Bitcoin’s Rush to The Top

October 30, 2024 @ 11:48 +03:00

Market Picture

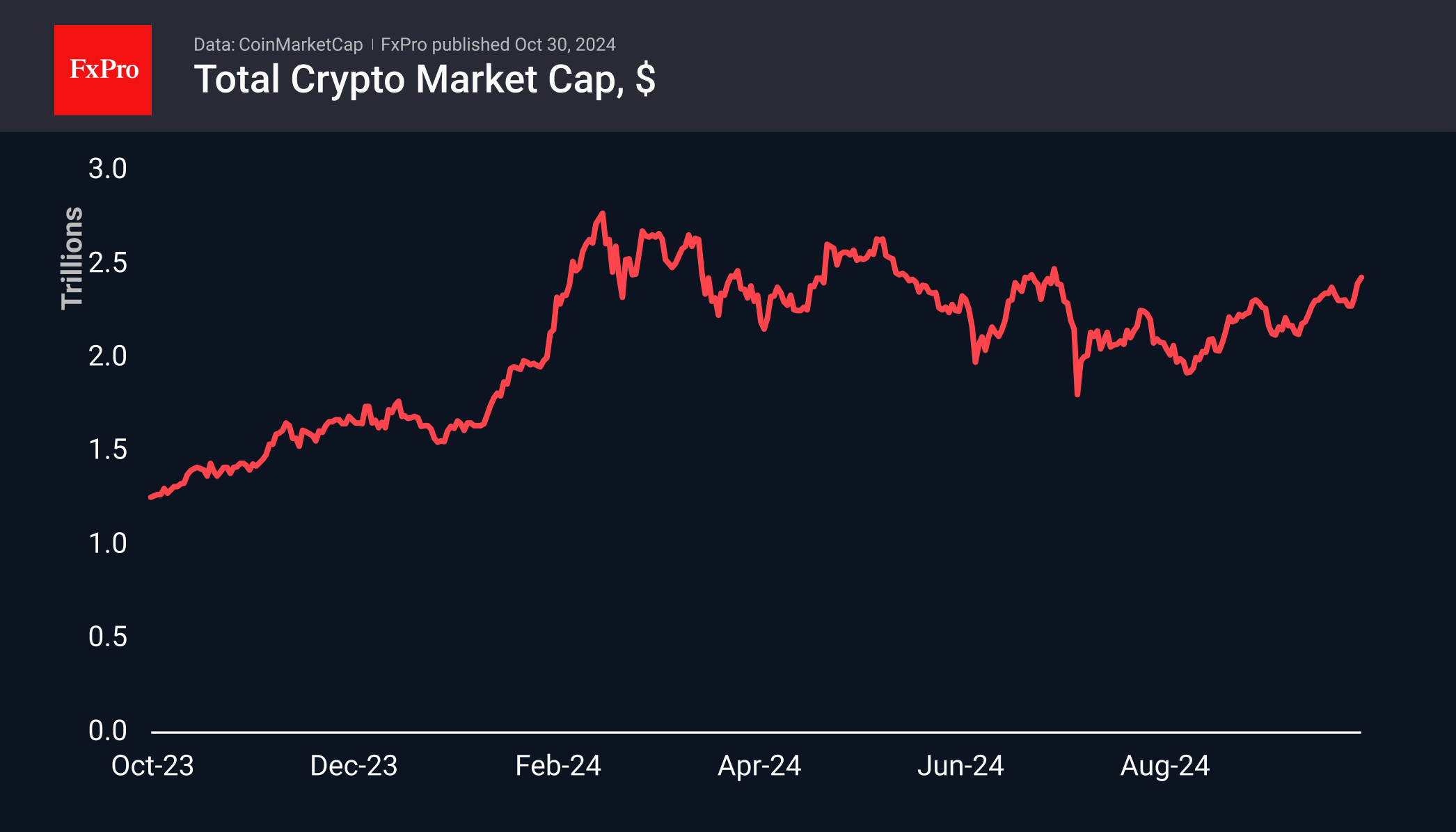

Bitcoin came within a hair’s breadth of an all-time high on Tuesday night, but the overall crypto market is well off its peak. Total cryptocurrency capitalisation at the overnight peak was $2.46 trillion, down $2.48 trillion from the July peak, almost 12% below the March high of $2.77 trillion and around $400 billion below the all-time high reached in November 2021. While the big picture points to a series of lower peaks, the medium-term uptrend since early September still suggests that new highs are a matter of months away. And the acceleration we saw last week suggests it’s a matter of weeks, not months.

