Crypto market continues to retreat

October 29, 2025 @ 11:47 +03:00

Market Overview

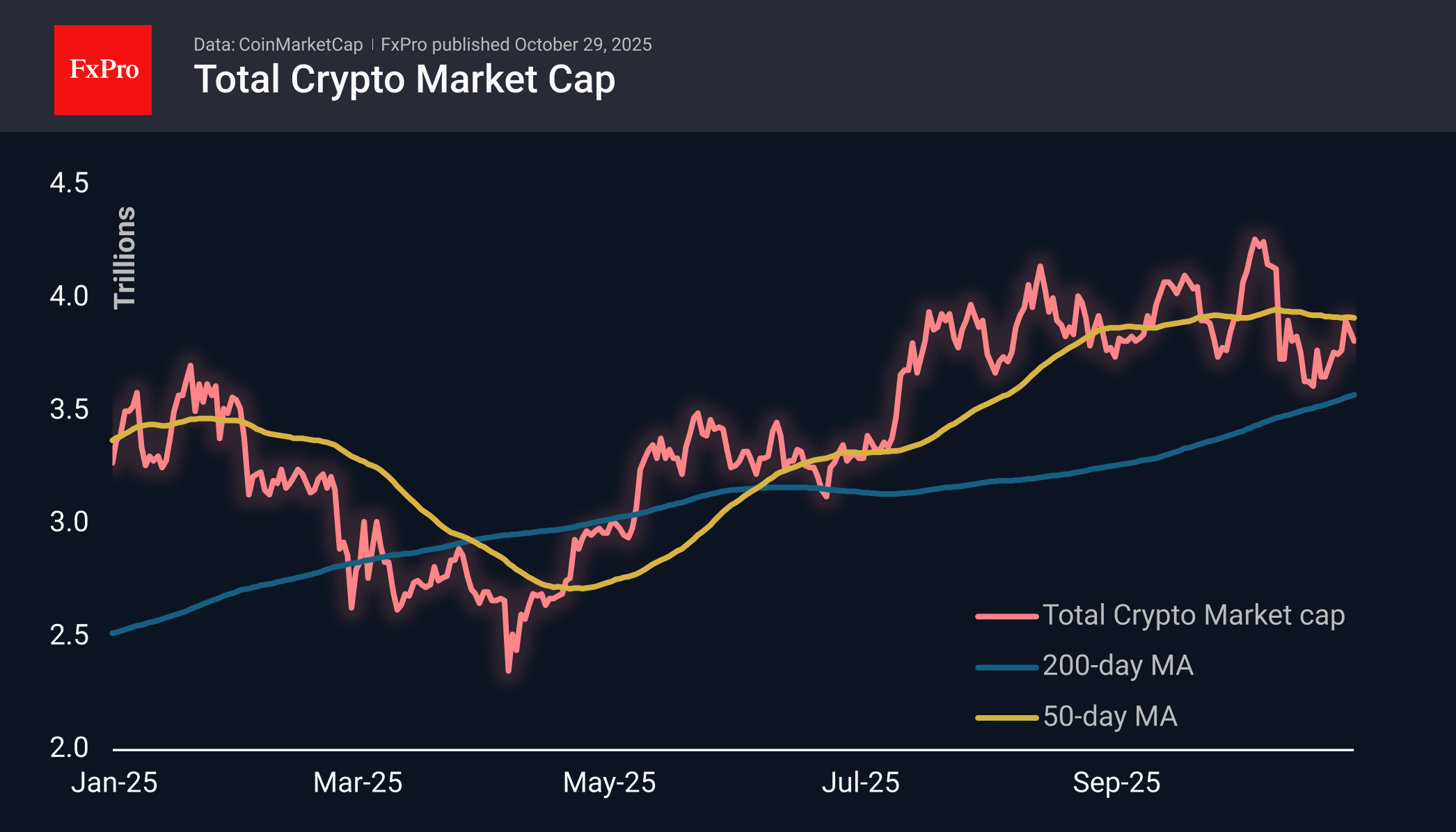

The crypto market cap fell by another 1% to $3.81 trillion over the past 24 hours, continuing its retreat. On Monday, the 50-day moving average acted as resistance, stumbling the market’s recovery. The Trump coin is bucking the market trend, gaining more than 15% in 24 hours and 35% in 7 days.

