Crypto: too early to be greedy

February 06, 2026 @ 13:47 +03:00

Market Overview

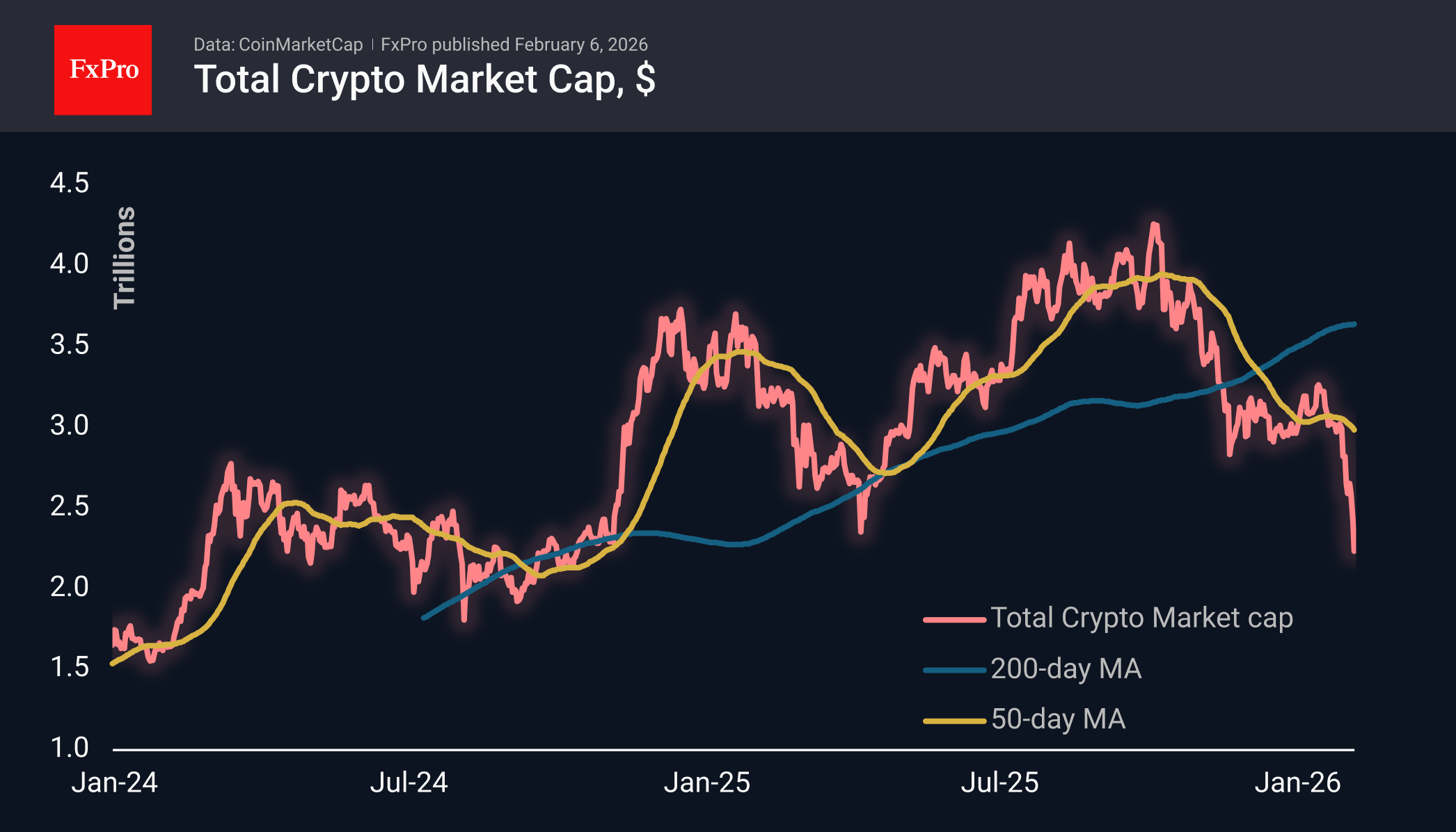

The crypto market cap has lost more than 8% in the last 24 hours to $2.22T, dropping to $2.09T at its lowest point. The Crypto fell below last April’s lows and rolled back to levels last seen in September 2024. The market did not hold on to the strong line that had served as support and resistance for more than two years. Either this is a switch to panic mode, or we saw a short-term overreaction during a period of reduced liquidity, and cryptocurrencies will partially rebound in the coming days.