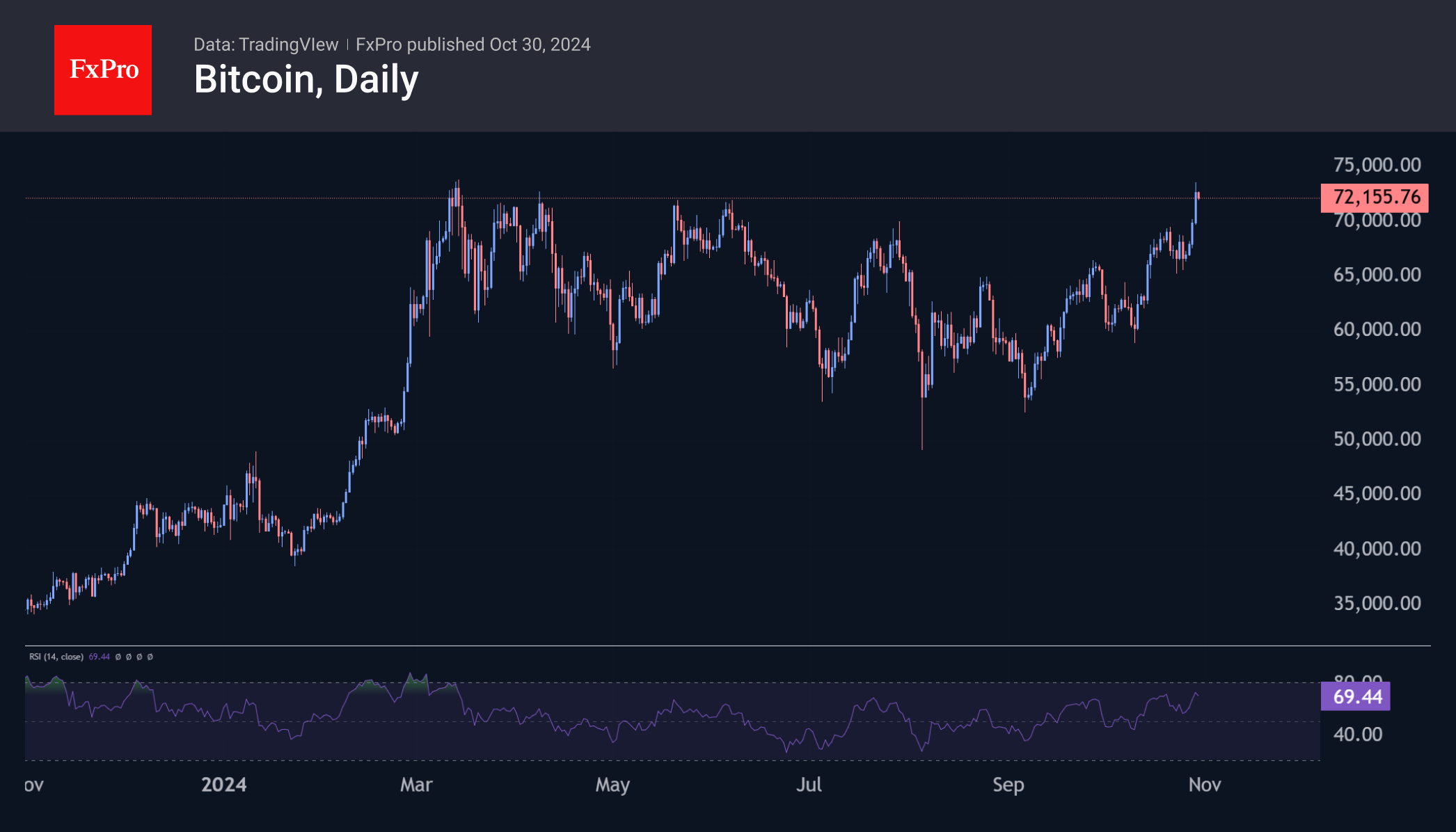

Bitcoin has been the main driver, gaining momentum since Saturday. Trading near $72.4K, Bitcoin does not appear to be extremely overheated, leaving room for further strength.

