Bitcoin has slowed but is still looking higher

January 17, 2023 @ 11:53 +03:00

Market picture

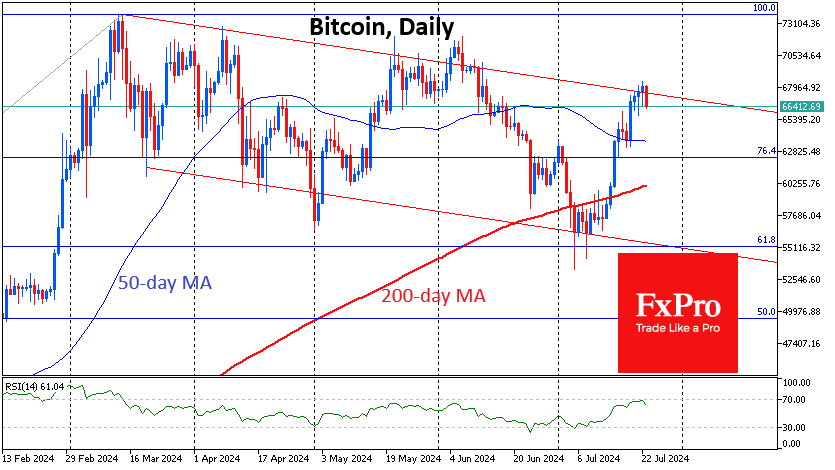

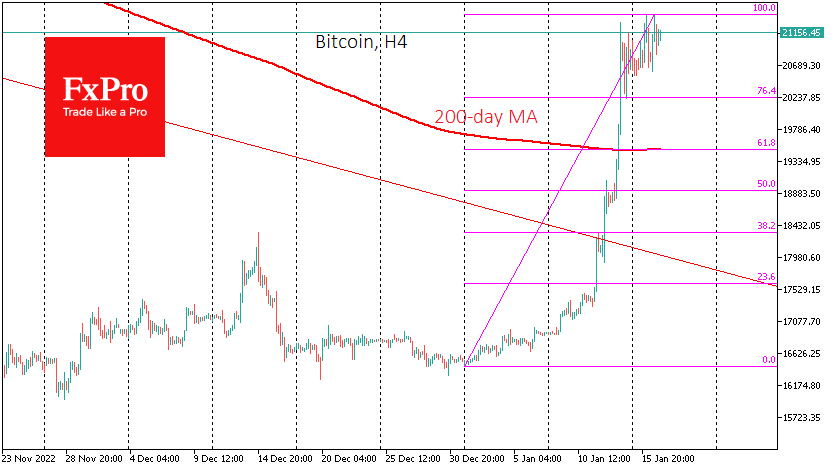

Bitcoin hit a high above $21.4K on Monday but pulled back to $21.0K – the area of the high since November – the rate is frozen, waiting for new signals.

It was apparent yesterday that the market needs a technical correction, or at least a consolidation around one level before it can continue rising after a 30% rally since the beginning of the year.