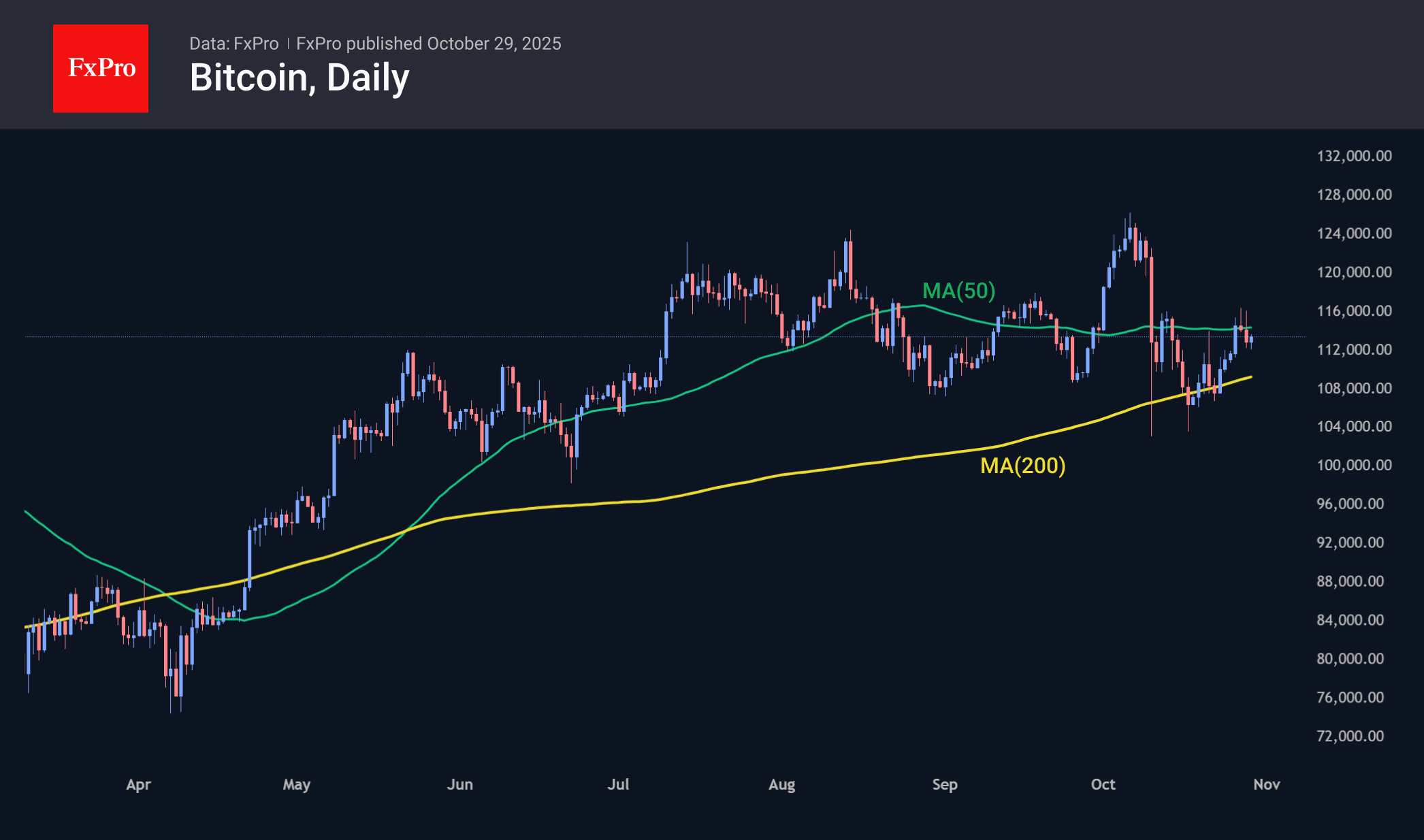

Bitcoin has gained slightly since the start of the day to $113.4K but is down 0.7% from the previous day’s level. The first cryptocurrency remains between two essential moving averages, the 50-day above and the 200-day below. So far this week, we have seen sales on the rise towards $115K. This performance contrasts with stock indices, which are constantly updating their all-time highs. We view this dynamic as an indicator of the fragility of global investor sentiment beneath the mask of general positivity.

