Bitcoin and Ethereum on the verge of breaking resistance

December 12, 2024 @ 11:35 +03:00

Market Picture

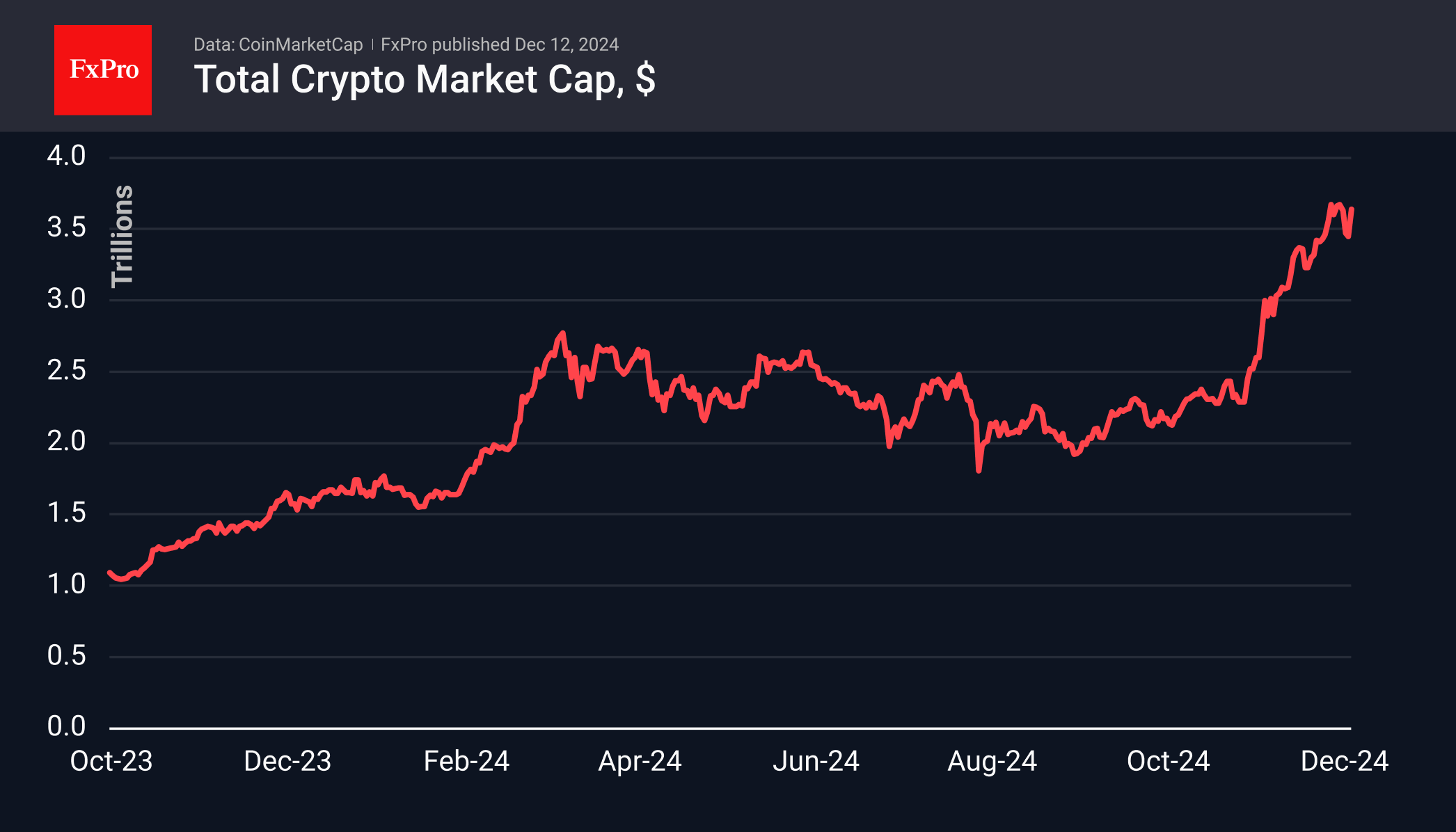

Crypto market capitalisation jumped 5% in 24 hours to $3.64 trillion. Optimism in the US stock market pushed Bitcoin above $100K, bringing buyers back into altcoins. The Cryptocurrency Sentiment Index returned to extreme greed territory at 83.

