Ethereum and Solana get support

June 20, 2024 @ 14:38 +03:00

Market picture

The crypto market added 1% in 24 hours to $2.4 trillion, supported by positive momentum in Bitcoin (+0.9%) and interest in Ethereum (+2%). Top altcoins are mostly adding to the levels of the day before except for falling Solana (-1.6%), but it too has been rising over the last hours. Toncoin is adding 4.9% over a day and 14% in 30 days, second only to Ethereum (+16%) in the top 20.

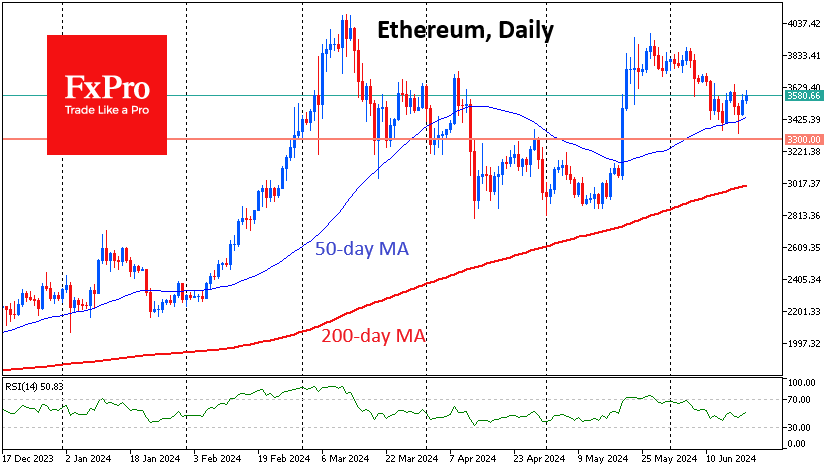

Technically, Ethereum has already received its second support this month on the brief dip to the 50-day moving average. This looks like the market’s commitment to the bullish trend that started last month. The news trigger for the rise was speculation about the likely start of trading in spot ETFs on the coin from July 2nd.

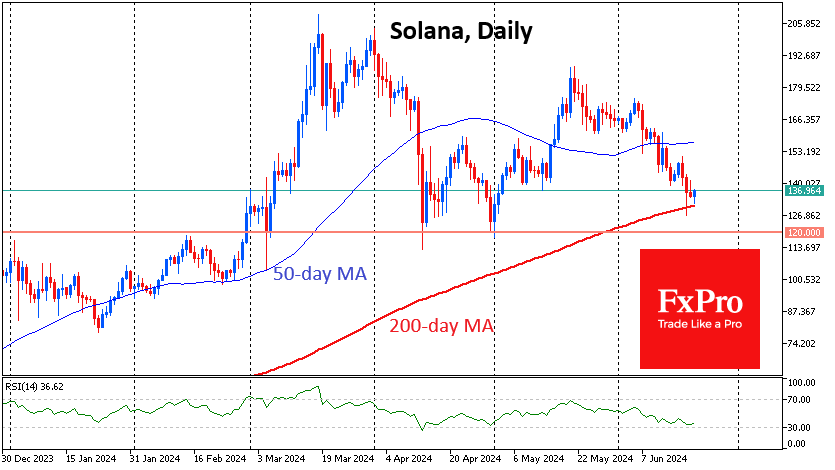

Solana is probing support at the 200-day moving average. It managed to push back from this level to nearly $130. The focus now is on whether this rise will continue. This is the fourth time since March that the bulls have defended this area. But the very fact of constant returns to it speaks about the bears’ persistence.

News background

According to ETC Group, cryptocurrency hedge funds are reducing the share of bitcoin in their investment portfolios. Hedge fund investment in BTC has fallen to its lowest level since October 2020.

CryptoQuant noted that traders are in no hurry to replenish their BTC holdings, whale demand remains weak, and the volume of stablecoins is growing at the slowest pace since November 2023. Bitcoin has fallen below the aggregate breakeven level of speculators (~$65,800), which could trigger a continued decline to $60,000.

Santiment estimates that almost all major cryptocurrencies have entered the “undervalued” zone.

The US SEC has dropped its investigation into ConsenSys for recognising Ethereum sales as securities transactions. The SEC took the step after ConsenSys sent a letter asking for clarification of the asset class in approving spot ETH-ETFs.

Arkham pointed out that a German government-affiliated wallet transferred 6,500 BTC (~$425 million) to a new address, some of which ended up on exchanges. The move has raised fears in the community of negative consequences for the exchange rate of the first cryptocurrency.

The FxPro Analyst Team