Bitcoin and Ethereum test 50-day MAs

July 16, 2024 @ 10:31 +03:00

Market Picture

The crypto market has rallied nearly 2% over the past 24 hours to a $2.34 trillion cap, with the slippage at the start of the day pushing the figure to $2.38 trillion, a level last seen on June 20th.

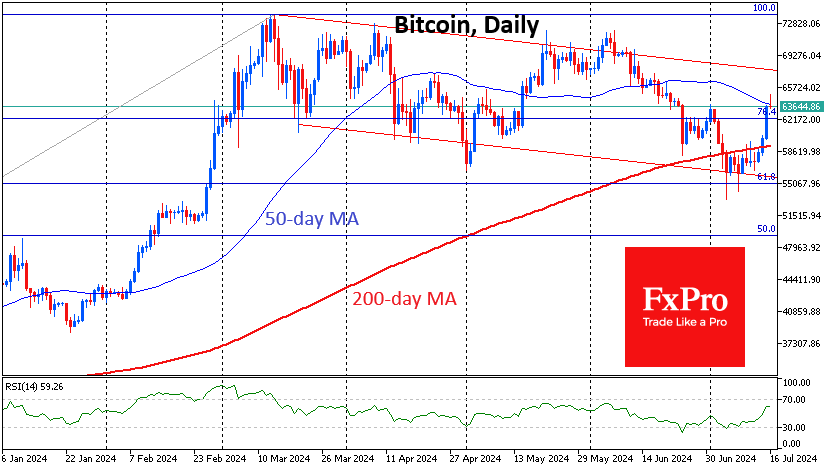

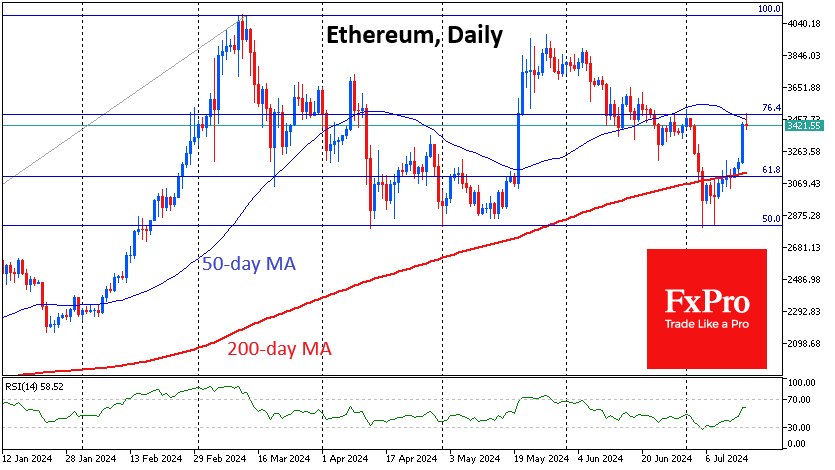

Bitcoin and Ethereum are testing their 50-day moving averages on Tuesday after retreating from the more important 200-day MA. A major correction and upside reversal has already finished earlier this month, so the $63K per BTC and $3500 per ETH levels now look like a temporary shakeout of positions but not impenetrable resistance.

According to data from CoinShares, crypto fund investments rose by $1.439 billion last week, following inflows of $441 million the previous week; the figure marked the second week of growth and was the fifth-largest weekly inflow on record. Investments in Bitcoin rose by $1.347 billion, Ethereum by $72 million, and Solana by $4 million, with Ethereum seeing the largest inflows since March, likely in anticipation of the imminent approval of spot ETH ETFs in the US.

News Background

However, weekly trading volume remained low at $8.9 billion, compared to this year’s average of $21 billion, CoinShares noted.

BlackRock CEO Larry Fink said Bitcoin is a legitimate financial instrument to invest in during times of heightened fear. BTC offers a way to invest “in something outside the control of any country.”

IntoTheBlock calculates that Bitcoin miners added $71K BTC to their wallets last week against a backdrop of falling prices. CryptoQuant noted that the 30-day coin accumulation rate was the highest since April 2023. Santiment cited a reduction in long positions by retail traders, which should support the long-term bullish trend.

At the same time, Whale Alert recorded the activation of a wallet that had been dormant for almost 12 years, moving 1,000 BTC worth ~$60 million.

Retail investors are underestimating Ethereum, which could reach a new high faster than other assets due to institutional demand, according to Michael van de Poppe. He expects spot Ethereum ETFs to be approved in the US this week.

Bernstein advises buying shares in companies in this segment because the “Trump factor” is creating an ideal economic growth scenario for Bitcoin miners.

The FxPro Analyst Team