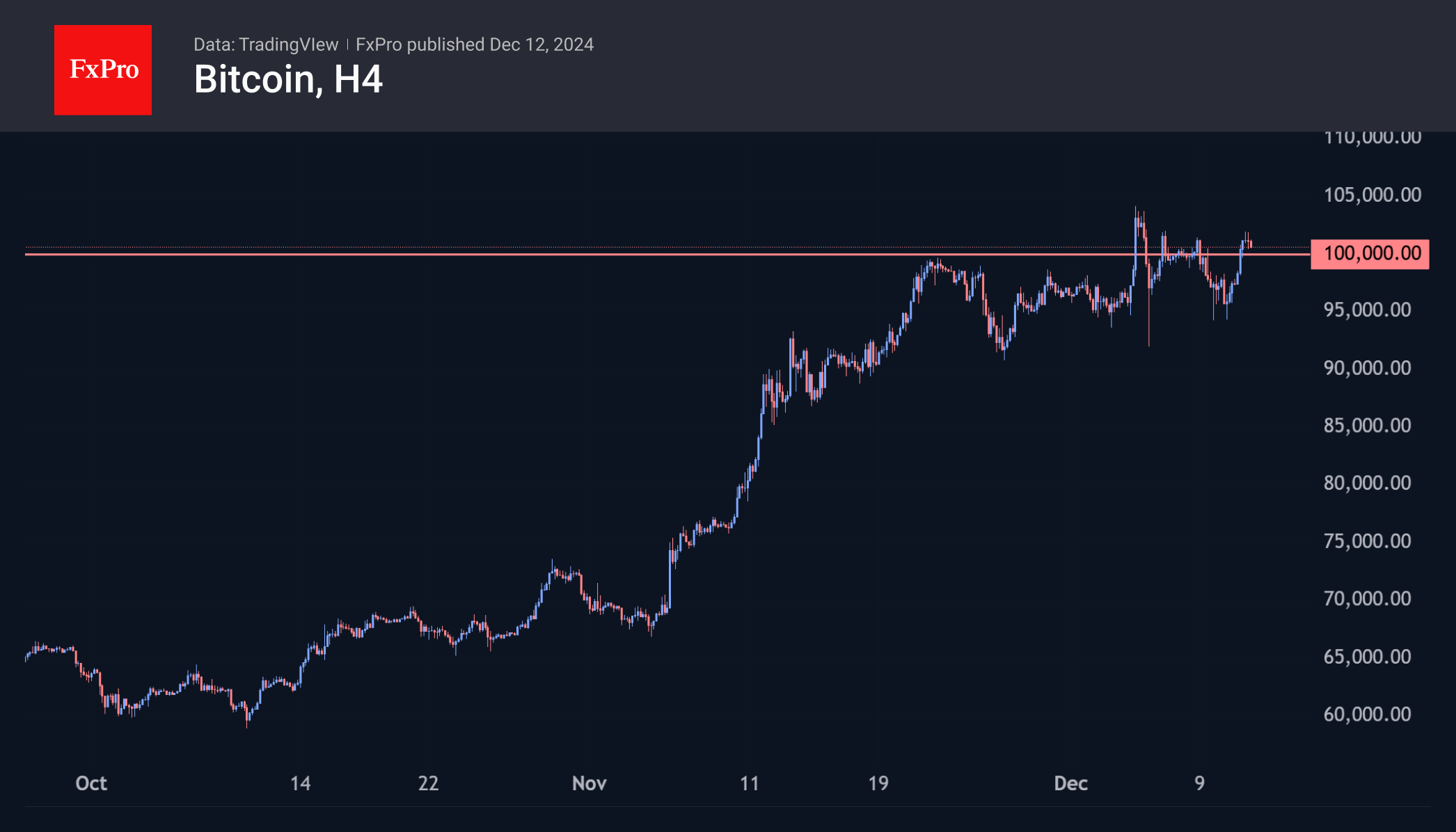

Bitcoin climbed just above $101.5K, meeting solid resistance for the past seven days. Current levels are above the psychologically important round level and the consolidation area of the last three weeks. It may be risky to talk about a breakout to new highs and a complete eradication of bearish sentiment. A confirmation of buying strength could see a quick rally into the $120,000 area.

