Bitcoin wandering in the range

July 06, 2023 @ 11:15 +03:00

Market picture

The cryptocurrency market lost another 0.5% of its capitalisation overnight, to 1.2 trillion. Most losses came on Wednesday afternoon, while capitalisation has risen since Thursday morning. Since last May, the market has failed to develop growth when it reaches levels above 1.22.

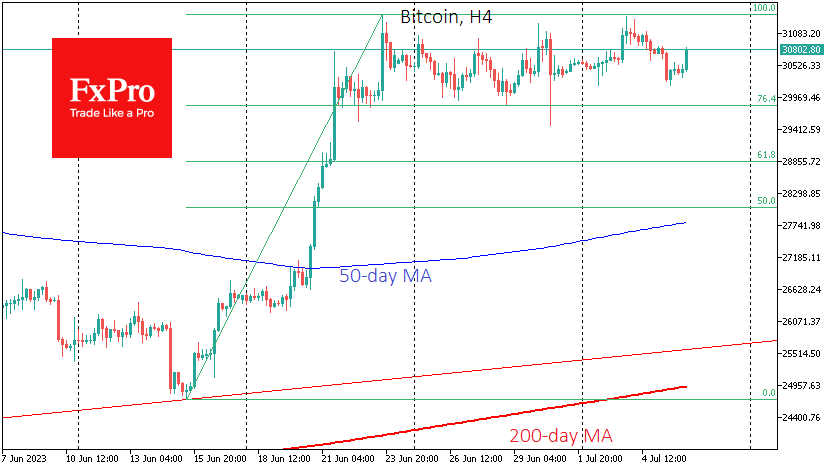

The main benchmark and psychological obstacle in this upward march is Bitcoin’s $30K level. It manages to go higher within local impulses for a while, but this only strengthens the local selling. Technically, Bitcoin never managed to break out of the narrow corridor, turning from decline to rise with the start of active trading on Thursday.

This resistance is temporary, and after some consolidation, we should expect a new test of this resistance. At the same time, one should not write off what is happening in the global equity markets. In spring, Bitcoin gained in March on the problems of regional US banks. Still, if the pressure on stocks increases due to the economic slowdown, the correlation between stocks and cryptocurrencies will be positive again.

News background

The Stablecoin sector has yet to fully benefit from Bitcoin’s rally to annual highs, drawing attention from Fitch.

In June, aggregate trading volume on centralised cryptocurrency exchanges rose for the first time since March. According to CCData, the figure rose 14.2% to $2.71 trillion.

In Australia, the offices of Binance were searched as part of an ongoing investigation into the crypto exchange’s activities in the country. An Australian Securities and Investments Commission (ASIC) spokesperson said the regulator’s probe into the company is ongoing.

Authorities in Denmark have ordered Saxo Bank to curtail cryptocurrency trading. All digital asset positions must be eliminated by 2024, as cryptocurrency trading is not on banks’ list of permitted activities.

Kenya has introduced a 3% tax on cryptocurrency transactions. According to a UN report, Kenya has the fifth highest global adoption of cryptocurrencies, with 8.5% of the country’s population owning them.

The FxPro Analyst Team