Crypto market encouraged to grow

November 27, 2025 @ 12:08 +03:00

Market Overview

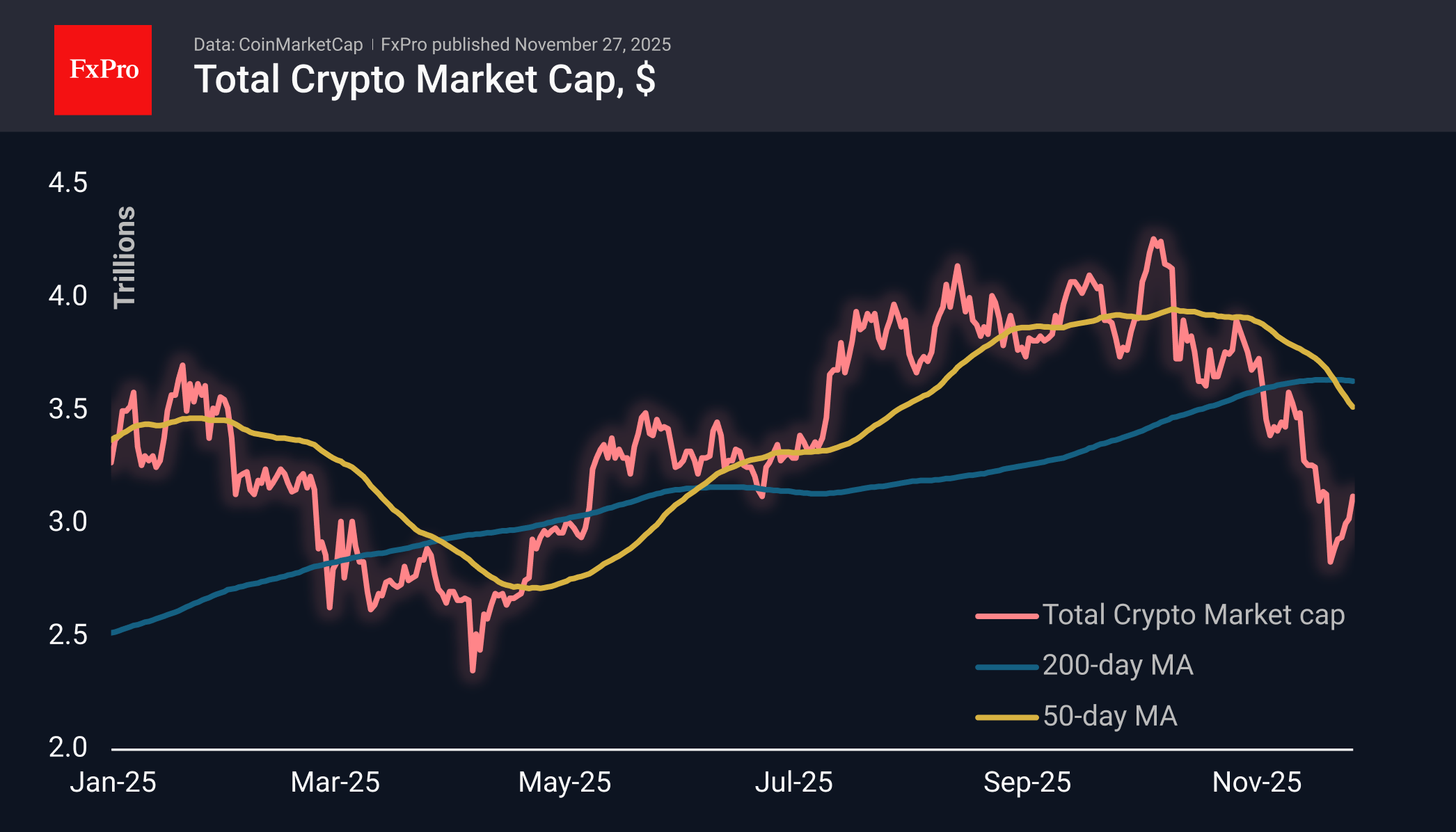

The crypto market accelerated its growth, adding more than 3% over the past 24 hours to $3.12T and recovering to levels seen a week ago. Among the heavyweight coins, Bitcoin and BNB are driving the market’s growth, adding over 4%, while many altcoins seem to be waiting for confirmation that the market has turned around.

The sentiment index rose to 22, a two-week high, but still in ‘extreme fear’ territory. However, at this stage, it is easy to see the activation of buyers, whose interests are gradually expanding to a wider range of altcoins.

