Bitcoin and Ether reached two of three bears’ targets

June 14, 2022 @ 09:58 +03:00

Bitcoin collapsed 15.1% on Monday, ending the day around $23,200 and slipped another 10% on Tuesday morning on inertia before finding support from buyers after touching $20,800.

Ethereum has lost 7.8% in the past 24 hours and more than 30% in the week. The top ten altcoins show buyer optimism, with Solana up 9.5% and Cardano up 7.3%. Among the decline, leaders are Tron with -8% and BNB with -3.5%.

The total capitalisation of the crypto market, according to CoinMarketCap, sank 6% overnight to $0.965 trillion. The Cryptocurrency Fear and Greed Index was down 3 points to 8 by Tuesday and remains in “extreme fear”.

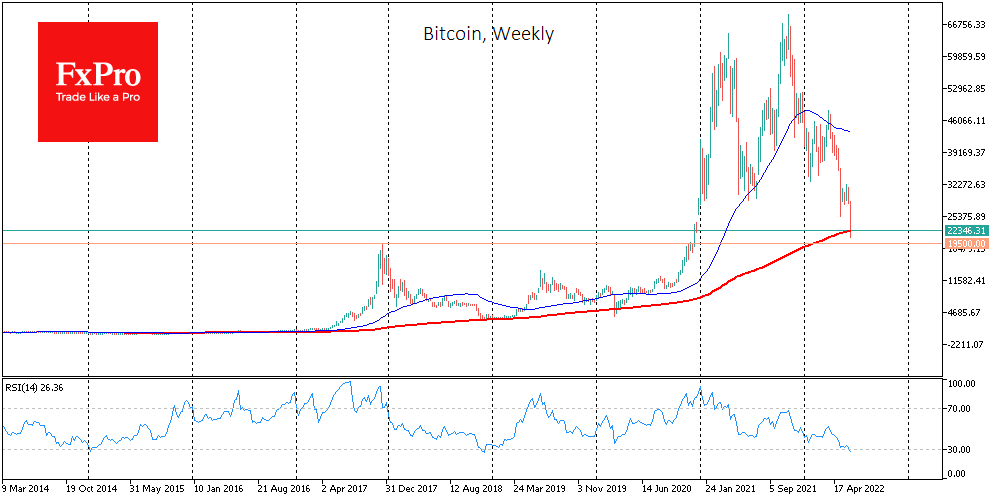

Bitcoin collapsed on Monday at its highest since the March 2020 crisis amid falling stock markets and a rising US dollar. Bitcoin closed the December 2020 gap by feeling the area below the 200-week simple moving average. But in our view, Bitcoin needs to touch levels near 19500: the 2017 peak, which is also where the most aggressive growth phase started at the end of 2020, for a definitive return of long-term buyers.

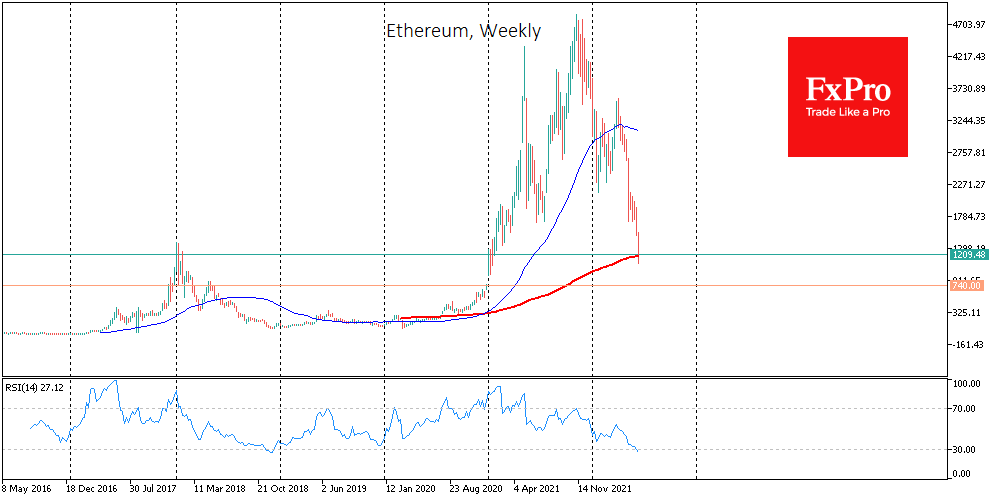

A similar three-point checklist for Ether is also incomplete. ETHUSD touched the 200-week average and dived below the peak levels of the previous cycle in 2018. However, the most aggressive rally at the end of 2020 came from $740, which is well below the day’s lows today at $1075. However, the latter target may prove too ambitious for the bears.

Along with BTC, cryptocurrency-focused stocks also collapsed. MicroStrategy shares lost 25.2%, while Coinbase dropped 11.4%.

The key trigger for the sell-off in the crypto sphere is the US inflation hike to 8.6% on Friday, followed by speculation that the Fed could raise rates by 75 points at Wednesday’s meeting or at the end of July.

According to IntoTheBlock, about half of cryptocurrency holders are now incurring losses. According to Crypto.com CEO Chris Marszalek, the market has entered a phase of “crypto winter” that could drag on, according to Crypto.com CEO Chris Marszalek.

Cryptocurrency lending platform Celsius has suspended withdrawals, exchanges and transactions of digital assets due to “extreme market conditions”. Tether has ruled out the impact of the Celsius incident on USDT reserves.

The US Office of the Comptroller of the Currency has warned of the risks associated with Stablecoin, citing the collapse of the Terra project. The US Treasury Department believes that the country’s authorities should be more proactive in seeking to regulate the crypto industry, given the active digitalisation of the financial sector.

The FxPro Analyst Team