Crypto Overcomes Last Week’s Corrective Sentiment

October 28, 2024 @ 11:55 +03:00

Market Picture

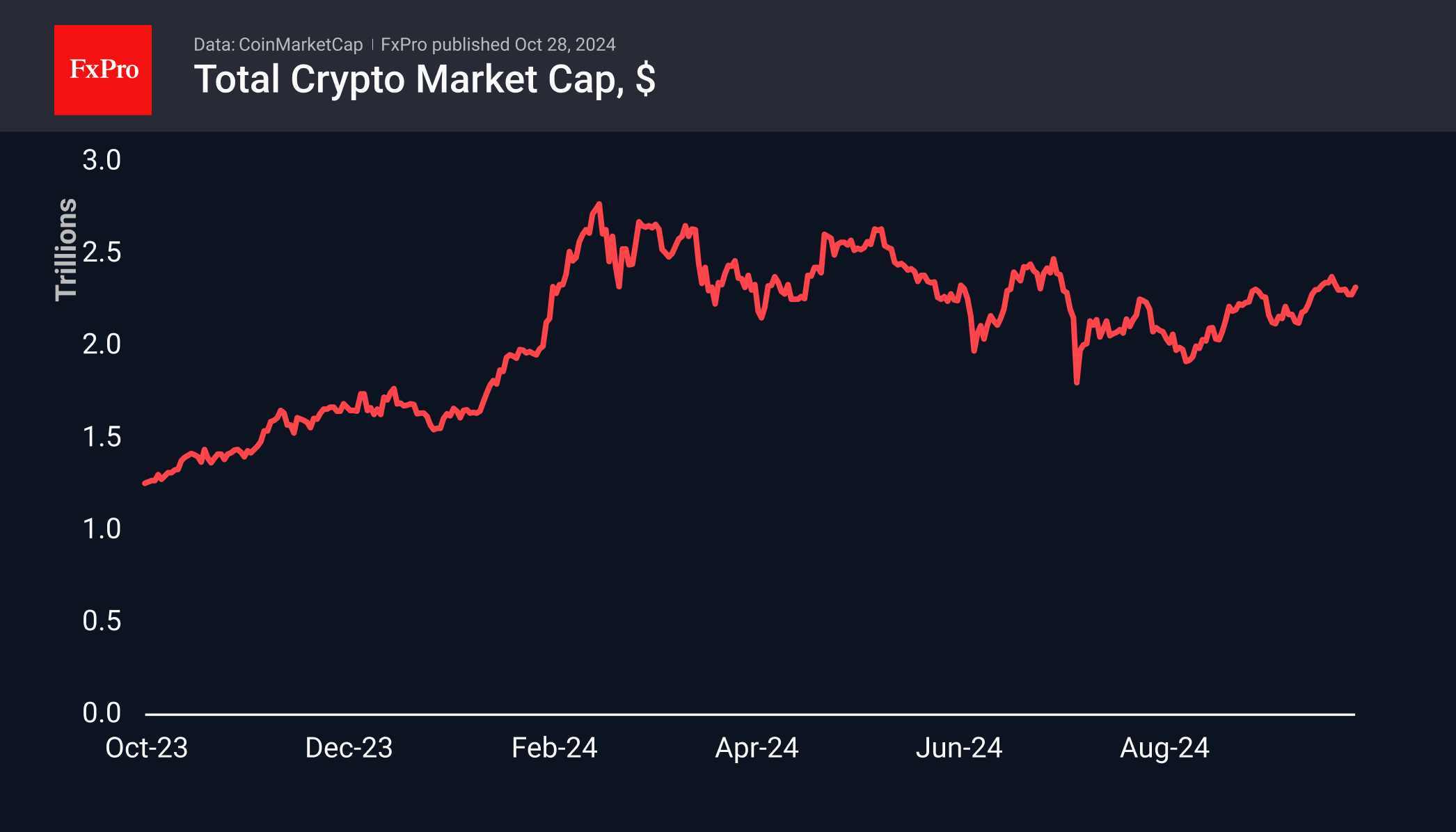

Last week, the cryptocurrency market was dominated by a risk-off sentiment that saw the total crypto market capitalisation fall from $2.4 trillion to $2.2 trillion. However, on Saturday, higher volumes led to a price recovery, bringing the market back to the $2.3 trillion valuation it started the week with. The sentiment index is at 72, having been in the 69-74 range for the past twelve days.

