Bitcoin unlikely to end correction

June 27, 2023 @ 11:18 +03:00

Market picture

The crypto market cap is down 0.75% over the last 24 hours to $1.178 trillion in what looks like cautious profit-taking after rallying from mid-month under pressure from stock index movements.

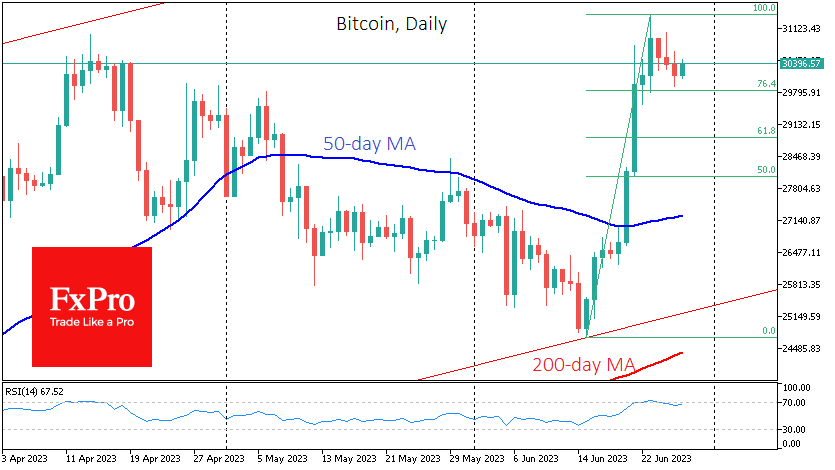

Bitcoin found support below $30K on Monday afternoon and has posted modest gains (+0.75%) since the start of Tuesday. Technically, the last pullbacks were to the 76.4% level of the rally of 15-23 June. Such quick and shallow corrections are not uncommon in solid bull markets. But given the pullback in equity indices and the fundamental headwinds (high Fed rates, ample Treasury supply), it is worth bracing for a correction to at least $28.9K and then looking at the asset dynamics to see if the crypto market looks attractive.

According to CoinShares, crypto fund investments rose by $199 million last week, the most since July 2022; the inflows offset almost half of the outflows over the previous nine weeks. Investments in Bitcoin rose by $188 million and Ethereum by $8 million. Investment in funds that allow shorting of bitcoin fell by $5 million.

The return of positive sentiment was due to recent SEC filings to launch spot bitcoin ETFs and did not affect altcoins, CoinShares noted.

News background

According to Glassnode, the total volume of cryptocurrencies on cryptocurrency exchanges has increased by around 5.6% since 14 June, mainly due to the recent surge in BTC. This marks the end of a long period of stablecoin outflows from exchanges, which has been in place since December 2022.

Hong Kong’s largest bank, HSBC, offered its customers the opportunity to trade Bitcoin and Ethereum ETFs listed on the local exchange. HSBC Hong Kong was the first major institution to offer such a service.

According to The Block, bitcoin’s Lightning Network (LN) micro-payment capacity has soared in dollars and cryptos. Over the past 12 months, the increase was 42% in Bitcoin and 105% in fiat.

The FxPro Analyst Team