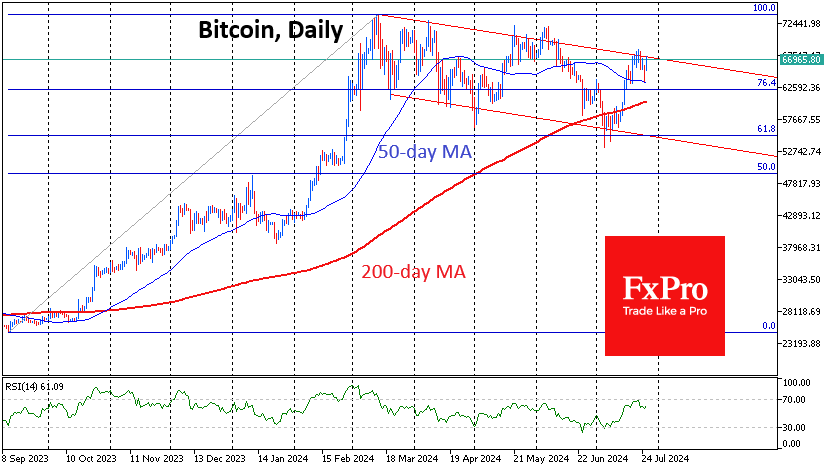

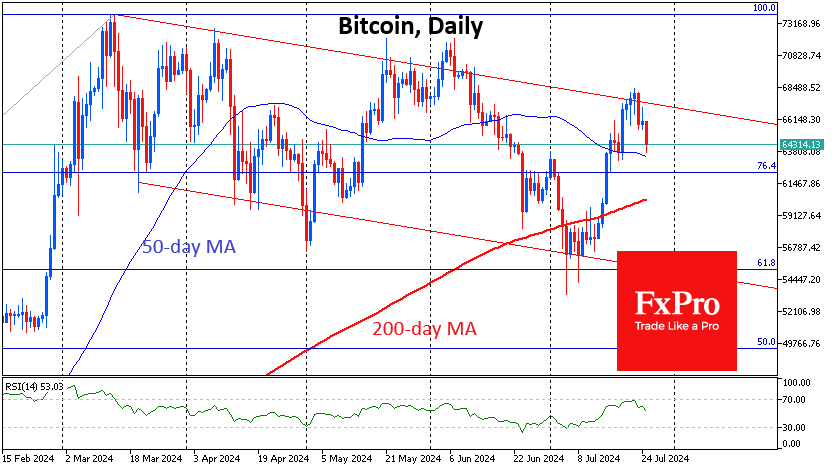

A technical correction might send the price to $20.2K or, more likely, $19.6K. The 200-day moving average and 61.8% Fibonacci level from the last rally pass near the latter level. A pullback to this area would be a typical correction. The emergence of new buyers will signal the end of the bearish trend in crypto. In the event of a more profound plunge, there is a high risk of a new disappointment of early buyers and an imminent return to a down-trend followed by lower lows.

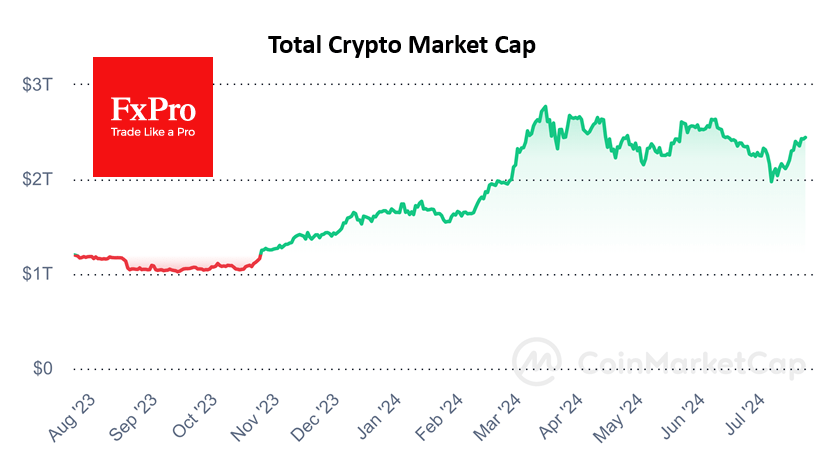

According to CoinShares, investments in crypto funds rose by $9M last week, with small inflows following three weeks of withdrawals. Bitcoin investments increased by $10M, and Ethereum by $6M. Investments in funds that allow shorts on bitcoin decreased by $1.5M. Among altcoins, Solana recorded the largest inflows of $1.3M; XRP showed the largest outflows at $3.3M.

Bitcoin’s mining difficulty rose last week by 10% to 37.59T, breaking record levels and marking the sharpest rise since October last year.

News background

Bitcoin could hit $100,000 within two or three years, said SkyBridge Capital hedge fund founder Anthony Scaramucci. The main trigger will be most investors’ acceptance of BTC as an asset class.

The Indian Central Bank (RBI) has advocated a complete ban on cryptocurrencies. The RBI believes that the crypto market should not be legalised as the definition of ‘cryptocurrency’ is very vague, and all digital assets are comparable to gambling.

The developers of Shiba Inu have announced the imminent launch of a beta version of the Ethereum-based Shibarum Level 2 network. This will accelerate the network and allow developers to create decentralised applications and integrate NFT.

The FxPro Analyst Team