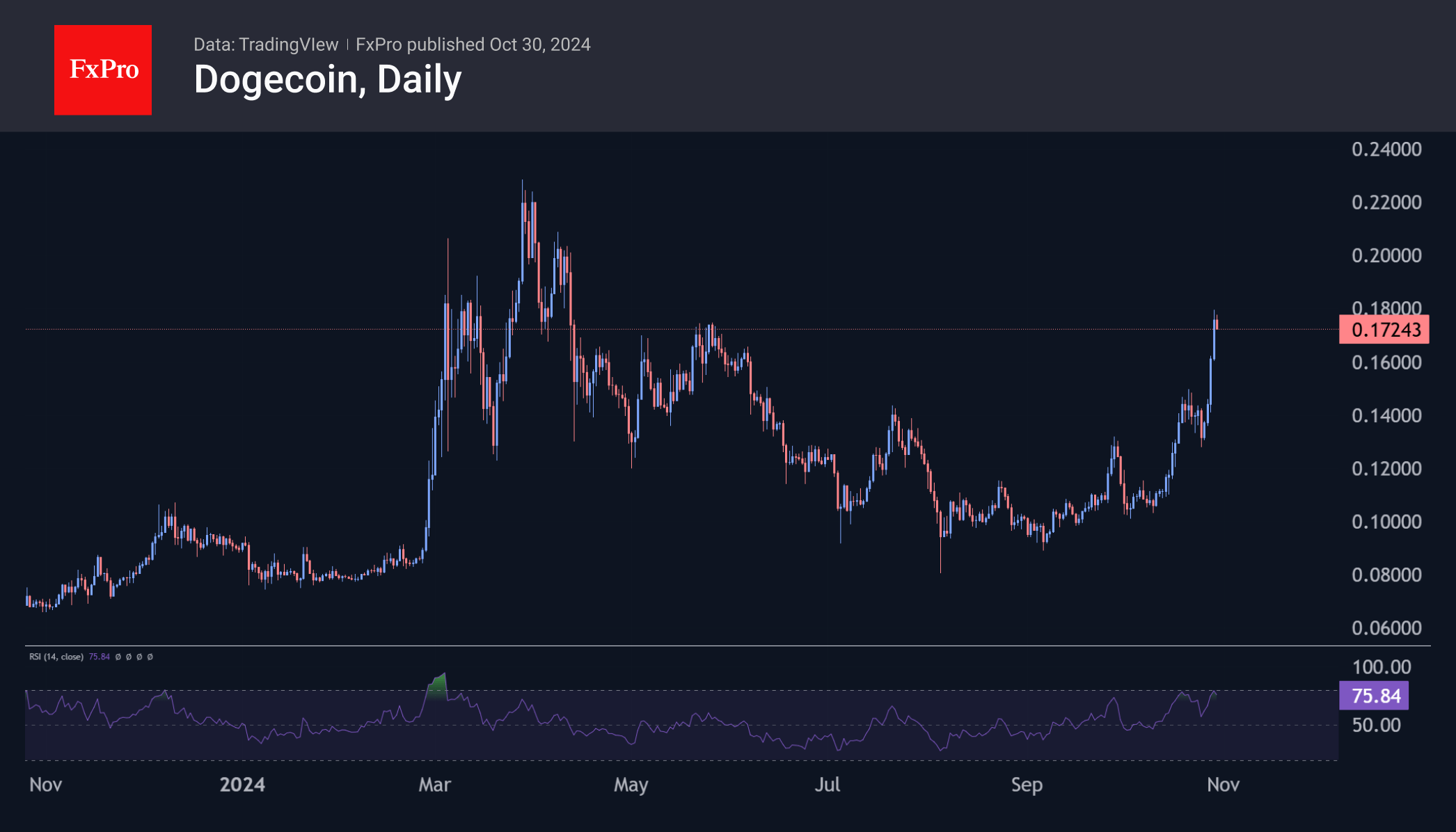

The market seems to be pricing in Trump’s victory and the easing of regulations on cryptocurrencies. The euphoria is particularly evident in Doge, which has gained another 6% in one day, 24% in seven days and over 41% in the last 30 days. The coin has no direct benefit from Trump’s rise to power, but speculators are warming to it because of frequent mentions of Musk, who may get a position in Trump’s government.

News Background

Bitget Research notes that several factors support BTC’s potential growth, including the expected Fed rate cut on 7 November. Market dynamics could also be influenced by the Microsoft board’s vote on the Bitcoin investment scheduled for 10 December.

According to former BitMEX CEO Arthur Hayes, demand for Bitcoin will rise sharply because of the Chinese stimulus. He believes that the injection of money into the economy and the threat of further inflation will lead to increased investment in risky assets.

The annualised yield on Steak, the second most capitalised cryptocurrency, has fallen to ~3%. Kaiko noted that Ether’s steak yield is now lower than that of other major tier 1 protocols, including Cosmos, Polkadot, Celestia, and Solana, which range from 7% to 21%.

Zeta Markets noted that Ethereum’s limitations are forcing users, applications, and capital to turn to L2 networks and competing blockchains such as Solana as demand for faster and more scalable solutions grows.

The FxPro Analyst Team