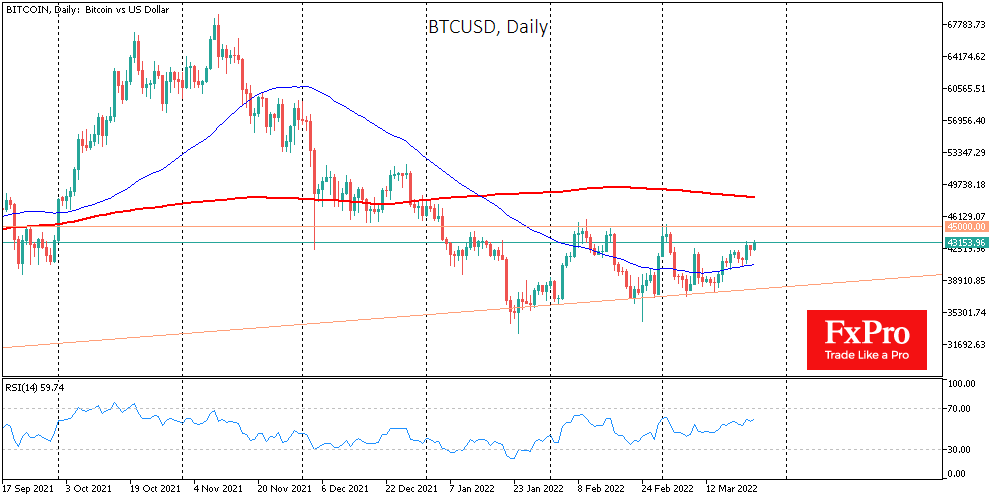

BTC is trying to gain a foothold above $43K

March 24, 2022 @ 16:27 +03:00

Bitcoin is trading above $43K on Thursday morning, gaining 2.5% over the past 24 hours. For the last ten days, we have seen a systematic increase in prices, although with a very modest amplitude by the standards of the crypto market.

Ethereum adds 3.4%, while other leading altcoins from the top ten add in the range from 1% (XRP) to 12% (Dogecoin).

According to CoinMarketCap, the total capitalization of the crypto market grew by 2.8% over the day, to $1.96 trillion. The Bitcoin Dominance Index lost another 0.2% to 41.7%.

The crypto-currency index of fear and greed has grown by 9 points over the past day, to 40. This is still a zone of fear, but already close to neutral territory.

Bitcoin retreated from the resistance at $43K on Tuesday, but on Thursday it is again making attempts to gain a foothold above this mark. The last rollback in this case could be nothing more than a tactical retreat of the bulls in order to develop growth with renewed vigor. However, confidence in the formation of a strong bullish momentum will come only after BTCUSD fixes above 45 thousand, from where we saw reversals in February and early March.

Moderate but steady optimism around bitcoin is the best breeding ground for altcoin buyers. It is clearly seen that their dynamics are now better than that of the first cryptocurrency. If this trend continues for a couple more days, the effect of a feedback loop may work, when the outstripping growth of altcoins will pull Bitcoin up.

Bank of America predicts that regulation of the cryptocurrency market will increase confidence and increase its capitalization by 15 times, up to $30 trillion.

The former head of one of the divisions of Bank of America, David Woo, believes that bitcoin will face economic and geopolitical pressure after the launch of the state digital currency (CBDC) of the United States. China has already acted in a similar way, which has come closest to the introduction of the digital yuan.

Thailand will ban the usage of cryptocurrencies as a means of payment from April 1st. They declared that such payments have a negative impact on the financial system and reduce the effectiveness of the state’s monetary policy.

The FxPro Analyst Team