Cryptomarket changing landscape

January 17, 2022 @ 16:18 +03:00

The Cryptocurrency Fear and Greed Index has been cruising between 21-23 for the past seven days – in the extreme fear territory, finding itself in the middle of that range on Monday.

Meanwhile, the value of all coins tracked by CoinMarketCap fell 0.5% in the last 24 hours to $2.05 trillion. By and large, a sideways range, $2.0-$2.1 trillion, has also been prevalent here for the past seven days, marking a lull in bull and bear fighting. It remains to be seen whether this signifies fatigue from the past months’ turbulent moves or preparations for a new strong momentum.

The local victory is on the bears’ side, dominating the top coins now, where losses range from -0.8% for Bitcoin to -5.7% for Polkadot over the last 24 hours.

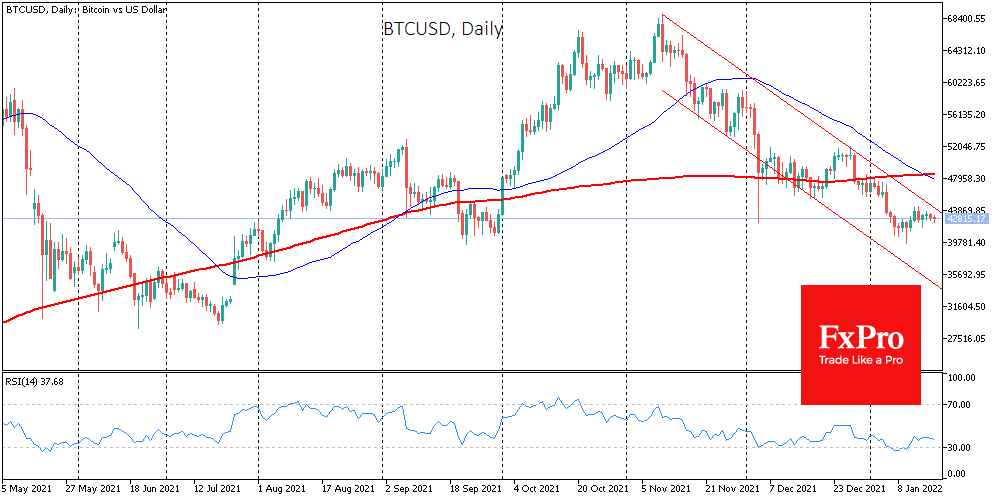

Bitcoin failed to build on last week’s upside momentum and is back in the $41-42K consolidation area, approaching it from above. A decline from these levels in the coming days will be a development of the downtrend since November, reversing the BTCUSD from the upper boundary of the downtrend channel.

A bearish scenario suggests a dip towards $31K by the end of this week to close the July gap. But the door for such a decline will only open after the bulls surrender the $40K level they managed to hold in September and earlier in January.

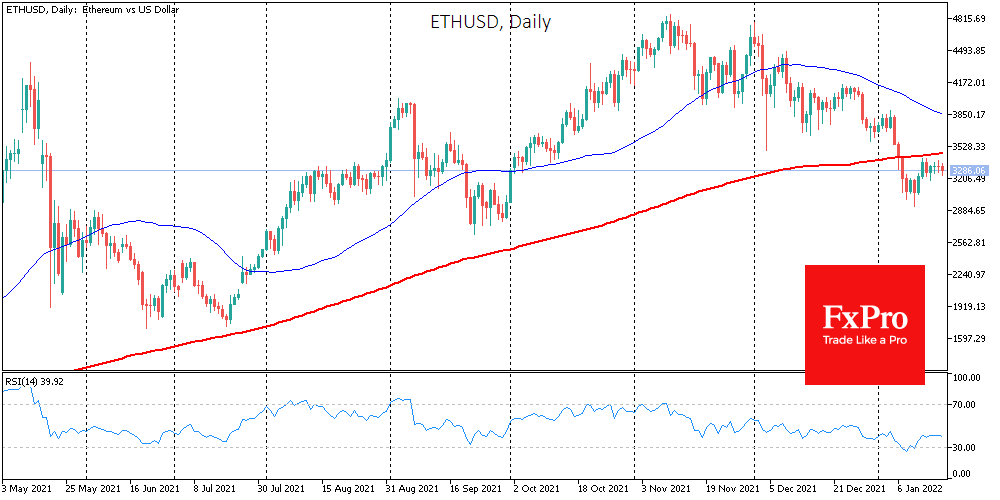

Ether has also encountered a sell-off in its attempts to rise above $3.3K. The 200-day moving average level is now acting as significant resistance.

Bitcoin and Ether, which have a combined capitalisation of almost 60% of all cryptocurrencies, show worryingly negative dynamics. At the same time, their share has been declining since late last year. We are seeing either a shift in investor attitudes towards the sector leaders or certain inertia of altcoins compared to the flagships.

Right now, it seems that crypto enthusiasts are not at all opposed to the changing landscape. However, as is often the case in nature, such changes rarely go smoothly.

The FxPro Analyst Team