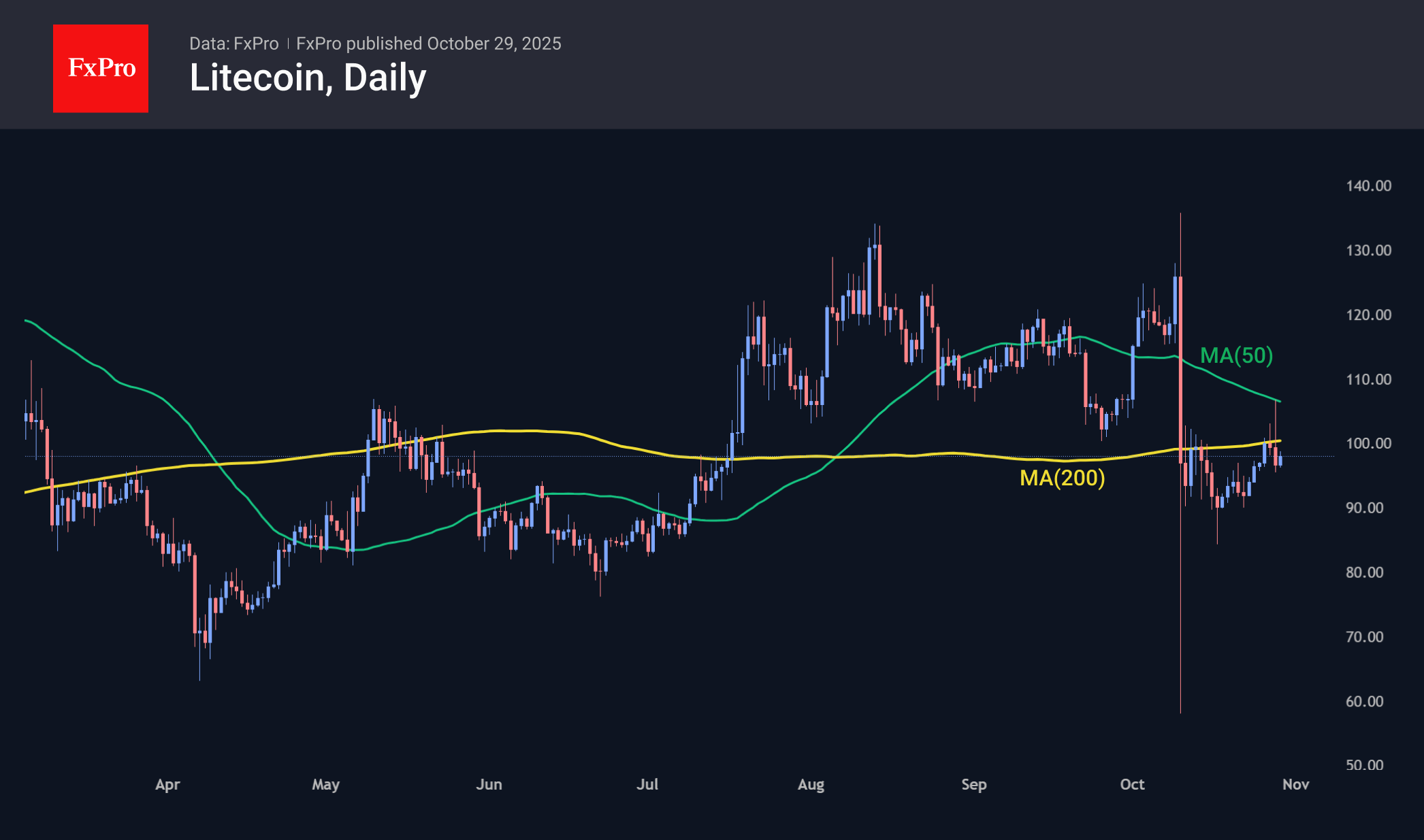

Litecoin has fallen more than 8% to $97 from Tuesday’s peak. As with the whole crypto market and Bitcoin, the coin failed to take the 50-day MA, which was tested later than in the first two cases. However, in this case, LTC immediately fell below the 200-day MA, and a death cross is brewing in the coin due to the downward 50-day MA.

News Background

To continue its rally to new highs, Bitcoin must hold the support level at $114K, where the 200-day moving average is located, Swissblock notes.

Bitcoin’s ability to overcome resistance at $116K is limited by the lack of significant inflows and low activity on the network, according to Glassnode. Continued growth requires an increase in spot trading volume and on-chain activity.

S&P Global Ratings has assigned Strategy a B- credit rating, classifying its securities as junk bonds. This is because of the company’s excessive concentration of assets in Bitcoin with debt obligations in US dollars.

In recent months, Strategy has sharply slowed the pace of BTC purchases due to difficulties in raising capital. TD Cowen remains optimistic about the company and its shares.

The Bitplanet crypto exchange will become the first public company in South Korea to create its own Bitcoin reserve. Bitplanet has already purchased its first 93 BTC and plans daily purchases to bring its reserves to 10,000 BTC.

The FxPro Analyst Team