Ethereum as a canary in the coal mine

January 29, 2025 @ 14:25 +03:00

Market Picture

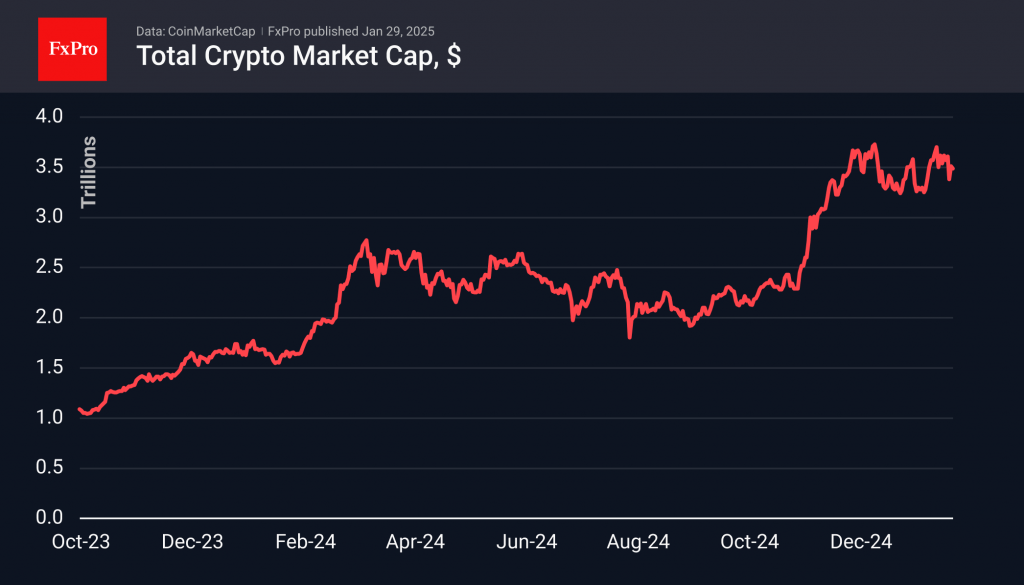

The crypto market is not yet showing sustained growth. The positive momentum seen on Tuesday morning was replaced by selling pressure. The cryptocurrency market quickly recovered to the $3.50 trillion level, where it consolidated after reaching the $3.6 trillion mark late last week.

Bitcoin gained 2% on Wednesday, trading around the $102.5K mark. The previous four daily candles closed with declines, undermining investor confidence. Nevertheless, bitcoin remains above its 50-day moving average, and the current lull can be attributed to risk aversion ahead of the Fed meeting.

Ethereum bounced off the $3,000 level on Wednesday morning, near the 200-day moving average and 61.8% retracement level of the November rally. Ethereum may serve as the canary in the coal mine: a significant drop below the $3,000 mark could trigger a widespread sell-off in crypto assets.

News background

Experts at Standard Chartered see Bitcoin’s fall caused by DeepSeek as a buying opportunity ahead of potential market stabilisation. The Fed meeting and reports of high-tech companies on 30 January will play a key role in the dynamics.

Over the past week, MicroStrategy sold shares and additionally bought 10,107 BTC for about $1.1 billion at an average price of about $105,596. The company’s balance sheet shows 471,107 BTC purchased for $30.4 billion at an average price of $64,511 per coin.

Jim Cramer, former hedge fund manager at Cramer & Co. and host of the Mad Money show, said he’d rather invest in Bitcoin than MicroStrategy stock. MicroStrategy accounts for 76% of public company bitcoin reserves and 2.24% of its overall supply.

Tuttle Capital Management has filed a proposal with the SEC to register ten crypto-ETFs with leverage of 2x, including meme-based products TRUMP and MELANIA. Other ETFs will be based on XRP, Solana, Litecoin, Bonk, BNP, Cardano, Chainlink and Polkadot.

French law enforcement authorities have launched a judicial investigation against Binance, accusing the platform of money laundering and drug trafficking.

The FxPro Analyst Team