Bitcoin spooked by highs, Ethereum still climbing

March 06, 2024 @ 13:56 +03:00

Market picture

The cryptocurrency market is building capitalisation towards the 24-hour level, but it’s a relatively modest +0.6% to $2.51 trillion. That’s close to, but still below Tuesday’s highs.

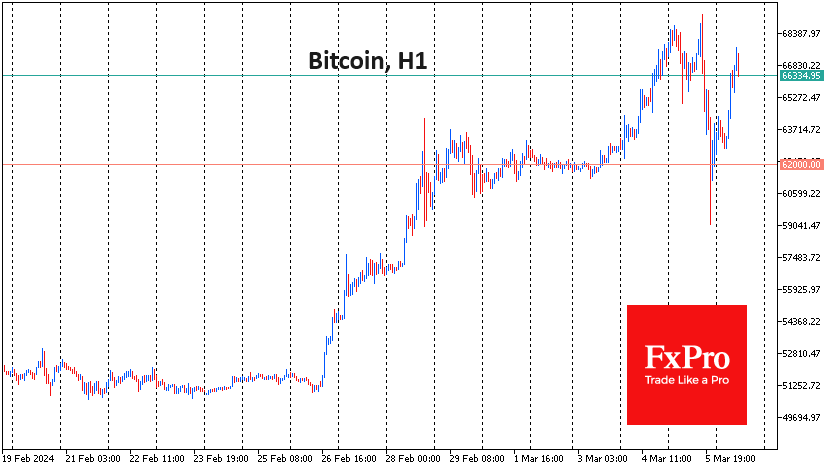

Bitcoin briefly topped $69K on Tuesday, setting a new all-time high, but has since corrected by more than 15%.

The size, speed and nature of the decline indicate a desire for “weak hands” to exit Bitcoin. At its lowest point, the price fell below $59K due to large orders that the market was unable to quickly digest. Excluding this spike, we can assume that the price fell to $62K – last week’s consolidation area – wiping out all the recent gains.

We saw these 15% corrections for a long time after the first update of the highs in the last cycle in 2020. It’s worth bracing for up to several weeks of consolidation in the 15-20% range.

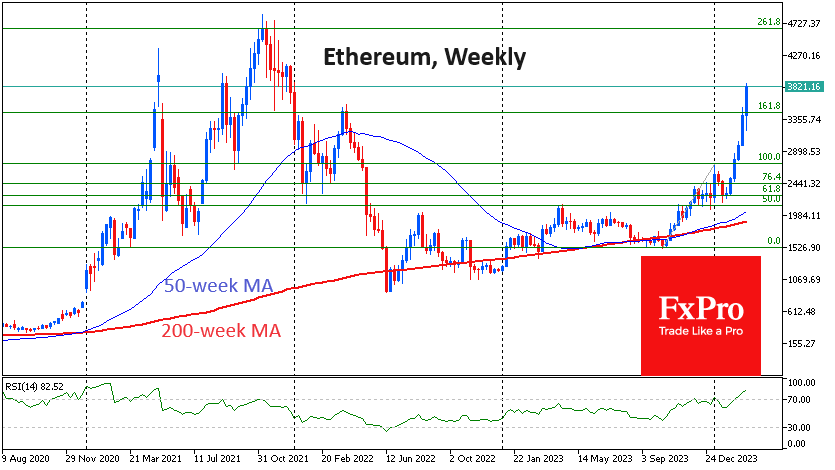

Many altcoins have pulled back significantly from recent highs, looking back at BTC. But not Ethereum, which hit new highs since January 2022 at $3865 on Wednesday morning. The second most important cryptocurrency very quickly crossed the key $3500 threshold (161.8% of the year-end rally and local April 2022 high). According to the Fibonacci model, the next upside target is the 261.8% level, which is just above $4600 and close to historical highs.

News background

Ethereum’s cumulative stakes have surpassed $117 billion. Ethereum validators have blocked more than 31.5 million ETH in stakes, according to The Block. The total ETH supply is around 120 million coins with a capitalisation of ~$450 billion, so around 26% of the asset issuance is involved in securing the network.

The SEC has delayed a decision on BlackRock and Fidelity’s spot Ethereum ETFs. The commission will continue to gather comments from the public. Experts are divided on when the regulator will make a positive decision on Ethereum ETFs.

Over the past 90 days, investors have invested the equivalent of 133,000 BTC in various regulated bitcoin products. Their total assets under management (AuM) rose to 1 million BTC, according to ByteTree. Outflows from gold and bond-based ETFs accompanied the trend.

Michael van de Poppe, founder of MN Trading, pointed out that this is the first time in history that a new ATN has been reached before rather than after a halving.

The upcoming halving in April will reduce the daily mining of new bitcoins from 900 BTC to 450 BTC, which will affect trading strategies, market cycles and mining, according to Glassnode. Historically, halves have preceded bullish rallies. Heavy buying of spot bitcoin ETFs could add to the increased demand.

Deutsche Börse has launched an institutional-focused regulated platform for spot trading, settlement and custody of cryptocurrency assets, Deutsche Börse Digital Exchange (DBDX). Settlement and custody services will be provided by Crypto Finance (Deutschland), a BaFin-licensed subsidiary.

The FxPro Analyst Team