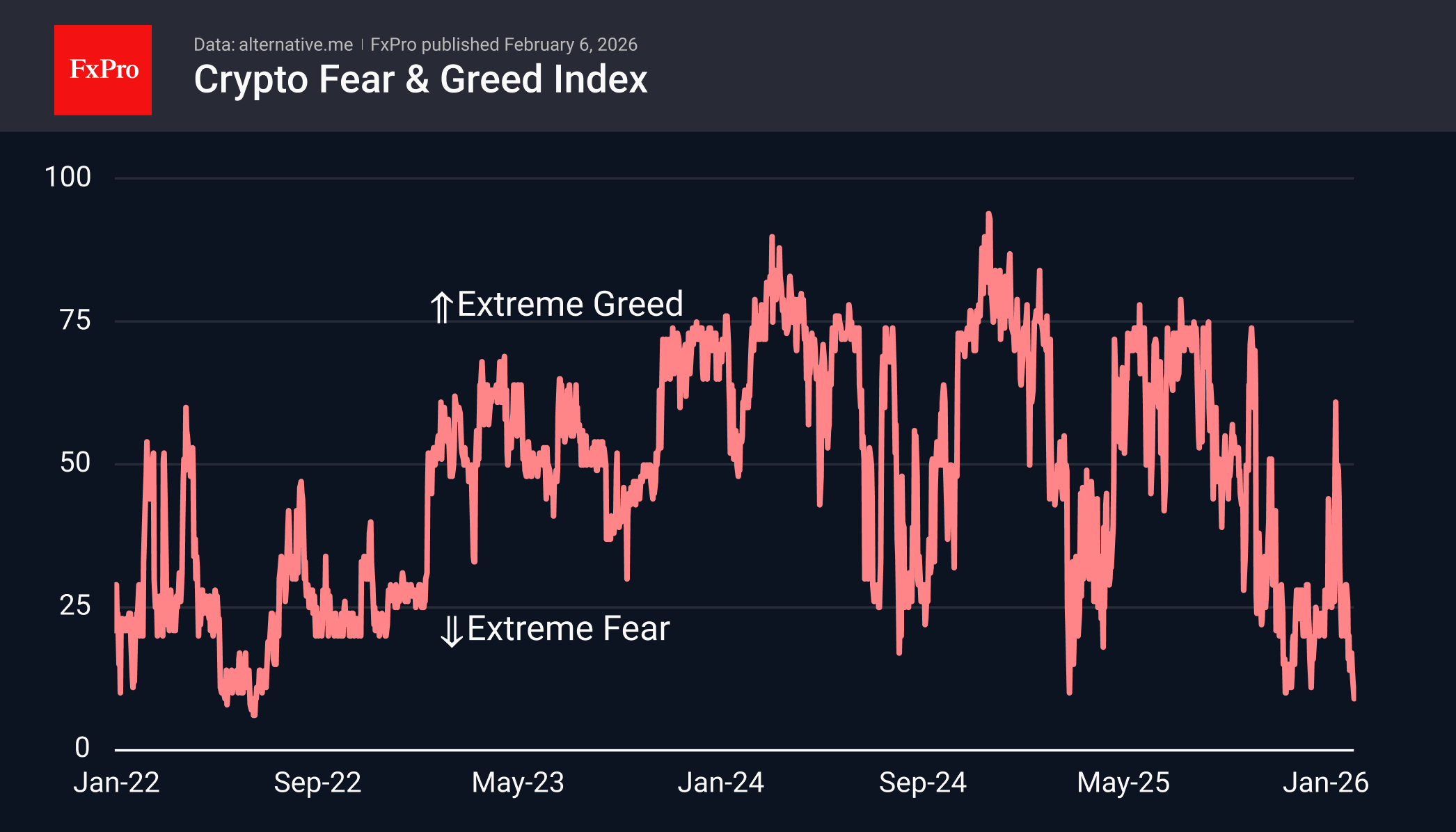

The sentiment index fell to 9, where it was last seen in June 2022. In general, reaching single-digit levels is a very rare occurrence. At the same time, we warn again that such oversold conditions may be followed by months of consolidation or bottoming out. Thus, in 2022, the market only bottomed out in November, falling by about a quarter, and the momentum for growth only appeared in January.

