Bitcoin weakness: a warning for stocks or its own problem?

August 26, 2022 @ 11:01 +03:00

Market picture

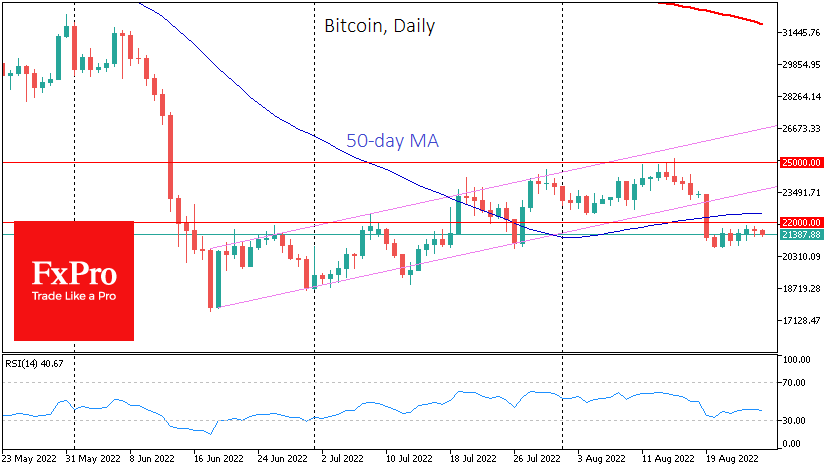

Things are slow now in crypto, with a slight downward bias for the second day. Bitcoin is losing 1.5% to $21.4K in the last 24 hours. Ethereum is unchanged for the same time, remaining at $1680. Top altcoins show mixed dynamics, ranging from a 4.1% decline (Solana) to a 2.6% increase (Cardano).

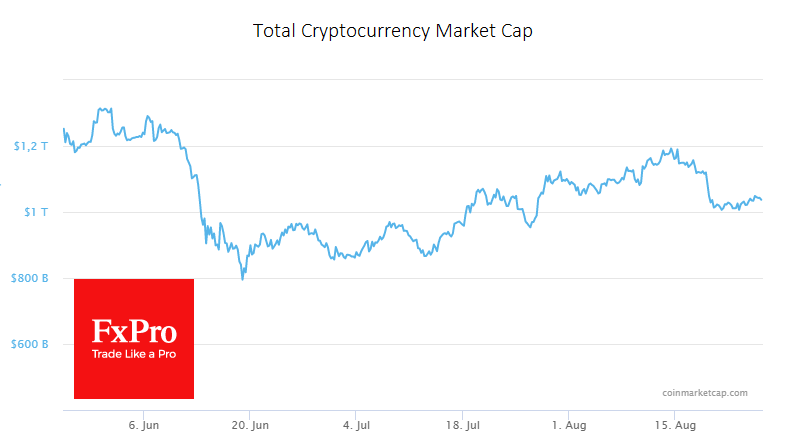

Total cryptocurrency market capitalisation, according to CoinMarketCap, was down slightly, by 0.1% overnight, to $1.04 trillion. The Cryptocurrency Fear & Greed Index rose 2 points to 27 by Friday and moved into “fear” status from “extreme fear”.

Bitcoin lags behind the equity market and altcoins on Thursday and early trading on Friday. And now, it is crucial to understand whether this is a formidable warning of domestic weakness in the latest demand for risky assets. Alternatively, the poor performance of the first cryptocurrency might be its own problem. But it would break the trend of recent months, where Bitcoin has often acted as a leading indicator for the global equity market.

News background

Coinbase CEO Brian Armstrong said that eventually, cryptocurrencies would be integrated everywhere, as the internet has previously been, and the catalyst for their universal adoption will come from large tech companies.

Ethereum co-founder Vitalik Buterin believes that people underestimate how much cryptocurrency payments are superior to other traditional payment instruments.

One of the world’s leading technology companies, South Korea’s Samsung, is serious about entering the crypto market by launching its cryptocurrency platform in the first half of 2023.

Olli Rehn, governor of the Bank of Finland, said the digital euro and private financial technology could make cross-border payments easier in Europe.

The FxPro Analyst Team