Crypto sellers are losing patience

September 08, 2023 @ 16:01 +03:00

Market Picture

It looks like sellers in cryptocurrencies are losing patience. The crypto market remains tightly pinned at $1.04 trillion in capitalisation. An attempt to break away and cross the $1.05 trillion mark has been met with heavy selling, and it’s well below the $1.1 trillion pivot late last month.

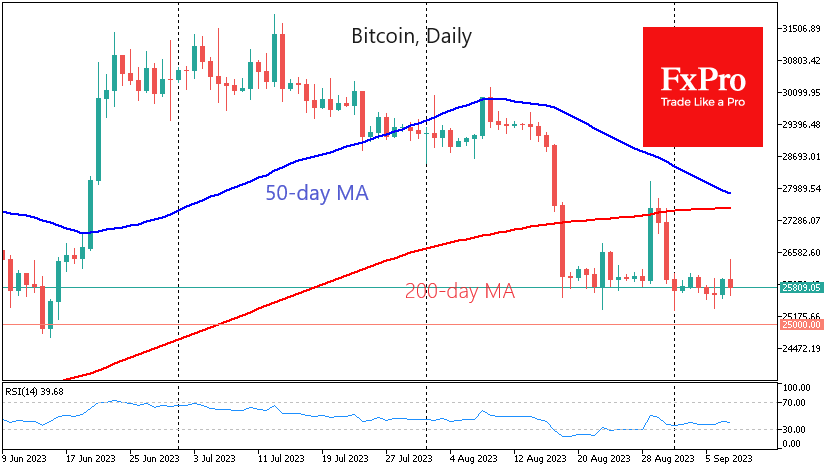

Similarly, Bitcoin is finding it increasingly difficult to keep its balance as it rises above $26.0K. The last such attempt on Friday morning was quickly thwarted, and BTCUSD is again trading near $25.8K.

Bitcoin’s technical picture on daily timeframes remains bearish, as the 50-day is approaching 200-day MA from above. The crossing (probably next week) can potentially trigger an impulsive sell-off, which is very dangerous in such a thin market.

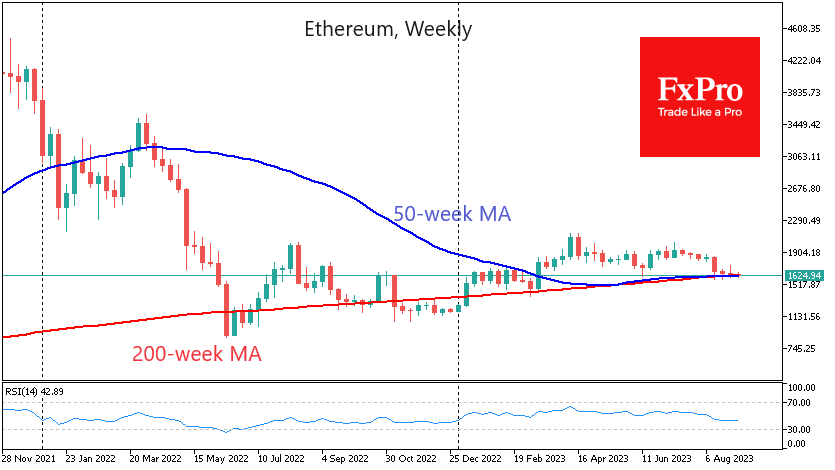

Ethereum is trading near its 50- and 200-week averages and near its lows from March. This is a bearish disposition, especially given the strengthening dollar and pressure on US stock indices in the background.

News background

The Financial Stability Board and the International Monetary Fund recommended regulating digital assets. The initiative aims to bring together standards and different positions to mitigate cryptocurrency risks.

The Chicago Board Options Exchange (CBOE) filed applications with the US Securities and Exchange Commission (SEC) on behalf of Ark Invest and VanEck to launch spot ETFs on Ethereum.

Google has allowed advertising of blockchain-based games using NFT from 15 September if they are unrelated to gambling.

Meanwhile, Arkham Intelligence platform identified Grayscale Foundation wallets that hold more than $16bn worth of bitcoins.

The FxPro Analyst Team