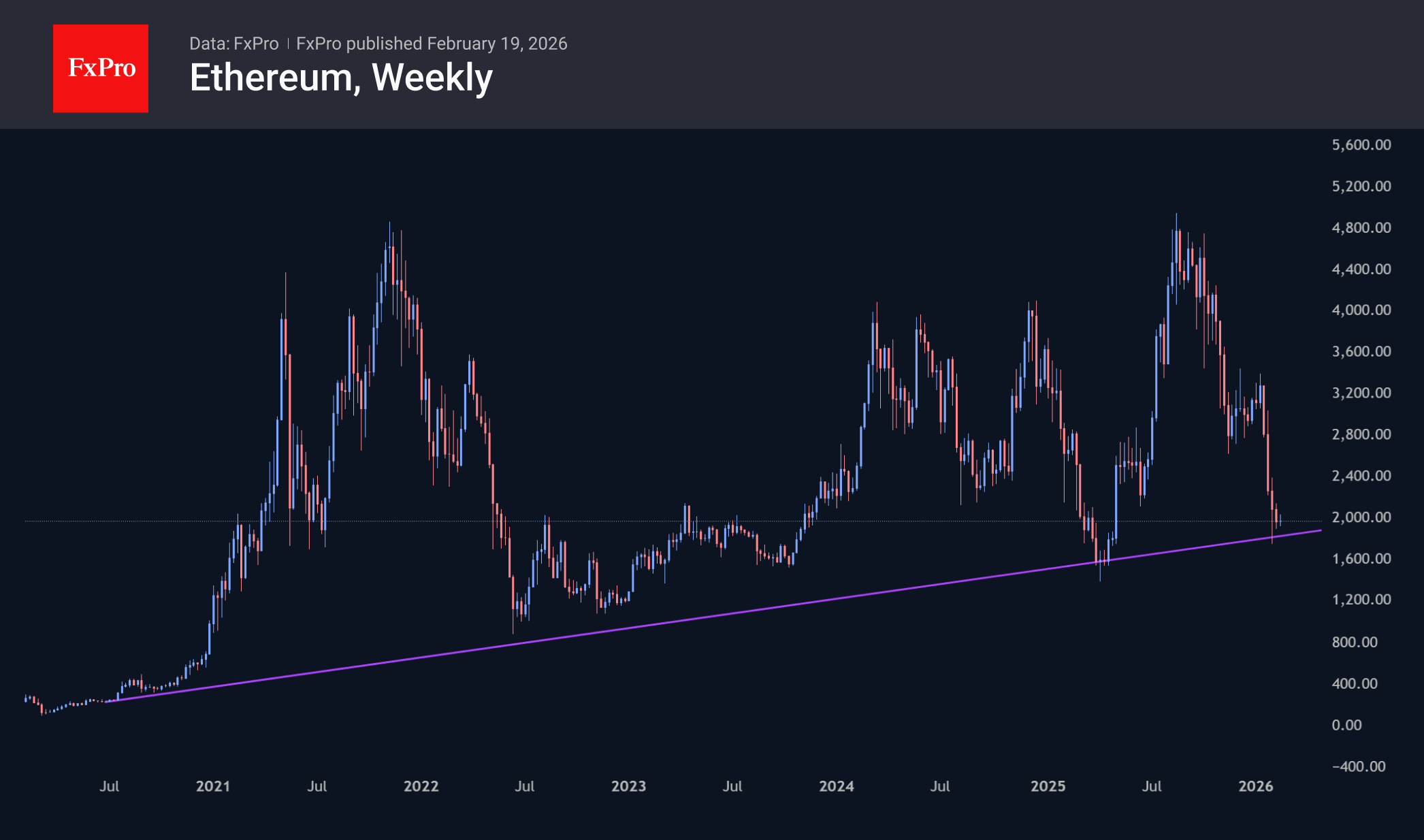

Ethereum is resting on a 6-year trend

February 19, 2026 @ 13:48 +03:00

Market Overview

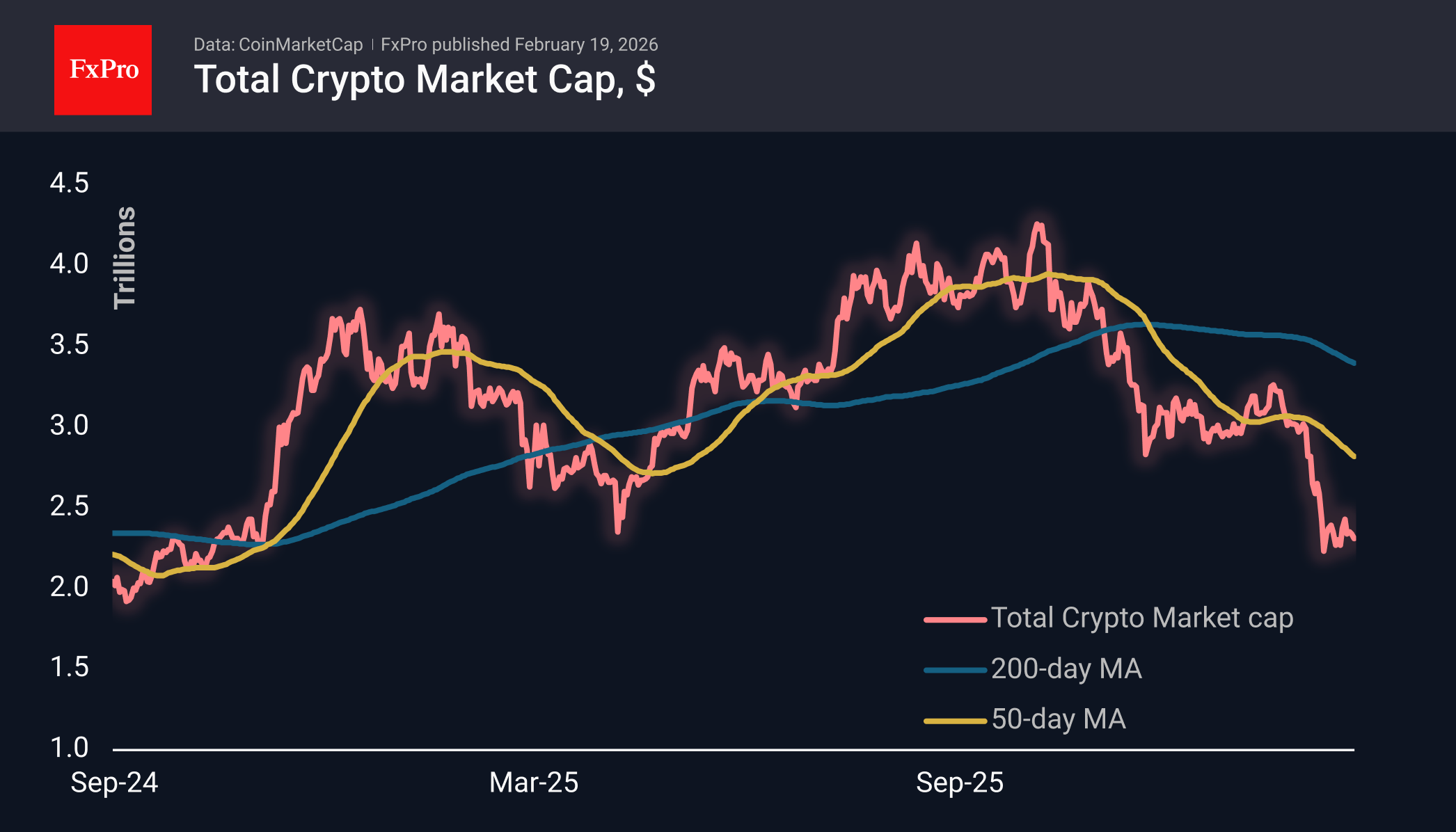

The crypto market cap fell by more than 1% in 24 hours to $2.31 trillion, approaching last week’s lows but leaving the market 5% above its low point on 6 February. The market’s range continues to narrow, suggesting that volatility is likely to soon break out of the $2.3-2.4T range. Given the previous dynamics and the increasingly cautious nature of growth in the US stock markets, there is a greater chance of an early update of local lows with a dip to the levels we saw in the second half of 2024.

Bitcoin is trading just above $67K, losing slightly under 1%, which is better than the market, as active selling has moved to altcoins outside the top five. BTC is trading at the bottom of the downward range of the last week and a half.

Ethereum is resting on a support line that originated in 2020 and was touched in early 2024 and at the February lows. This global trend line now also coincides with the area around $2,000, which further reinforces its significance. However, for such a serious event as the breakdown of the 6-year support, confirmation in the form of a failure below the recent lows at $1,500 is required. Until then, bulls may remain hopeful, attracting long-term buyers on dips.

News Background

The indicator of Bitcoin inflows from large holders to the Binance exchange has reached record levels, indicating increased pressure on BTC from large players, according to CryptoQuant.

