Corporates have weighed in on crypto once again

July 12, 2024 @ 10:37 +03:00

Market picture

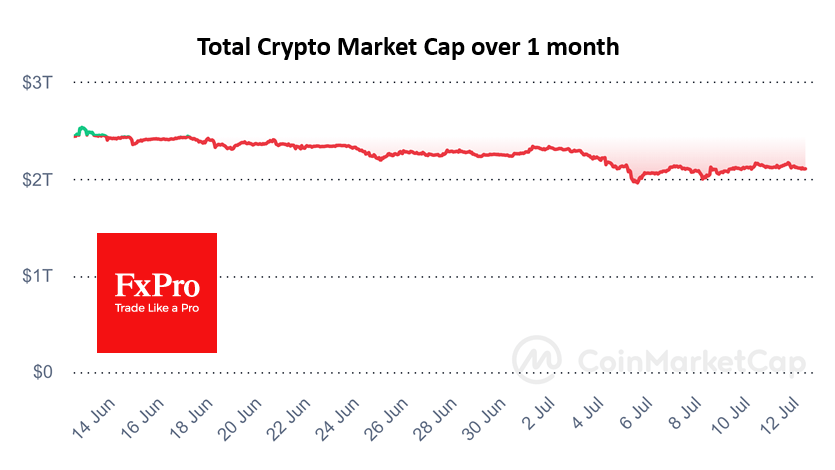

The crypto market capitalisation fell by 0.8% in 24 hours to $2.11 trillion. An attempt to strengthen the market’s offensive on news about inflation in the US attracted new sellers, which this time can easily be linked to the similar dynamics of the Nasdaq index, with which crypto has the closest correlation.

At the same time, the dynamics of the last 24 hours were not one-sided: Bitcoin lost 1.4%, Ethereum—0.3%, BNB—0.9%, and Solana—3.5%, but such coins as XRP, Toncoin, and many others added. Perhaps we can say that those who added were the majority, but their weight in the market was not that big. That is, buyers showed interest in buying, but corporate and government sellers were pulling the market down this time.

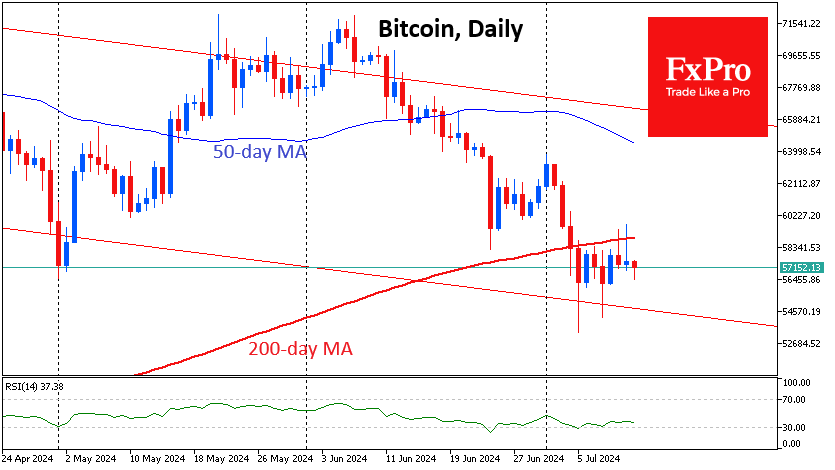

Bitcoin is back at $57K after a failed assault on $60K on Thursday. Technically, the bears are keeping the price above the 200-day moving average. In fact, the sellers could be corporates, whose actions are often closely tied to Nasdaq100 performance. German authorities were also actively selling off previously confiscated Bitcoins. This volume is not huge, but some potential buyers prefer to stay on the sidelines, seeing the overhang of sales.

Could we be seeing the start of an altcoin rally? We doubt it, suggesting that the altcoin season only begins when the prices of the largest coins have reached all-time highs and appear overvalued to some.

News background

German authorities have left only 4925 BTC worth about $282 million for sale. This is less than 10% of the original amount seized in January from the pirate movie site Movie2k.

The BitMEX exchange pleaded guilty to violating the US Bank Secrecy Act and wilfully failing to implement an anti-money laundering (AML) programme. The platform became a vehicle for large-scale money laundering and sanctions evasion schemes, the US Attorney for the Southern District of New York said in a statement.

The US SEC has terminated its investigation into stablecoin issuer Paxos and does not intend to pursue enforcement action.

US CFTC Chairman Rostin Banham said that 70-80% of crypto assets do not qualify as securities, contradicting the SEC’s position.

Ethereum co-founder Vitalik Buterin urged the community to prepare for a potential ‘51% attack’ on ETH, one of the main threats. In the context of Proof-of-Stake, a 51% attack occurs when an attacker controls more than 50% of all coins blocked from participating in the validation of network blocks.

The FxPro Analyst Team