Crypto market stalls after pump

February 20, 2023 @ 11:15 +03:00

Market picture

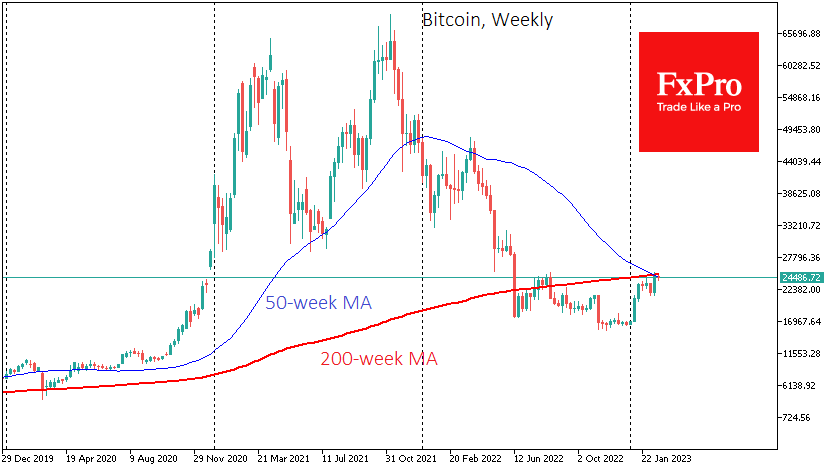

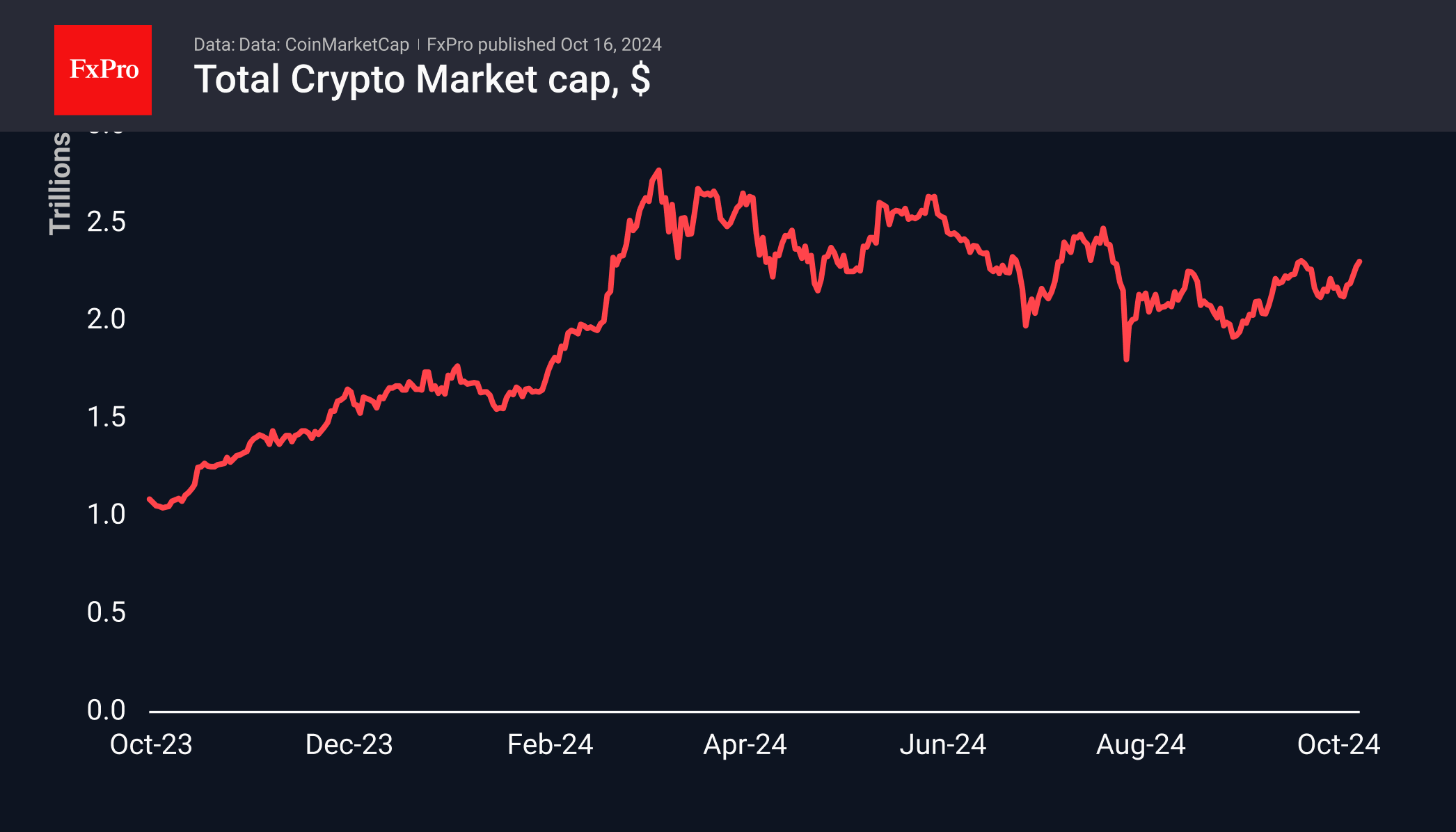

Bitcoin gained 11.5% last week to close at $24.5K. The price stabilised near this level at the start of the new week. The cryptocurrency’s market capitalisation rose 9.3% last week to $1.12 trillion. Almost all of the growth came in the first half of the week, with smaller gains in the final days.

Sunday saw a fresh attempt to push BTCUSD above $25K. However, the bulls failed to form a nice weekly candle to close above a significant level, leaving the rate below the 200-week average and touching the 50-week. Buyers may be more cautious in the coming days as a death cross formed on the weekly timeframes last week, although it should not be taken as a sell signal.

Ethereum grew 9.5% to $1680. Other leading altcoins in the top 10 gained between 1.2% (XRP) and 16.7% (Polygon). The exception was BNB (-2.3%).

News background

US authorities continue their “cryptocurrency crusade”. The US Securities and Exchange Commission (SEC) has charged Terraform Labs (TFL) and its CEO, Do Kwon, with running a multi-billion-dollar securities fraud scheme. The SEC charged TerraUSD (UST) and the LUNA token with algorithmic stablecoin.

US Senate Banking Committee Chairman Sherrod Brown called for a comprehensive regulatory framework for cryptocurrencies to protect investors from losing money. The congressman recalled that the digital asset market lost $1.46 trillion in capitalisation in 2022 and that cryptocurrencies have cut more than 1,600 jobs.

The Wall Street Journal wrote that banks are ending partnerships with crypto firms for fear of reprisals from regulators threatening to separate digital assets from the traditional financial system.

Platypus, a decentralised financial protocol based on the Avalanche blockchain, suffered an attack in which a hacker stole around $8.5 million in crypto assets. However, Chainalysis estimated that during 2022, the total amount of money raised by cryptocurrency fraudsters fell from $10.9 billion to $5.9 billion.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks