Early flight to the moon

February 29, 2024 @ 13:00 +03:00

Market picture

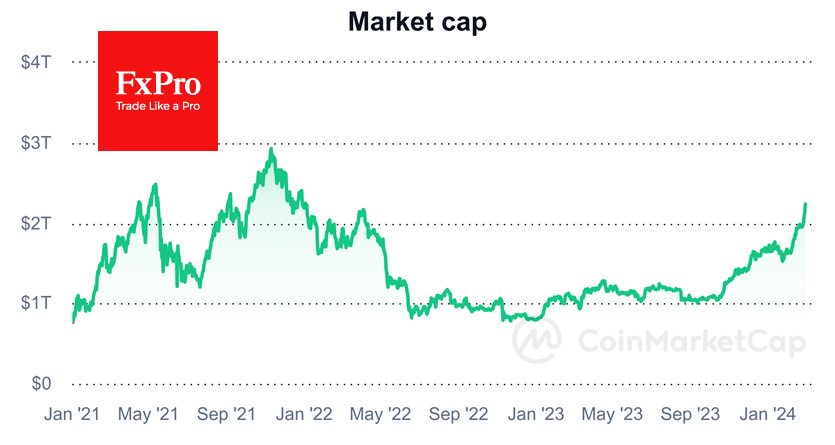

In an impressive surge of more than 7.3% in 24 hours, the crypto market capitalisation reached $2.32 trillion. The crypto market hasn’t been worth this much since late 2021. Back then, it took two months to get from current valuations to a peak of $3 trillion. But it’s worth remembering that the rally then started from a higher point of around $1.9 trillion versus the current $1.5 trillion. This means that we’re likely to see some profit-taking before the all-time highs are reached.

Yesterday, Bitcoin broke above $64.25K, followed by a sharp but short-lived pullback to $59K. In the early hours of Thursday morning, the price moved back up and was again at $63K by Thursday morning.

The main catalysts for Bitcoin’s rise above $60K were the influx of big money into spot ETFs and the multiplied liquidation of short positions. BTC has already hit all-time highs against local currencies in many countries. Now, investors are waiting for the milestone to happen with the US dollar.

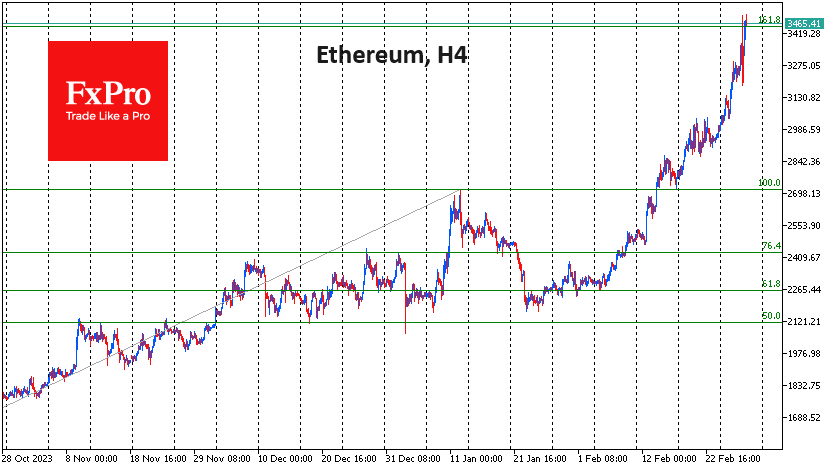

Ethereum is showing smoother growth, adding 5.9% for the day against Bitcoin’s 8%. On the chart, however, the rise is smooth and reminiscent of the period when professional players were accumulating coins. We attribute this behaviour to the ongoing speculation around the launch of Ethereum ETFs, given the success of Bitcoin.

Meanwhile, the second cryptocurrency’s exchange rate approached $3500, close to Wednesday’s intraday high and a return to the April 2022 peak.

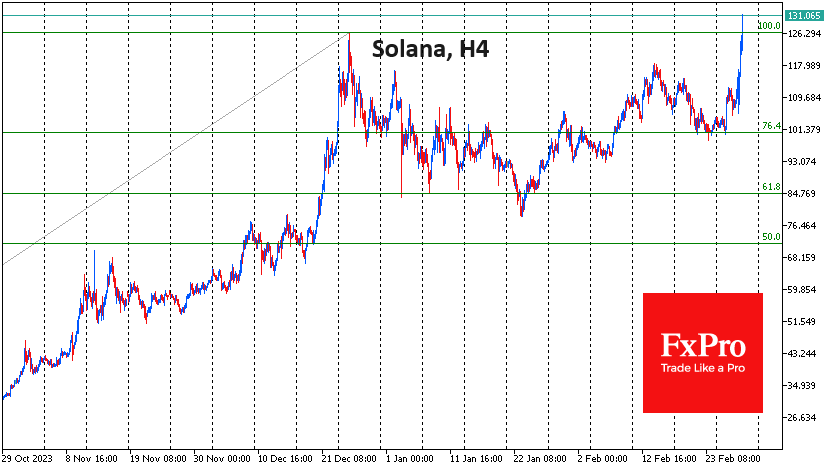

Solana, the market favourite at the end of last year, is showing double-digit growth overnight, rewriting December’s highs. Here, we see a classic Fibonacci pattern at work: the September-December growth momentum ended with a 38.2% pullback, and on Wednesday evening, the price retraced the highs. Now, the growth target for this pattern is $194 (161.8%).

News background

Dogecoin (DOGE) soared 30% in two days. DOGE developers reported that they are ready for the new Dogecoin Core 1.14.7 update, which includes security improvements.

Toncoin (TON) jumped 30% after the announcement of payments for Telegram channel owners to display ads. From March, the Telegram Ads platform will be open to all advertisers in nearly one hundred new countries. Users will receive 50% of the revenue that the messenger earns from displaying ads on their channels.

The dynamics of capital flows, exchange activity, leverage and institutional demand all point to a surge in risk appetite among bitcoin investors, Glassnode said. The current situation is reminiscent of the 2020-2021 boom.

The introduction of digital currencies in the countries of Oceania can solve many problems, but do not resort to the use of “unsecured private crypto assets” for this purpose, the IMF experts warned in their report.

Kraken Exchange announced the launch of Kraken Institutional, a new service offering comprehensive solutions for institutional clients.

The FxPro Analyst Team