Crypto market opts for caution

February 23, 2024 @ 12:25 +03:00

Market picture

The crypto market lost around 1.2% overnight to $1.95 trillion, according to CoinMarketCap. The Crypto Fear and Greed Index rose to 76 (Extreme Greed). This is a somewhat lagging indicator, reflecting sentiment the day before rather than at the moment. Since Friday morning, crypto has been dominated by selling despite all-time highs in many global equity indices. As a very sensitive indicator, the crypto market may be signalling that investors have become a little more cautious.

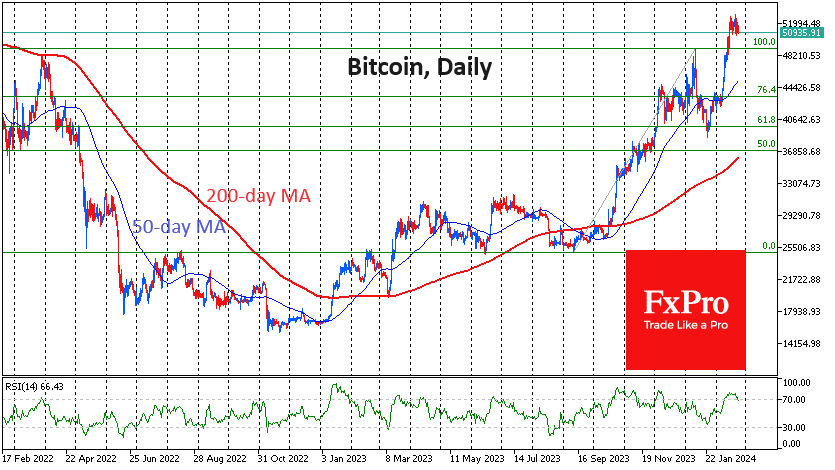

The price of Bitcoin has fallen below $51K, which is near the bottom of the consolidation range of the last eight days. Without a bounce from here, we could see a deeper correction begin, potentially as low as $47-49K.

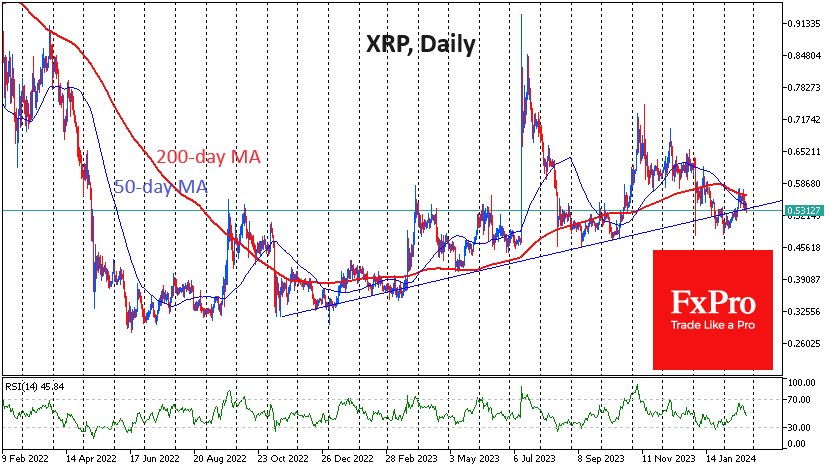

XRP failed to break above its 200-day moving average resistance again this week. It also fell below its 50-day MA on Friday morning. Both curves are pointing down, reinforcing the bearish signal. XRP is testing a long-term support line that has been in place since November 2022, the low point of the crypto market in the current cycle.

News background

The crypto market is at the beginning of its fourth major cycle, ushering in a bullish period for cryptocurrencies for the next 18 months to two years, according to a new report from Pantera Capital. The growing functionality of Bitcoin and its use in layer two networks is becoming a key element in the development of a new decentralised financial system comparable in scale to the Ethereum ecosystem.

Nvidia beat earnings expectations in the fourth quarter, fuelling growth in artificial intelligence-related tokens. The company reported revenues of $22.1 billion, beating analyst forecasts by almost $2 billion.

Fundstrat’s Thomas Lee suggested that bitcoin will top $150K in 2024 due to its halving in April and high demand for spot ETFs.

According to The Block, the meme coin segment has seen capital outflows in the last week amid an increase in overall crypto market growth. Nansen attributes this to investors switching to Bitcoin and Ethereum.

The launch of spot ETFs on Ethereum could concentrate a significant amount of ETH in the same hands, posing risks of centralisation of the ETH network, according to S&P Global Ratings. The emergence of new institutional custodians for cryptocurrencies could mitigate the risks.

According to Deribit, bitcoin call options expiring at the end of June have concentrated above the $60K strike price, signalling bullish sentiment. In February, open interest in call options is locked between strike prices of $53K and $60K. The “maximum pain point” is at $48K. However, Deribit notes that the market could face increased selling pressure after the halving in April.

The FxPro Analyst Team