Bitcoin lags against altcoins

November 04, 2022 @ 10:51 +03:00

Market picture

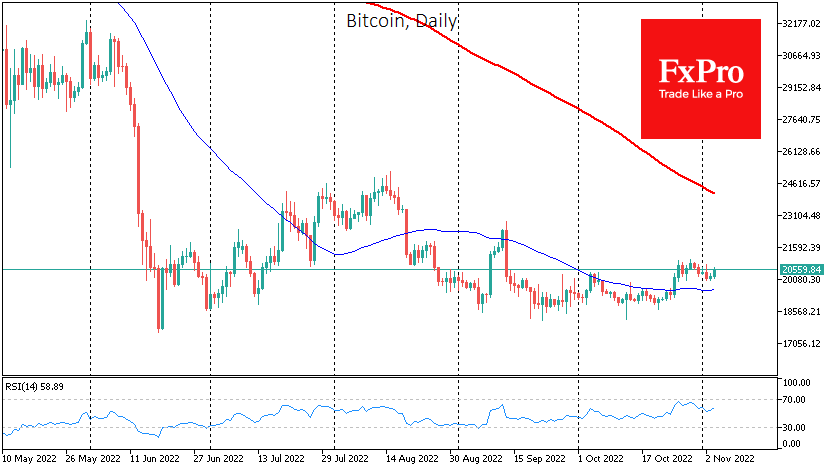

Bitcoin is trading at $20.6K, adding 1.5% in the last 24 hours and almost as much in the 7- and 30-day intervals – a clear illustration of the exhausting sideways market that has engulfed the crypto. However, looking under a magnifying glass, there is an optimistic shift with a positive close on Thursday despite a sell-off in traditional markets.

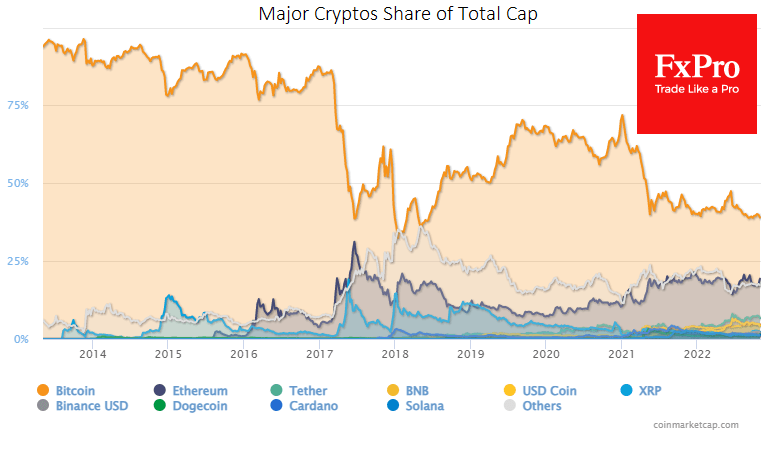

Right now, traditional markets are now pulling Bitcoin and Ether down rather than helping them grow. Over the past month, cryptocurrency market capitalisation has increased by 8% – noticeably outperforming the first cryptocurrency. We’ve previously noted how the altcoins in the top 20 have shot up one by one. One outcome is that Bitcoin’s share has fallen from 40% a month ago and 46.5% at its peak in June to 38.5%, usually during FOMO rally periods. And one should remember that its share was above 80% before 2017 and above 60% before 2021.

Active projects are gradually eating away at the share of the first cryptocurrency. It would not be surprising if bitcoin’s percentage drops another notch during the next crypto rally, ceasing to be the dominant market force.

News background

According to CryptoQuant, the Chinese government has become one of the major bitcoin whales, with its BTC holdings nearly one and a half times the size of MicroStrategy’s reserves. Chinese authorities handed over to the national treasury 194,000 BTC seized from the cryptocurrency pyramid scheme PlusToken in 2019, giving them extreme leverage and control over the crypto market.

According to Santiment, crypto whales have recently sold off more than $110 million worth of Dogecoin.

Meta is testing a new feature to create and sell NFTs on Instagram. The option will initially be available on the Polygon blockchain.

Meanwhile, investment giant Fidelity Investments will allow retail clients to invest in bitcoin and Ethereum.

The FxPro Analyst Team