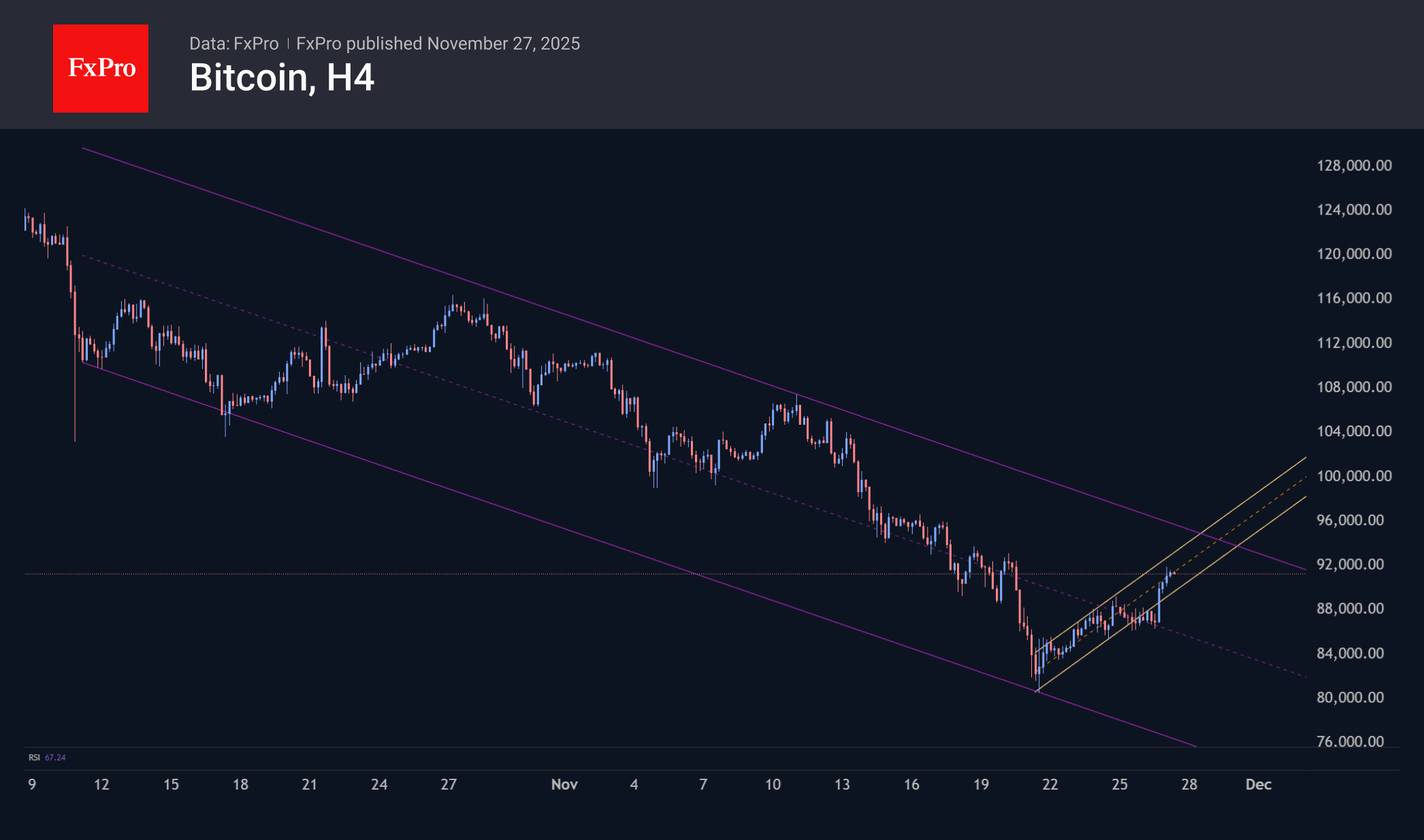

Bitcoin broke through the $91K mark, rising to 7-day highs and recovering to the classic Fibonacci retracement level of 61.8% of the collapse from November 11th to 21st. If the recovery does not lose momentum at these levels in the coming hours, we can expect a price rise to the $100K level soon and an attempt to break through an even more significant round level.

News Background

The 30% drop in Bitcoin from its highs provides an attractive long-term entry point, according to K33 Research, noting that BTC has lagged the Nasdaq in 70% of sessions over the past month. This situation has only been observed a few times since 2020.

According to data from the Deribit derivatives exchange, major players expect Bitcoin to rise to $100K-$118K, but do not believe that the asset will break above $120K soon.

Tether’s reserves have reached 116 tonnes of gold, which is comparable to the reserves of South Korea, Hungary or Greece. Investment bank Jefferies named the issuer of USDT stablecoins the largest holder of precious metals outside the public sector.

S&P Global Ratings downgraded the Tether (USDT) stablecoin to the fifth level: ‘weak’ due to its reliance on riskier asset classes, including Bitcoin, gold, and corporate bonds. This is the worst sustainability rating on the rating agency’s scale.

The FxPro Analyst Team