Buyers have returned to cryptocurrencies

September 23, 2021 @ 15:40 +03:00

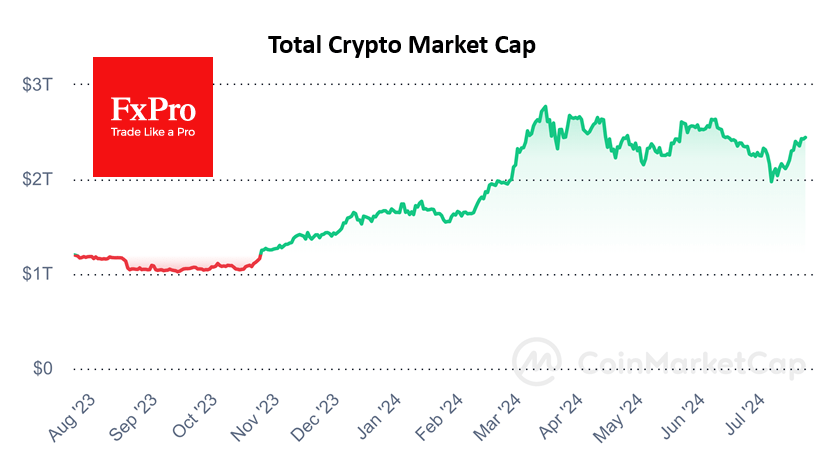

The cryptocurrency market is bouncing upward along with the traditional market and is even ahead of the scale of growth. Over the past 24 hours, the top 10 coins were in the green zone. The total capitalization of the crypto market increased by $120 billion during the day. Nevertheless, this indicator remains below the threshold of $2 trillion. Investors began to buy on the fall rather quickly, indicating a high demand. However, it is worth understanding that these may be short-term positions, and a rapid rebound in cryptocurrency prices may lead to equally rapid profit-taking.

