Crypto market cools off after spurt

July 18, 2024 @ 13:24 +03:00

Market picture

The cryptocurrency market has pulled back 0.7% to $2.37 trillion from local extremes in the last 24 hours while remaining around highs. This looks like localised profit-taking after the rally, but not exhaustion.

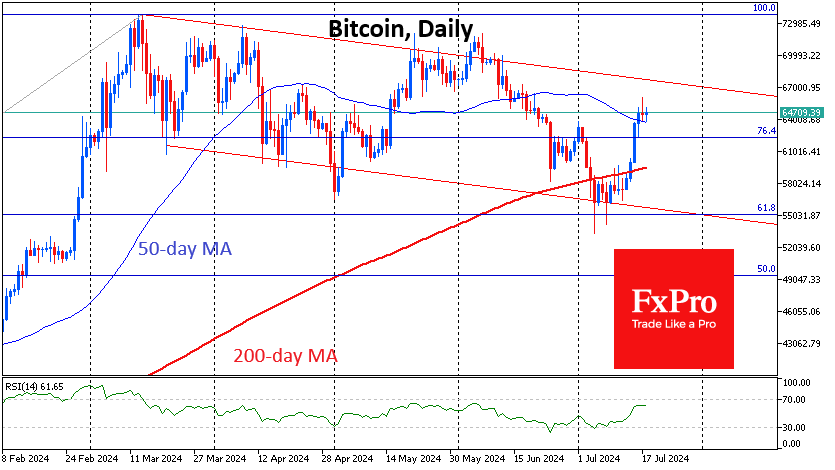

For Bitcoin, it is technically significant that the current consolidation around $64K is taking place above the 50-day moving average, making it support. The closest technical resistance looks to be the $67-68K area, where the upper boundary of the descending channel from March passes.

However, in our view, FOMO may come to the markets only after overcoming the $70K level, the last round mark before the historical highs. It looks to be a matter of weeks, but don’t expect a smooth ascent – a definite selling overhang still exists.

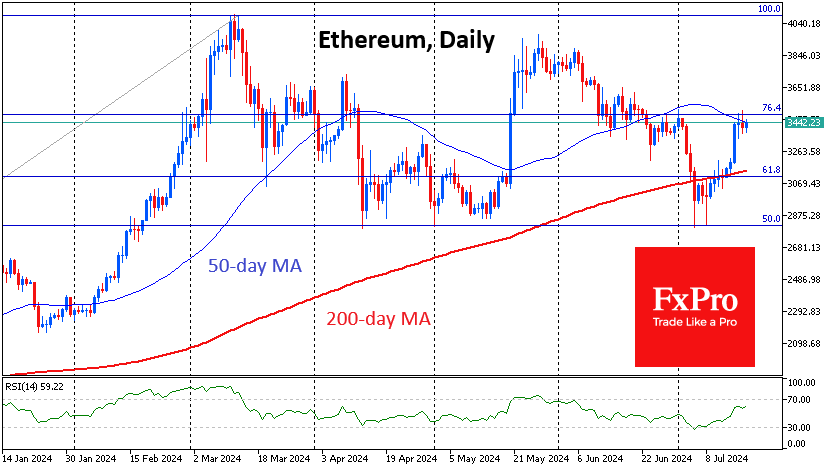

Ethereum remains chained to its 50-day moving average, running just below $3500. News of a spot ETF is not pushing the price up yet. It seems that only actual buying, or rather even its accumulative effect, can do that, which will reduce the circulating supply of coins.

News background

According to CryptoQuant, concerns regarding possible sales of bitcoins distributed by the bankrupt Mt. Gox exchange are exaggerated. Since 2023, $224bn worth of digital gold has been sold during the market’s bull phase, but its price has risen 350% in the process.

German authorities have revealed the price of bitcoins confiscated from the piracy portal Movie2k. After an “emergency sale” of 49,858 BTC, the German government raised an “unprecedented” $2.88bn. The average sale price was $57,760. Local laws require an “immediate” sale of confiscated funds if there is a risk of a 10% depreciation.

Glassnode noted that the bitcoin market has “absorbed” 48,000 BTC linked to German authorities and is expecting a new batch of sales from Mt. Gox customers.

Bankrupt crypto exchange FTX and the Commodity Futures Trading Commission (CFTC) have agreed to a $12.7bn settlement after months of negotiations.

Bitwise expects the launch of spot Ethereum-ETFs to push cryptocurrency quotes to all-time highs above $5,000. Meanwhile, flows into the ETFs will have a greater impact on Ethereum than on the first cryptocurrency.

Ripple CEO Brad Garlinghouse criticised the US Securities and Exchange Commission (SEC) for its strict approach to regulating cryptocurrencies and hinted at the company’s possible departure from the US market.

The FxPro Analyst Team