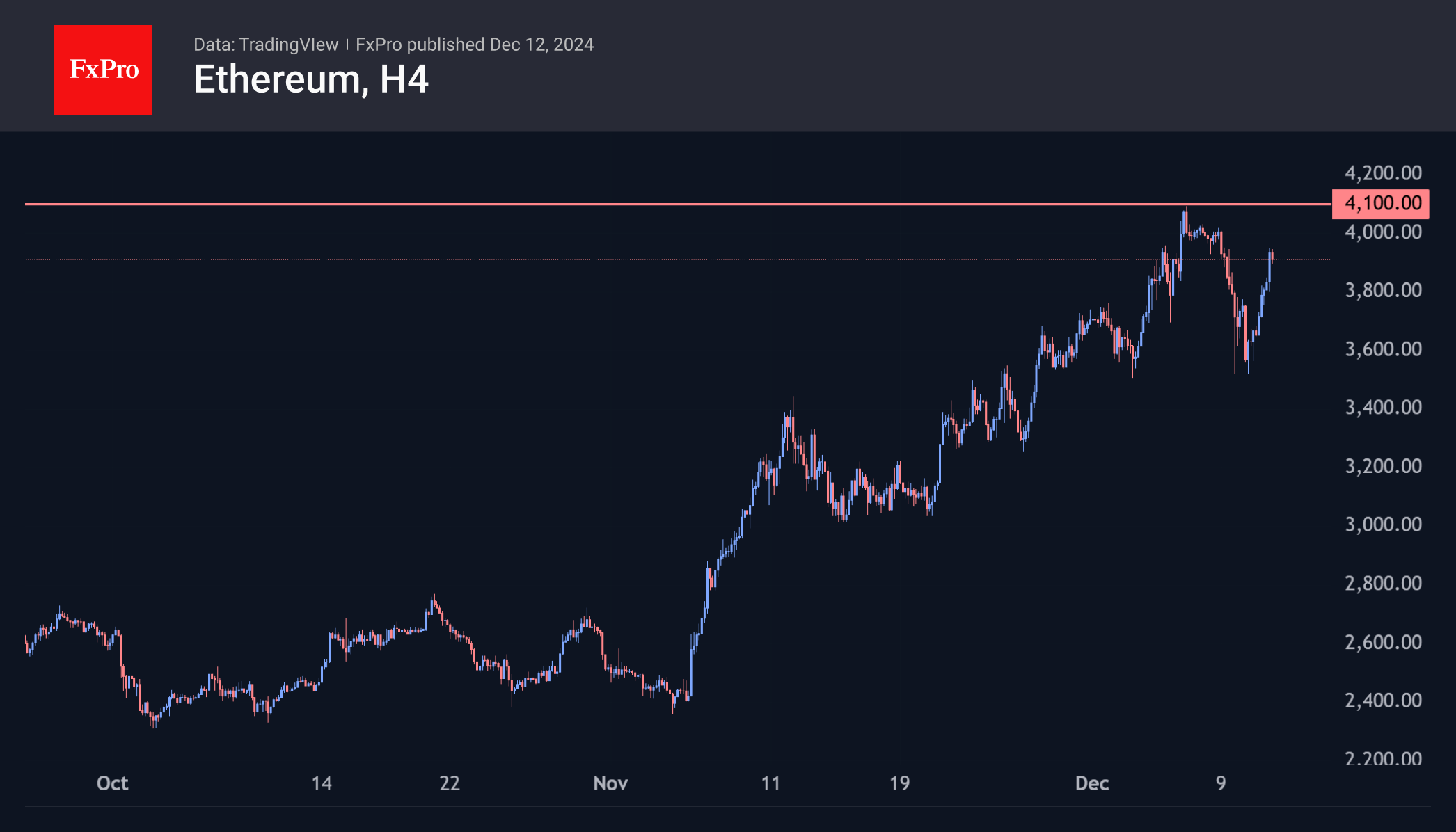

Ethereum rose 7% on the day to $3900, doubling bitcoin’s performance. However, this is a rally and not a breakout to new highs, which makes the path easier. It will be interesting to watch the price action as it enters the $4100 area. From this level, there are roughly equal chances of a sharp reversal to the downside and a break of resistance with a flight to the $5000 area.

News Background

Ray Dalio, founder of Bridgewater Associates, said he would invest in the first cryptocurrency amid the inevitable debt crisis and the coming fall of fiat currencies. He urged people to ‘stay away from leveraged assets like bonds and own hard money like gold and bitcoin’.

According to options protocol Derive, Ethereum’s chances of hitting $5,000 in December have fallen below 10%. However, according to EthHub founder Eric Conner, a ‘supply crisis’ is looming for the coin. Ethereum ETFs attracted more than $305 million on 10 December alone.

Circle and the Binance exchange have entered a strategic partnership to expand the USDC stablecoin’s global presence. The exchange will also list the ‘stablecoin’ as an asset in its corporate treasury.

On 11th December, shares of the Japanese exchange Coincheck began trading on the Nasdaq, becoming the second crypto exchange on the US stock market after Coinbase.

According to K33 Research, the volume of liquidations in altcoins ($1.75bn) on 10 December was the largest since 19 May 2021, while the cryptocurrency market ($12.8bn) hit a record high. This signals a reduction in excessive leverage and sets the stage for more sustainable growth.

The FxPro Analyst Team