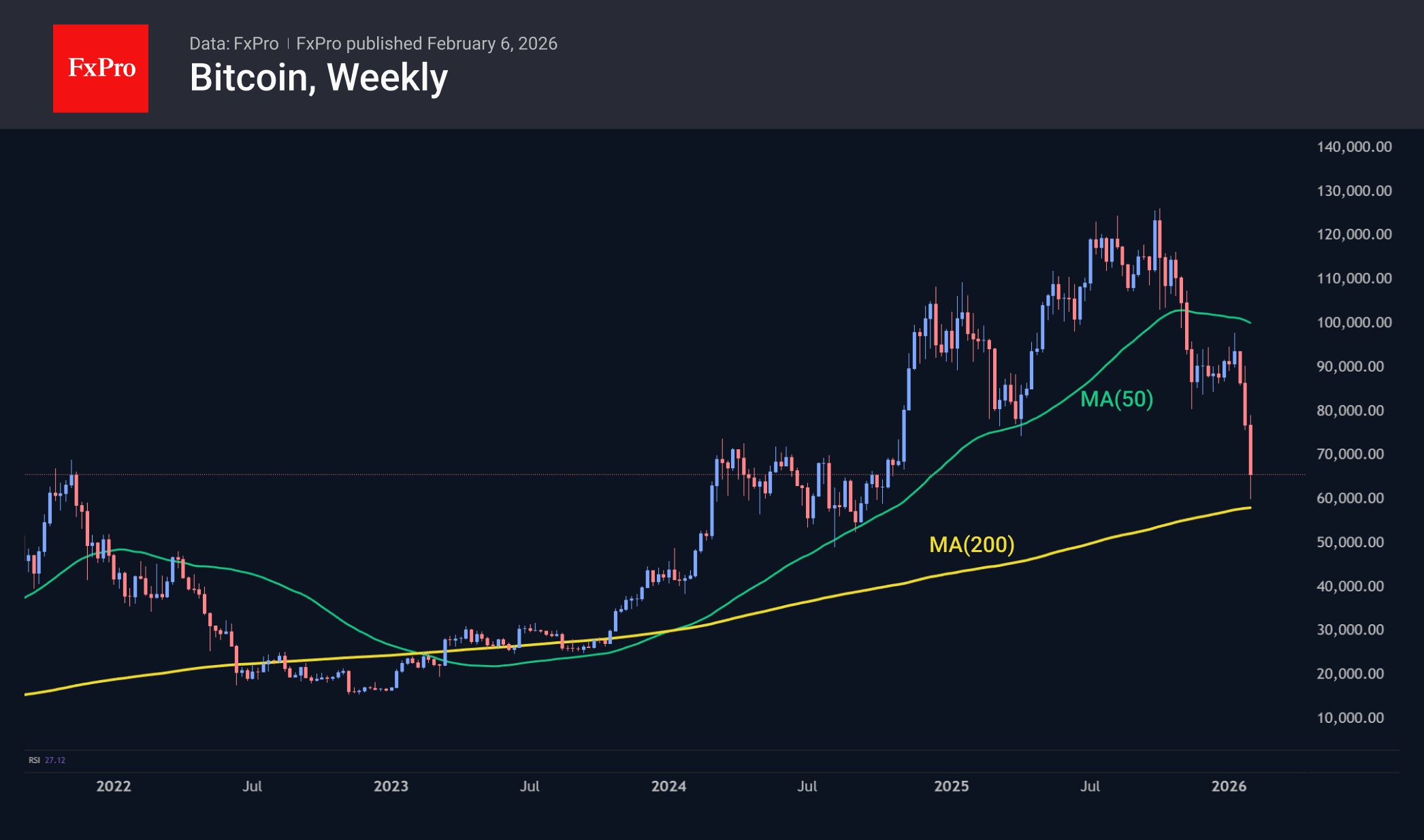

Bitcoin, at its lowest point at the start of trading on Friday, fell to $60K, ending up just one step away from its 200-week moving average, which is just below $58K. Bitcoin only fell below this line in 2022 and the following year, 2023. Before that, in 2015, 2019, and 2020, touching this line effectively stopped the sell-off, attracting buyers.

News Background

The collapse of the crypto market reflects a decline in interest in digital assets at the institutional and regulatory levels, according to Deutsche Bank. Three factors are putting pressure on Bitcoin: a steady outflow of institutional investor funds, changes in traditional Bitcoin market relationships, and the loss of regulatory momentum that previously supported liquidity and reduced volatility.

The collapse of Bitcoin was caused by the actions of large market participants, not panic among private investors, said technical analyst Peter Brandt. In his opinion, the nature of the movement, when BTC updated its lows for eight days in a row, has all the signs of a “planned sell-off.”

Tension was heightened by unconfirmed rumours of a $9 billion sale of bitcoins by a Galaxy Digital client.

Stifel admits that Bitcoin could collapse to $38K due to the high correlation of cryptocurrencies with the falling US tech sector.

According to DeFiLlama, the net inflow of funds to Binance over the past 24 hours amounted to almost $700 million. The data refuted rumours circulating on social media about mass withdrawals and account closures after Binance reported technical problems with withdrawals on February 3rd.

According to Bloomberg, there is still disagreement in the US over the Clarity Act. The current version of the document prohibits the accrual of interest for staking. Crypto companies are making new concessions to US banks, but the parties have not yet reached an agreement.

The FxPro Analyst Team