Bitcoin keeps at heights, Litecoin pushes back from resistance

September 24, 2024 @ 10:54 +03:00

Market Picture

The cryptocurrency market corrected 0.5% to levels from a day earlier to $2.22 trillion, continuing to settle at the top near the previous month’s peak. As expected, cryptocurrency selling intensified near the previous peak. The cryptocurrency market will need to rise another nearly 3% to validate the breaking of the multi-month downtrend.

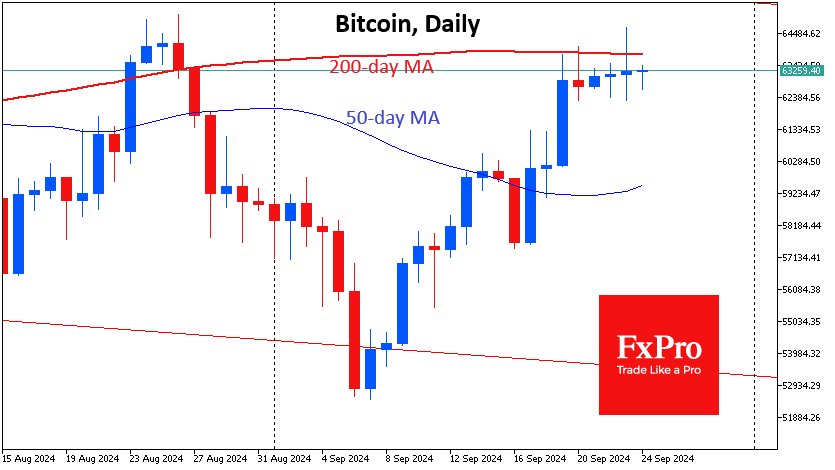

Bitcoin’s previous four daily candles and today’s candles show a very moderate end-of-day trend with relatively impressive intraday swings. The battle for the 200-day moving average continues. In this case, the former cryptocurrency is moving up more cautiously than the stock market.

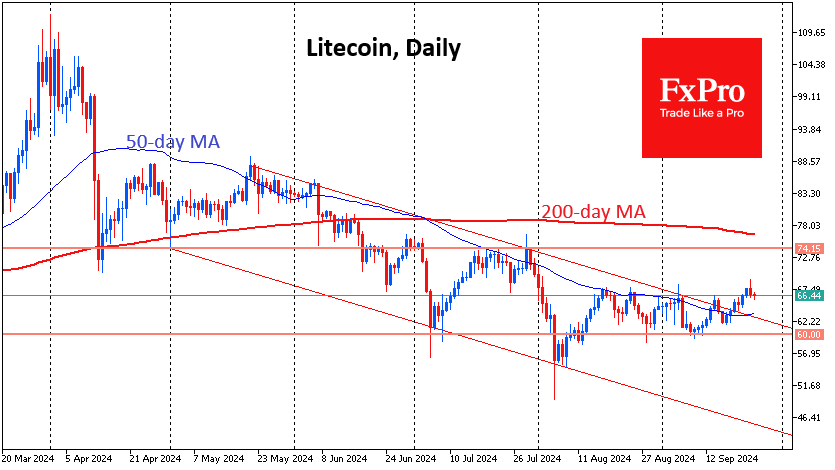

Last week, Litecoin overcame the resistance of the descending channel, inside which it has been trading since May. However, selling intensified as it approached the horizontal resistance level just above $67, which turned the price downward for the fourth time in the last five weeks. A return of risk appetite in global markets will help validate the break of the downtrend, sending the price to $74 (+12%). Intensifying selloffs will force the price to look for support at $60 (-10%) as soon as possible.

News Background

According to CoinShares, investments in crypto funds rose by $321 million last week after inflows of $436 million a week earlier. Bitcoin investments were up $284 million, while Solana was up $3 million; Ethereum was down $29 million. Investments in funds with multiple crypto assets were up $54 million.

The inflow of funds last week was probably caused by the US Federal Reserve’s decision to cut the interest rate by 50 basis points at once. As a result, total assets under management (AUM) rose 9% to $9.5bn. Ethereum remains the exception, with outflows for the fifth week in a row. This is due to persistent outflows from Grayscale Trust and meagre inflows into the recently launched Ethereum-ETFs, CoinShares noted.

Larry Fink, CEO of BlackRock, said Bitcoin is a legitimate financial instrument that can diversify risk. In his view, it is an instrument that ‘people invest in as soon as they become fearful of the market.’

The average transaction fee on the Ethereum network rose to $3.98, almost fivefold from $0.85 in early September. Uniswap tops the ranking of the most gas-consuming apps.

The FxPro Analyst Team