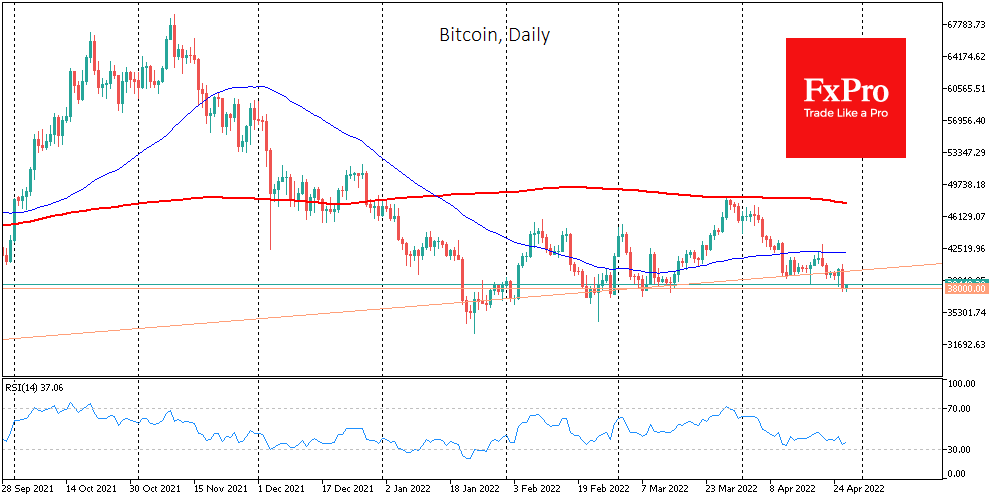

Bitcoin’s last hope for $38K

April 27, 2022 @ 09:42 +03:00

Bitcoin has lost 5.3% in the past 24 hours, falling to $38.4K. Ethereum is down 5.4% to $2845 in the same time frame. In the top 10 altcoins, losses range from 3.6% (BNB) to 12.7% (Dogecoin).

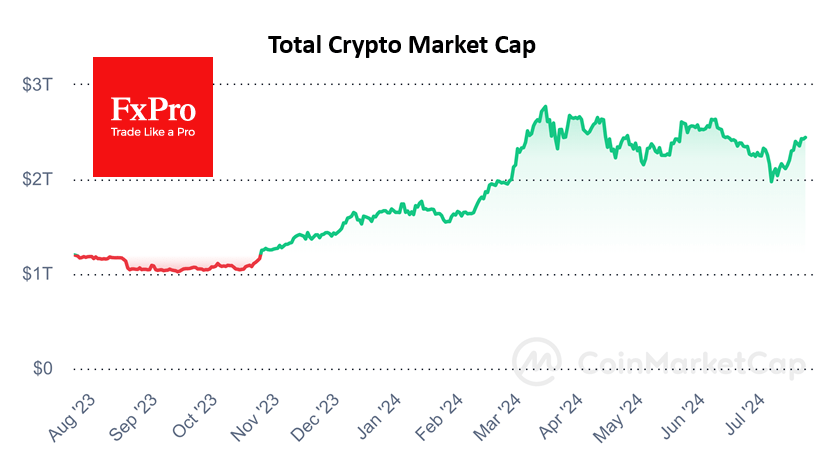

Total crypto market capitalisation, according to CoinMarketCap, fell 5.1% overnight to $1.77 trillion. Bitcoin’s dominance index fell to 41.2%.

By Wednesday, the Cryptocurrency Fear and Greed Index fell 6 points to 21 and moved back to “extreme fear”.

Bitcoin collapsed with acceleration to the stock market on Tuesday, falling the most in 15 days. Near the $38K level, the first cryptocurrency fumbled for buyer demand. Around these levels in February and early March, buyers were already breaking the downtrend, but the upside momentum proved unsustainable.

On the balance sheet, we have contradictory short-term signals. The BTCUSD has abruptly fallen below a critical support line, a bearish signal. At the same time, the uptrend breakdown failed to be confirmed by buying near previous local lows. We can describe it as Bitcoin fell out of the window but latched onto the windowsill.

Equally contradictory was the news backdrop.

According to CoinShares, institutional investors continue to withdraw capital from crypto funds from the downside. The net outflow of funds last week was $7.2 million, although it was down from the previous two weeks when investors withdrew more than $231 million.

In addition, regulatory pressure continues unabated, as ECB spokesman Fabio Panetta called the cryptocurrency industry the “Wild West” and called for stricter regulation.

Meanwhile, bitcoin steps further in recognition of a long-term investment vehicle. Fidelity Investments, one of the largest asset management firms, will make it possible to add bitcoin to its retirement portfolios.

In addition, the sustainability of mining has improved. The Bitcoin Mining Council (BMC) stated that mining efficiency increased by 63% in the last quarter thanks to the widespread adoption of sustainable energy and modern techniques.

As a result of the controversial picture, investors refrain from active action. According to Kaiko, trading volume on cryptocurrency exchanges has fallen to its lowest level since the summer of 2021. Glassnode believes that bitcoin’s fundamental metrics have improved in recent months.

The FxPro Analyst Team