Ethereum and Bitcoin are ready to dive

September 22, 2023 @ 12:37 +03:00

Market picture

The crypto market capitalisation has fallen to $1.056 trillion, losing around 0.9% in the last 24 hours. The main pressure on the market came from outside, as equity indices fell, with the US market losing a further 1.8% on the Nasdaq, returning to August lows. It should be noted that against such an unfavourable external backdrop, the consolidation of cryptocurrencies near the levels seen at the beginning of the week looks like a vote of confidence from crypto enthusiasts.

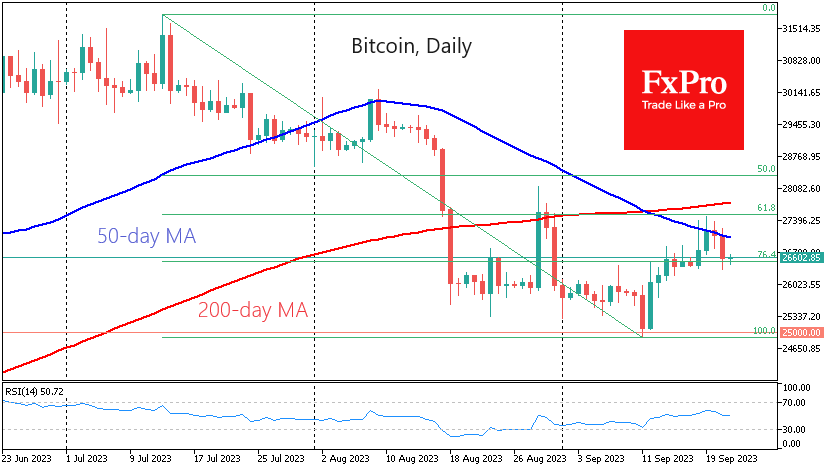

The bitcoin price has returned to $26.6, erasing the mini pump at the beginning of the week. The ability to hold on to last week’s support looks like a positive signal. On the other hand, we saw earlier this week that bears control the market. But they aren’t in a hurry yet.

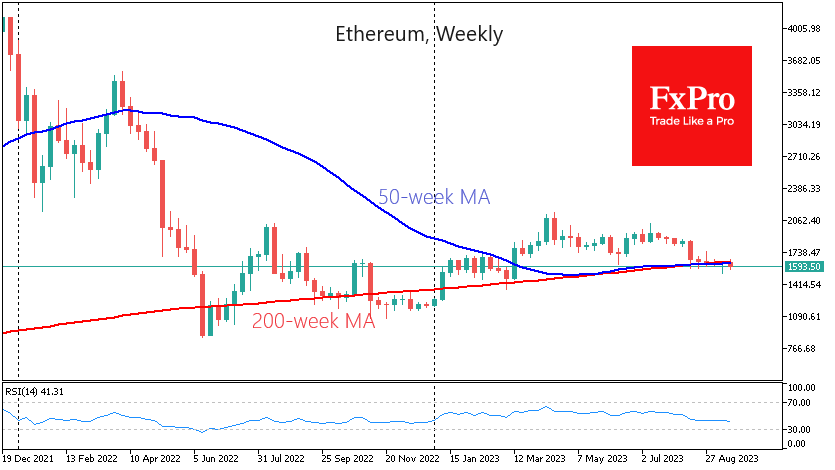

Ethereum looks weak. After five weeks of trying to stay above its 50- and 200-week moving averages, the digital silver is in danger of closing below these lines and $1600 this week. The following essential lines of defence look to be the $1500 and $1200 levels, where buyers came to the coin’s rescue in March and December last year.

News Background

Bloomberg notes that Bitcoin continues to evolve as a global payment network while carbon emissions fall. That’s what’s needed to increase adoption of the world’s first cryptocurrency.

The court allowed bankrupt cryptocurrency exchange MtGox to extend its deadline to repay creditors until 31 October 2024. These reports supported bitcoin exchange rates earlier in the week, removing a potential overhang of crypto assets from the market. MtGox’s creditors have been expecting repayment for nearly a decade, and the deadline has been pushed back several times.

According to the Wall Street Journal, Tether has increased its USDT lending again despite promising investors it would reduce it to zero by 2024. According to the paper, Tether’s inconsistent lending policy is causing serious concern among crypto investors.

Binance has warned of a possible delisting of stablecoins in Europe. This is because the exchange’s lawyers have not yet found a way to meet the requirements of the new MiCA rules adopted in the European Union.

The FxPro Analyst Team