Bitcoin’s breakthrough

June 21, 2023 @ 11:44 +03:00

Market picture

The market capitalisation of cryptocurrencies rose 5.7% in the last 24 hours to 1,134 trillion. Bitcoin was the growth engine, but buyers quickly expanded to some altcoins. Bitcoin is up 7.6%, Ethereum is up 4.7%, and the top altcoins are up from a modest 1.9% (XRP) to 9.4% (Litecoin).

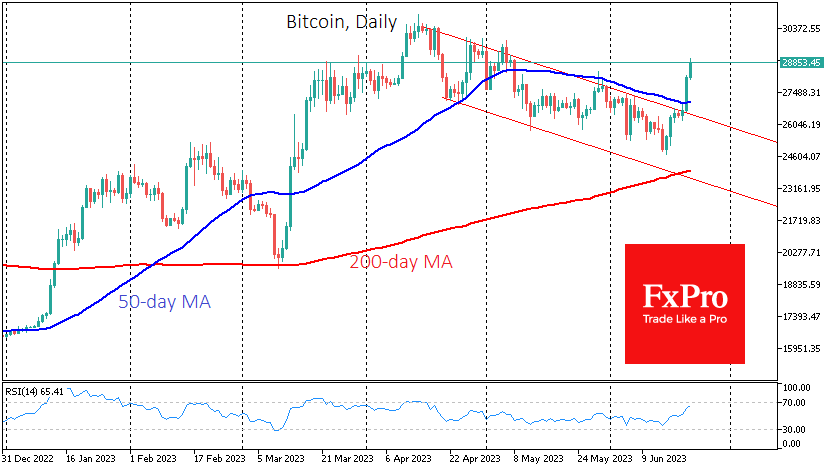

Bitcoin briefly topped $29K at the start of trading on Wednesday. In terms of technical analysis, this is an important bullish signal as the price closed above its 50-day moving average and above previous local highs in a sharp move on Tuesday. This move confirms the breakdown of the downtrend in place for the past two months. The next target for the bulls is the area between the April and May highs at $29.4-$30.4K.

News background

BlackRock’s intention to launch a spot ETF for Bitcoin has boosted institutional investor interest in the cryptocurrency, according to OrBit Markets. BlackRock filed to launch the crypto fund on 15 June. The SEC has rejected such applications more than 30 times, citing market problems and a lack of investor protection.

In anticipation of the halving, hoarders continue accumulating coins, Glassnode noted. Based on the duration of previous such periods, a return to an all-time high could occur within 8-18 months.

According to Coinbase, it is still difficult to predict the impact of a bitcoin halving in 2024. The halving could positively impact BTC’s value, but predicting the impact is speculative.

According to Santiment, Bitcoin outflows from exchanges intensified in June. By mid-June, the amount of BTC on exchanges had fallen to its lowest level since February 2018. The trend to store cryptocurrency autonomously has been dominant since late 2022.

Between 10 and 17 June, the number of new Litecoin addresses increased by 55% in the run-up to the halving, scheduled for 4 August 2023. The total number of addresses reached 200 million, surpassing the Ethereum blockchain, where around 180 million wallets.

The FxPro Analyst Team