Bitcoin retreats but not yet broken

February 27, 2023 @ 11:41 +03:00

Market picture

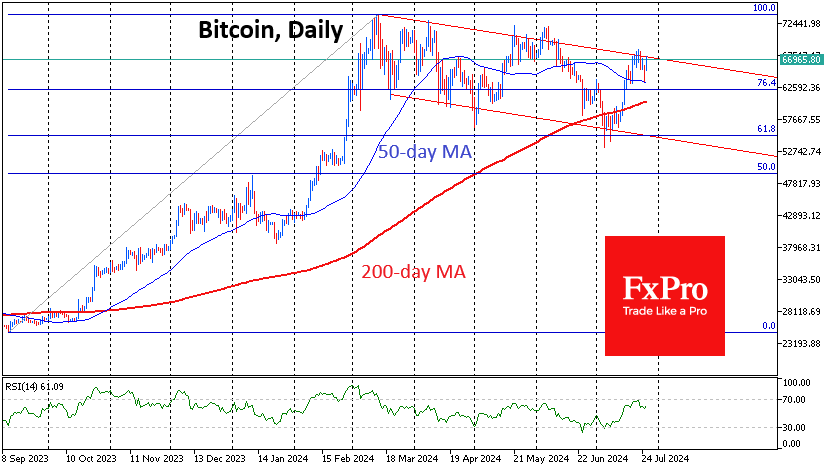

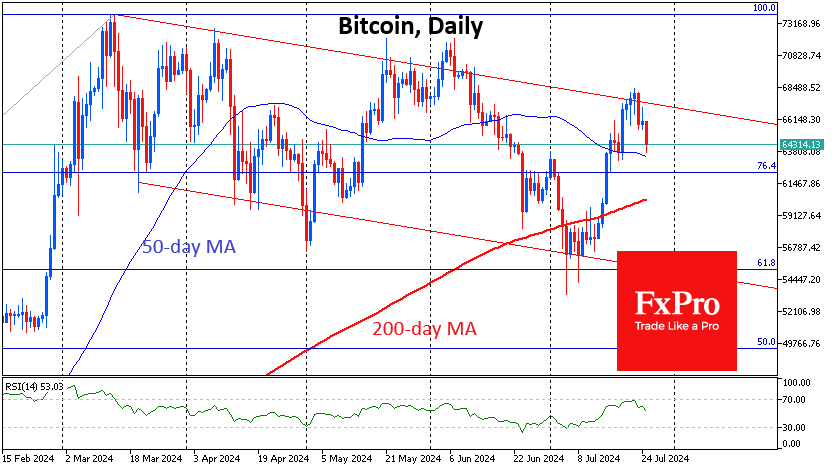

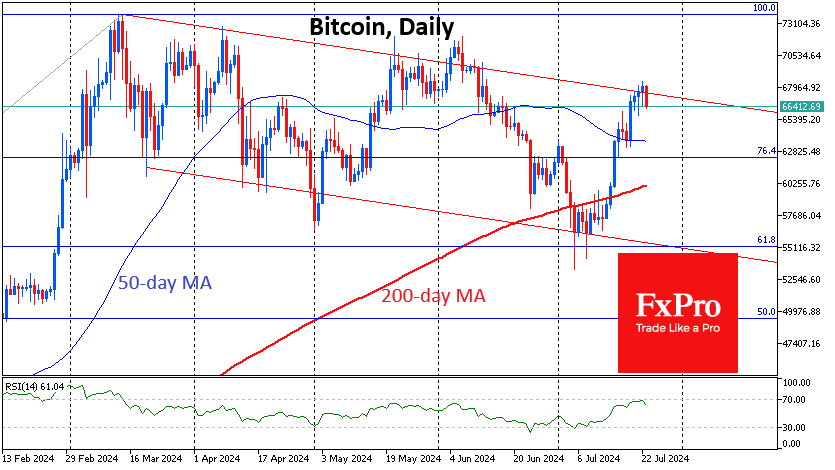

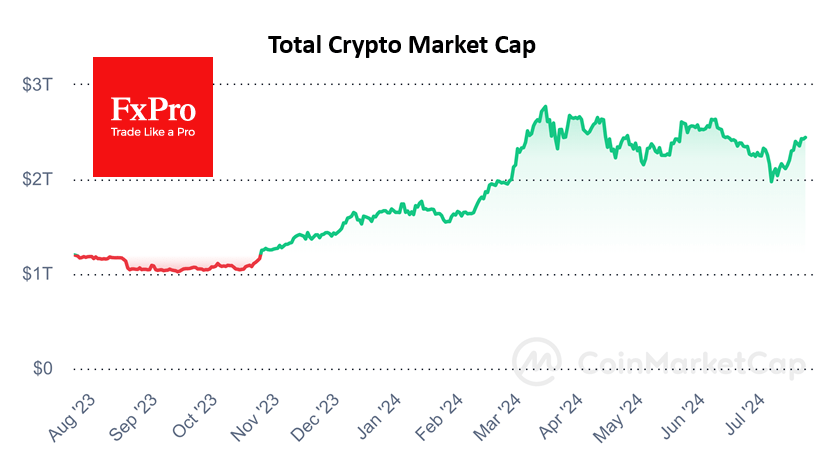

Bitcoin closed last week down 6.8%, ending the week at around $23K. Ethereum lost 6.7% to $1570. According to CoinMarketCap, the total capitalisation of the crypto market is $1.07 trillion at the time of writing, down from $1.13 trillion the week before.

Bitcoin fell during the week amid falling stock indices and a rising USD on expectations that the Fed will have to raise interest rates further to cool inflation. Higher interest rates hamper the availability of money and risk appetite.

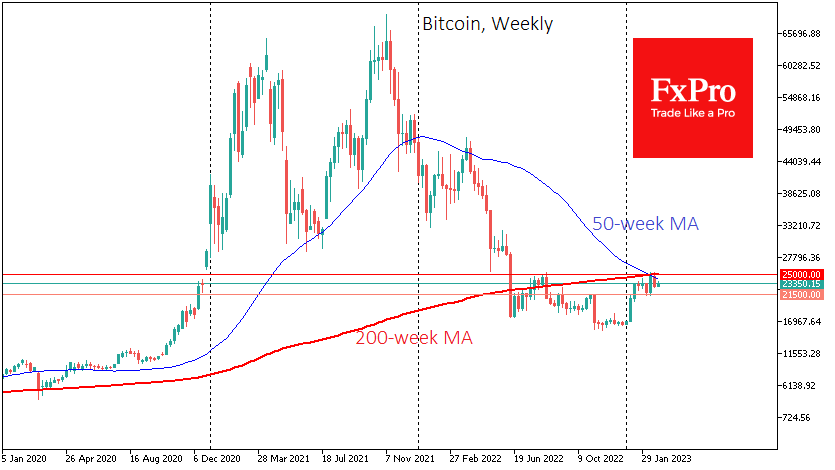

Technically, bitcoin is selling off after touching its 200-week moving average. And due to the negative momentum at the end of the week, it has also fallen below the 50-week moving average. This dynamic may be a prologue to further declines, a predictable tug-of-war near trend levels.

A pullback in bitcoin to $21.5K would remain a correction within a bull market, but a sharp drop below that level could force a reassessment of whether we are out of a bear market.

Another recalculation has resulted in a 9.95% increase in the BTC mining difficulty. The figure hit an all-time high of 43.05 T. According to Glassnode, the network’s smoothed 7-day moving average hash rate is close to 303 EH/s.

News background

The International Monetary Fund (IMF) has called for a “coordinated response” to cryptocurrencies. The growing acceptance of digital assets requires harmonisation of supervisory efforts across countries to regulate them, the IMF said in a statement. The fund said that cryptocurrencies should not be recognised as a means of payment.

The Fed, FDIC and OCC issued a joint statement reminding the US banks about the potential risks of crypto-services-oriented companies. The regulators cited the “unpredictable size and timing of deposit inflows and outflows” from such companies.

Treasury Secretary Janet Yellen said that while the US was not considering an outright ban on cryptocurrency activity, it was important to establish a regulatory framework for the sector. In contrast, IMF chief Kristalina Georgieva believes a cryptocurrency ban is possible.

Solana’s verifiers restarted the network twice due to an unknown error, causing a complete shutdown of economic activity on the blockchain. The malfunction occurred during a node software upgrade to a newer version.

The FxPro Analyst Team