The current state of the crypto market resembles the final stage of the 2022 bear phase, which was followed by a protracted period of consolidation, according to K33.

Bitcoin has only entered the first phase of the bear cycle, according to Willy Woo, co-founder of the CMCC Crest investment fund. The second phase will be associated with a fall in global stock markets, and the third will mark a period of stabilisation.

Strategy bought 2,486 BTC ($168.4 million) over the past week at an average price of $67,710 per coin. Strategy now owns 717,131 BTC, purchased for $54.5 billion at an average price of $76,027 per bitcoin.

Japan’s Metaplanet reported a net loss of $619 million for 2025. The negative financial result is due to the revaluation of the company’s Bitcoin reserves.

Ethereum’s share of staking exceeded 50% of the total supply of the asset for the first time in history, according to Santiment. The queue for Ethereum staking is near historic highs — 3.8 million ETH (waiting time — 67 days). BlackRock has taken the first step towards launching a staking Ethereum ETF in the United States.

The Founders Fund, a venture capital fund owned by billionaire investor Peter Thiel, has sold all of its shares in the DAT company ETHZilla, one of the largest corporate holders of Ethereum. Back in August, Thiel’s share was 7.5%.

Updated rules from the US Internal Revenue Service (IRS) have scared American crypto investors. Starting in 2026, all US-licensed crypto exchanges will be required to disclose information about their clients, from the volume of investments to the profits or losses they have.

The FxPro Analyst Team