Bitcoin looks set to take a severe dive

June 06, 2023 @ 11:56 +03:00

Market picture

The cryptocurrency market hit a sell-off on Monday night, losing 3.8% in the last 24 hours, down to a capitalisation of $1.091 trillion – near almost three-month lows.

Bitcoin is losing 4% to 25.7 over this period; Ether is losing 3% to $1814, with top altcoins losing between 3.7% (Tron) and 7.9% (BNB).

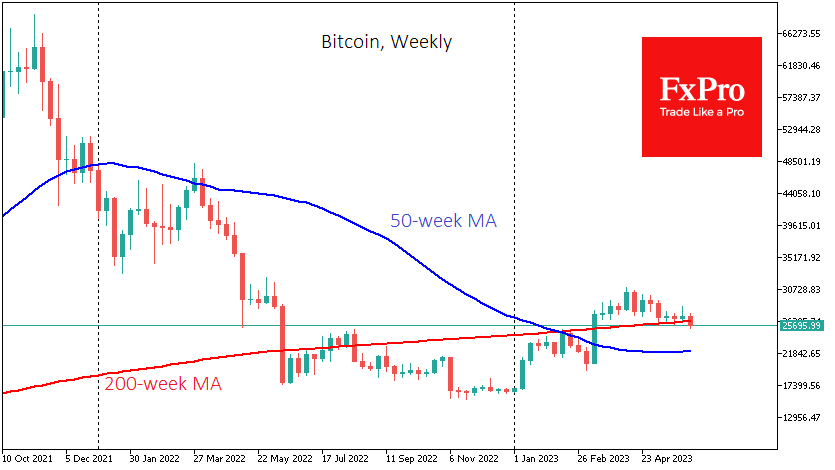

The sharp move down has pushed Bitcoin’s price below its 200-week average ($26.3K). And now all the attention of position traders is focused on whether the price returns to territory above that line before the end of the week. If not, we should be prepared for a big sell-off down to $22K. This is the main working scenario, given the series of lower highs and lower lows over the past two months.

An alternative and less likely scenario would be a reversal to the upside after a brief dip below the 200-week average. This dynamic could assert that big players are gaining on Bitcoin at this level, suggesting considerable upside potential.

According to CoinShares, investments in cryptocurrencies fell by $62M last week, the 7th week of outflow. Bitcoin investments fell by $3m, as did Ethereum. Tron, a smart contracts platform, saw a $51m outflow over the week due to the closure of the offering by one of the providers.

News background

According to Bloomberg strategist Mike McGlone, Bitcoin won’t be able to show significant growth in the summer months. He also doesn’t rule out a substantial drawdown in the crypto market amid a halt to change and a stagnant equity market.

According to The Block, bitcoin’s 30-day average volatility on a year-over-year basis has fallen from the asset’s characteristic average of 71% to 32%. The famous Meta and Amazon stocks have overtaken digital gold on this measure.

The US Securities and Exchange Commission (SEC) has sued cryptocurrency exchange Binance and its CEO Changpeng Zhao. The regulator brought 13 charges, including unregistered offers and sales of BNB and BUSD tokens, Simple Earn and BNB Vault products, and staking.

JPMorgan will speed up interbank transactions in India using blockchain. The financial giant has agreed with five Indian banks to implement its blockchain-based Onyx settlement platform.

The FxPro Analyst Team