Crypto market has cooled slightly

August 27, 2024 @ 11:23 +03:00

Market picture

The crypto market failed to grow steadily, with total capitalisation falling 1.6% to $2.21 trillion. This is a slight correction following the unimpressive performance of the equity market. The Sentiment Index fell back into neutral territory, losing 7 points on the day to 48.

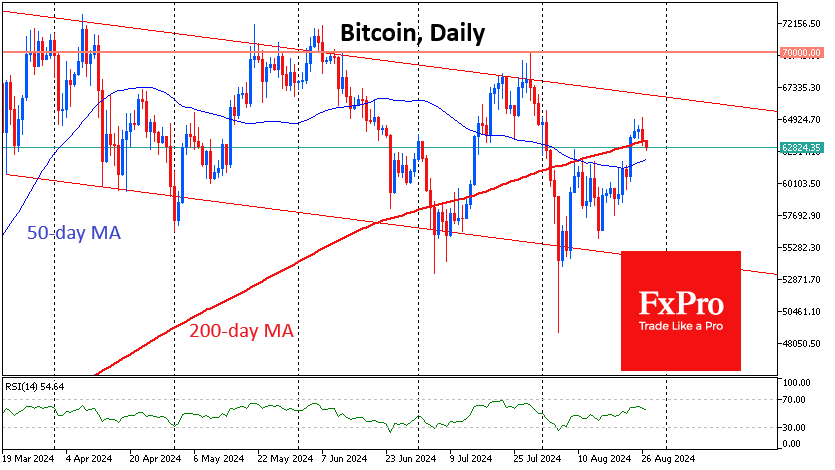

Bitcoin fell below $63K, losing 1.4% in 24 hours and dropping below its 200-day moving average. It’s too early to tell if this line has become resistance.

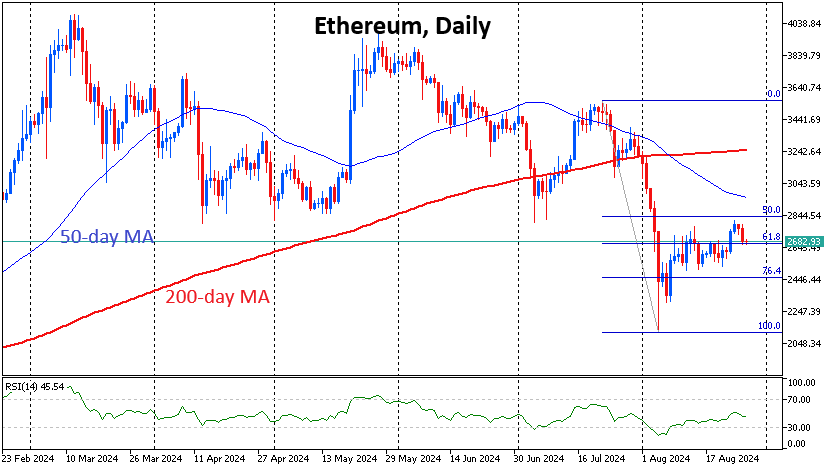

Ethereum fell 1.7% to $2690, remaining in the lower half of the range from the July highs to the August lows. The $2800 area served as strong support on the dips from April to July this year and now provides important resistance.

Toncoin overnight approached the $5 level, which was the turning point for the early August and May sell-offs. Although impressive bounces have accompanied the decline, the high volume means that we must remain negative on the coin’s near-term prospects.

News background

According to CoinShares, investment in crypto funds rose by $533 million last week, the largest inflow in five weeks and the third consecutive week of growth. Meanwhile, new Ethereum ETF issuers continue to see inflows, with $3.1 billion in new money for the month, partially offset by a $2.5 billion outflow from Grayscale Trust.

A federal court in the Northern District of California rejected the SEC’s request to recognise digital assets traded on the US crypto exchange Kraken as investment contracts. This is a significant victory for Kraken and cryptocurrency users. The exchange’s general counsel said the SEC will no longer be able to rely on its theory that cryptocurrencies are securities.

The combined market value of stablecoins has reached a new all-time high of $168 billion, a figure that has risen for 11 consecutive months. Dynamo DeFi interprets the trend as a sign of an influx of ‘new money into cryptocurrency’.

Tether has helped 145 law enforcement agencies in 40 jurisdictions recover more than $108.8m in USDT since its launch in 2014, the company said. The USDT issuer has also ‘voluntarily’ blocked more than 1,900 wallets linked to illegal activity.

Luke Dashjr said the decentralised nature of the first cryptocurrency has come under threat. Just two companies now control more than 55% of the BTC network’s global hash rate.

The FxPro Analyst Team