Bitcoin completes a corrective pullback

December 14, 2020 @ 16:06 +03:00

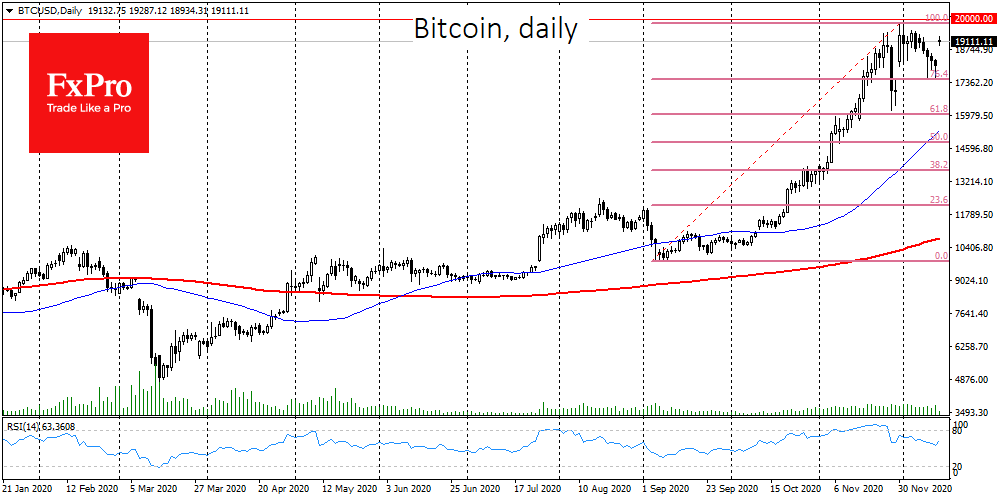

At the end of last week, Bitcoin was declining towards $17,500, which caused quite strong negative sentiment in the market. Many investors feared that we were at the beginning of a large-scale correction, which has the potential to reverse the trend and push the crypto market into a new recession or prolonged weak dynamics. Nevertheless, buyers rushed to the rescue of the first cryptocurrency, pushing it back to $19,200. Thus, for the week, Bitcoin shows almost zero change in price.

Technical analysis once again confirmed its fundamental impact on Bitcoin. The correction of the last few days lost its strength on the approach to the 76.4% level of the September-November rally, which is considered as the first line of correction in rapid growth trends. If so, bitcoin may test the $20,000 area again as early as this week.

Institutional investors are driving the rally in the crypto market, although their attention is now more drawn to the traditional market. The launch of vaccinations is one of the most eagerly awaited events of the year. The impact of the vaccines is likely overestimated by investors, as there is a huge amount of statistical work ahead. Besides, massive cases of complications could negate the entire positive effect. Nevertheless, the market is growing again, and the situation is somewhat similar to cryptocurrencies.

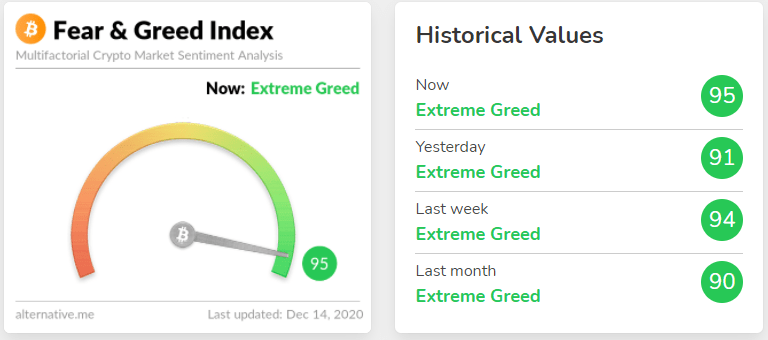

The Crypto Fear & Greed Index for Bitcoin and major cryptocurrencies is back in the “extreme greed” area at 95. The traditional market is also essentially overheated but it is still not enough in the current environment to trigger a full-scale correction. Bitcoin may have also been supported by news from MicroStrategy, which managed to raise $650 million instead of $400 million to buy more bitcoins. MassMutual, a U.S. insurance company with a $235 billion investment fund, invested about $100 million in Bitcoin.

JPMorgan Chase & Co. believes the current investment cases are just the beginning. When large, and especially conservative funds, invest in Bitcoin – it significantly improves its reputation, which brings even more new investors to the market. Analysts at JPMorgan Chase & Co. expect insurance companies, pension funds, and other large market participants to invest about $600 billion in Bitcoin.

So while a fairly aggressive correction may well be expected in the short term, we see no impact on the overall sentiment of large investors. Probably, the last episode of decline is still more related to profit-taking by smaller investors, as well as sales of miners, who, to support their operating activity have been waiting for the right moment to sell for quite some time since the crypto market has been mostly falling since the beginning of 2018.

The FxPro Analyst Team