Bitcoin’s short-term upward channel

May 17, 2022 @ 12:34 +03:00

On Monday, Bitcoin was down 3.6%, ending the day around $29.9, but is trading back above $30K on Tuesday morning. Ethereum has little changed over the past 24 hours (-0.4%), remaining near $2000. Other altcoins from the top 10 changed in price from -2.7% (Polkadot) to 1.2% (Solana).

Total crypto market capitalisation, according to CoinMarketCap, rose 0.1% overnight to $1.30 trillion. Bitcoin’s dominance index fell 0.1 points to 44.3%. The Cryptocurrency Fear and Greed Index was down 6 points to 8 by Tuesday, hitting its lowest level since August 2019.

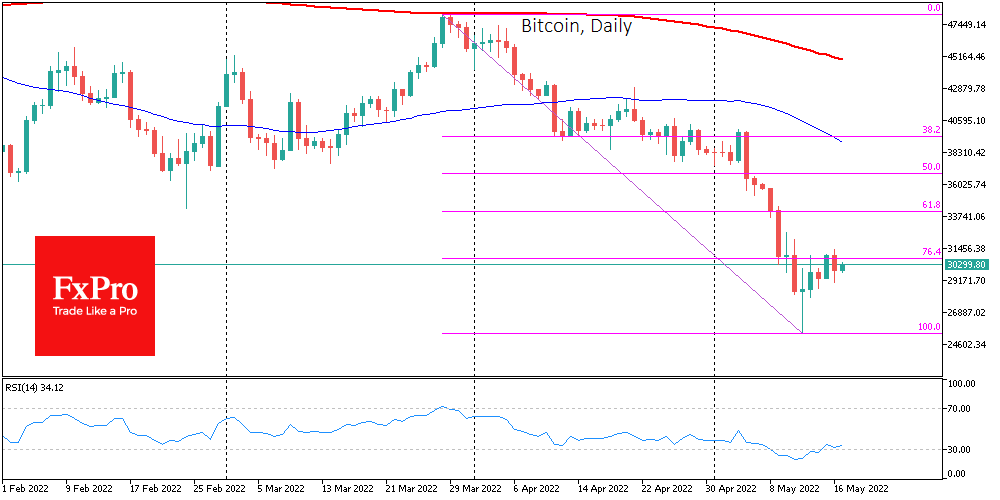

Technically, the crypto market on Monday followed the cautious sentiment of the stock market. We note that after hitting lows on May 12th, a short-term upward channel is forming in BTCUSD with increasingly higher local lows and local highs.

Such dynamics of the flagship crypto resemble the work of traders of institutional managers, who moderately “buy the fear” or fix the profit from the short positions. So far, there is little reason to argue that a prolonged rise will follow the current buying, as the fundamentals (tightening markets, slowing economy) remain in place.

According to CryptoQuant, institutional investors continue to buy BTC through market makers despite the decline in the crypto market.

Sam Bankman-Fried, CEO of cryptocurrency exchange FTX, believes bitcoin has no future as a payment network because of its low scalability and negative impact on the environment. There is a need for an alternative blockchain-based Proof-of-Stake (PoS) protocol for payments.

IMF managing director Kristalina Georgieva called for a new public infrastructure for payment systems, including digital currencies.

Do Kwon, founder of the Terra ecosystem, presented a new plan to rehabilitate the project. On May 18th, the developer intends to present Terraform Labs team with a new management system for the Terra fork, decoupling it from the TerraUSD (UST) stable coin.

The FxPro Analyst Team