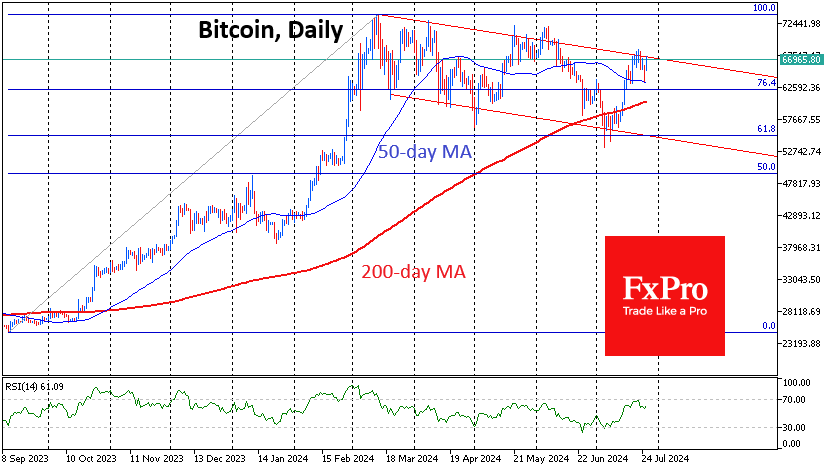

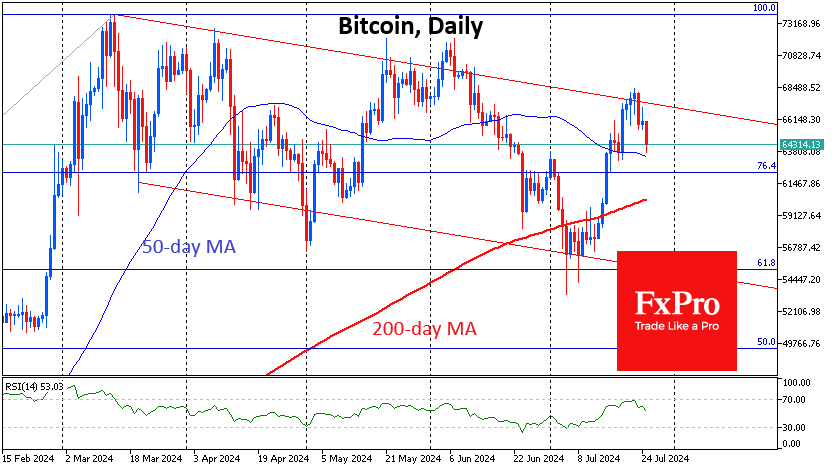

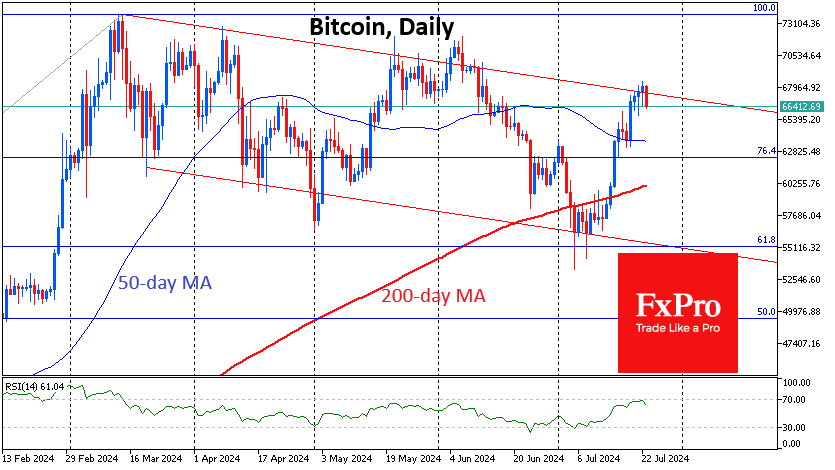

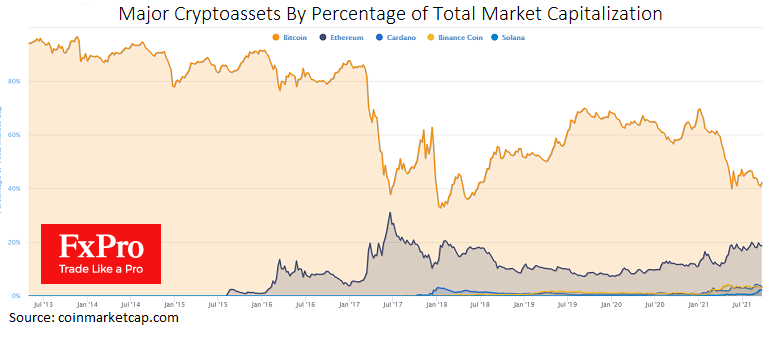

The decline of the Bitcoin dominance index confirms the presence of widespread demand for cryptocurrencies. This indicator is now at 41.9%, reflecting investor interest in altcoins. Bitcoin has added almost 4% over the past 24 hours and is trading around $44,000. Nevertheless, so far, the coin has failed to offset the scale of the recent correction. Over the past 7 days, Bitcoin has been losing about 9%.

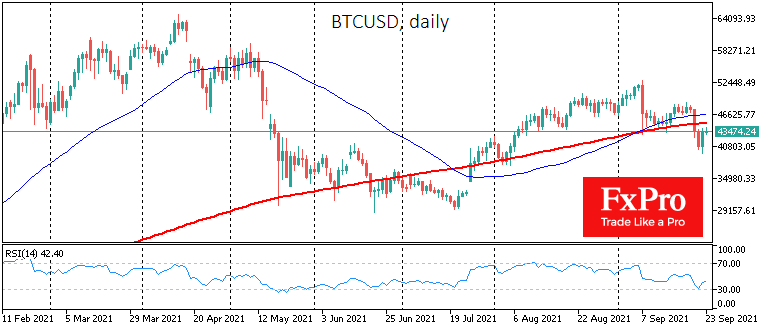

The Crypto Fear & Greed Index for Bitcoin and major cryptocurrencies is at 27, which corresponds to the “fear” mode. The RSI index for the BTCUSD on the daily chart is in the neutral zone near the “45” mark, showing moderate growth.

In general, it can be noted that the crypto market now faces uncertainty about future prospects, and in such periods there is increased attention to the actions of the BTC whales. Regardless of Bitcoin’s declining dominance index, everyone understands that the first cryptocurrency is the main engine of the crypto market.

Arcane Research, an analytics company, notes a divergence in the actions of the “first whales” and the “new whales of 2020-2021.” The company’s analysis shows that “new whales” may be prone to profit-taking, while “first whales” prefer to accumulate BTC on price declines. The trigger for the crypto market may be data on active coin sales, which have been unmoved for about a decade.

The cryptocurrency community also speculates that we may now be witnessing the division of the largest participants in the crypto market into several camps. Both sides are interested in maximizing profits, but in the case of the “long whales,” they also want to own as many coins as possible as they approach the asset issue ceiling. It is this type of investor that can now keep the crypto market from collapsing during episodes of deep corrections.

The FxPro Analyst Team