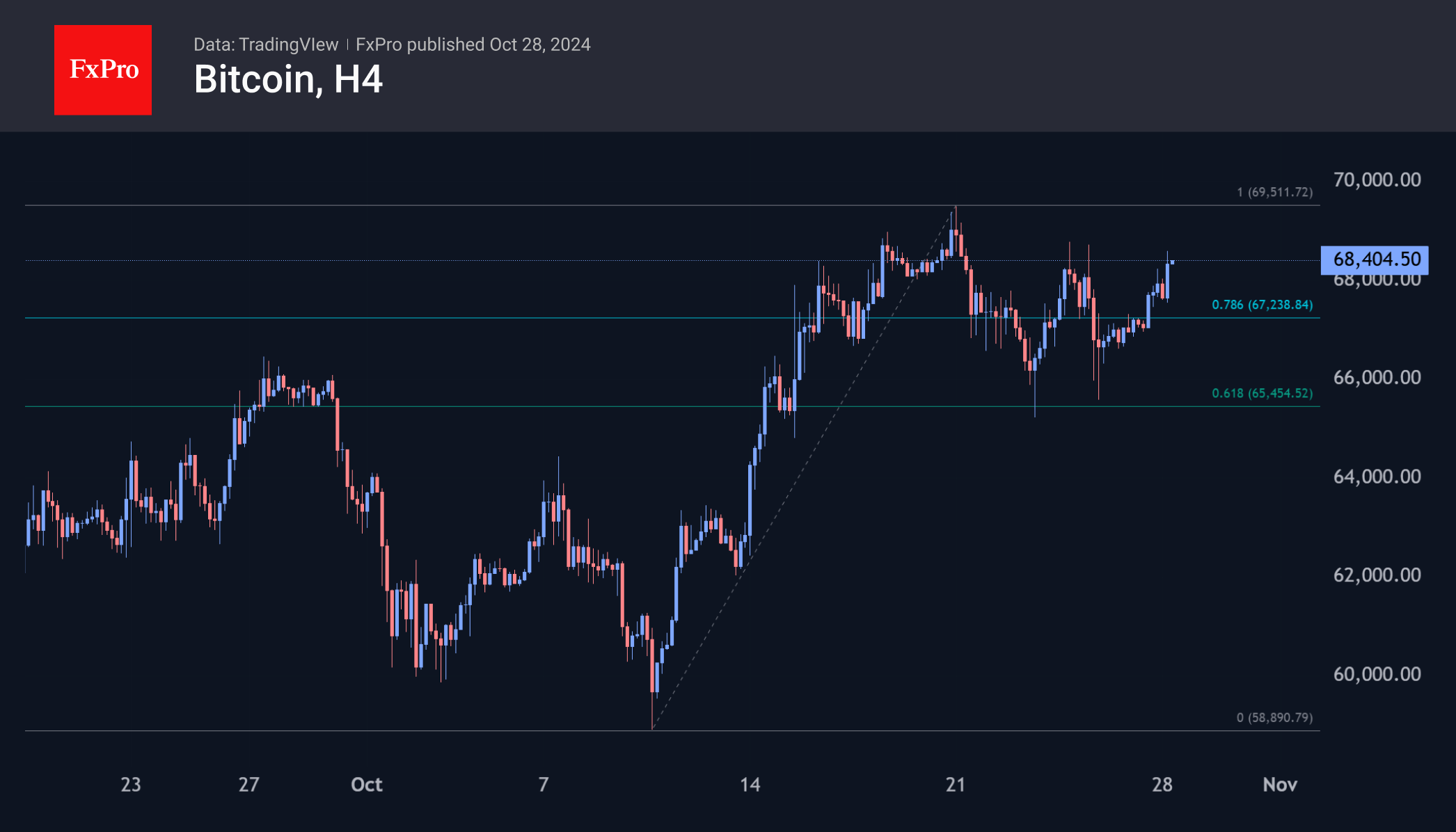

Bitcoin climbed to $68.4K, entering the range of the last six days. Last week, the market corrected the October 10th-20th gains, potentially paving the way for fresh upside momentum. Fibonacci pattern extensions suggest a potential upside to $76K, but the $70K and $72K areas could be a notable obstacle on the way.

News Background

Inflows into US spot Bitcoin ETFs continued for a third week, albeit at a slower pace. According to data from SoSoValue, inflows into BTC ETFs totalled $997.7 million last week, bringing the total to $21.93 billion since their launch in January.

The Ethereum ETF saw renewed outflows, totalling $24.5 million last week. Net outflows have risen to $504.4 million since the product’s launch.

Options on Deribit indicate only a 10% chance of Bitcoin hitting $100,000, notes CoinDesk analyst Omkar Godbole. Most market participants expect BTC to move towards the $80,000 mark.

Bitcoin alone isn’t enough to kick off the altcoin season just yet. According to Hashkey Capital, the altcoin season will be when BTC crosses $80K. Historically, the altcoin rally has been associated with BTC’s market dominance index rising to levels in the 62-70% range.

According to the Wall Street Journal, US authorities are investigating USDT issuer Tether for alleged violations of sanctions and anti-money laundering rules. Tether CEO Paolo Ardoino denies the information about the investigation.

The FxPro Analyst Team