Bitcoin testing a downtrend

June 20, 2023 @ 13:18 +03:00

Market picture

Crypto market capitalisation rose 0.8% to $1.073 trillion, close to its level of 10 days ago. Bitcoin was a major contributor to the rally, rising 1.6% to $28.8K, while Ethereum gained just 0.4% to $1730. Among the top altcoins, Solana (+3.5%) stands out, with other altcoins ranging from -1.2% (XRP) to +1.6% (Polygon).

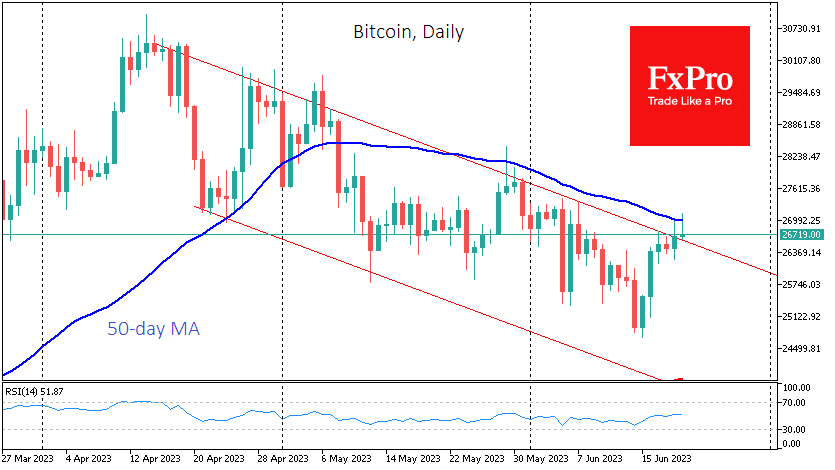

For the fifth day out of the last six, Bitcoin has breached the upper boundary of its bearish range and tested the 50-day moving average near $27K. Although the price has now breached the channel’s upper boundary, a break of the downtrend cannot be declared until a close above $27.2K, the previous local high, is achieved. A reversal from current levels offers a downside of more than 10% with the potential for a drop to the 200-day moving average.

According to CoinShares, investment in crypto funds fell by a paltry $5 million last week, but net outflows continued for the ninth consecutive week. Retail traders helped push Bitcoin above $26K, according to Glassnode, which noted an increase in activity from addresses controlling between 0.1 and 1 BTC.

News background

MicroStrategy founder Michael Saylor said that recent SEC actions against crypto have made it clear to the industry that it is doomed to be bitcoin-centric. According to him, BTC is the only institutional-level asset.

US crypto payments company Wyre announced it was shutting down after a decade of operation due to difficult bear market conditions. After fintech company Bolt terminated a $1.5bn acquisition agreement in September 2022, the platform was on the brink of bankruptcy.

Ethereum developers discussed details of a future update to the Deneb consensus level during a conference call that will be part of Dencun hard fork. The minimum balance for ETH network validators is proposed to be increased from 32 ETH to 2048 ETH, attempting to improve blockchain efficiency.

The International Monetary Fund (IMF) is working on a global infrastructure for central bank digital currencies (CBDCs) and legislation to control the movement of funds in CBDCs, said IMF chief Kristalina Georgieva.

The FxPro Analyst Team