Bitcoin and Ether increasingly move in line with stock market laws

November 15, 2021 @ 16:54 +03:00

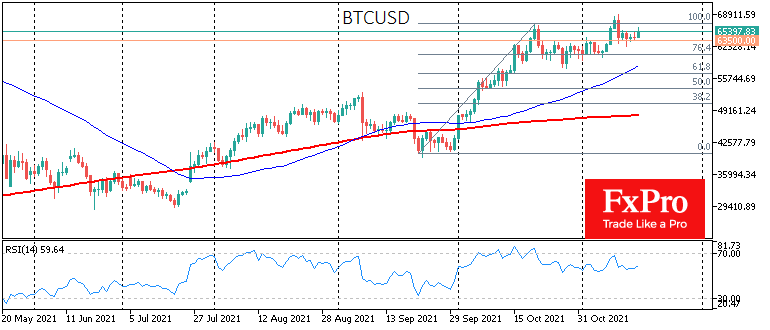

Bitcoin has been adding 1% since the start of the day and is almost unchanged (-0.3%) to levels seven days ago at $65.8K. Consolidation in a very narrow range for cryptocurrencies has been observed since last Wednesday. However, this disposition is more on the bullish side. Bitcoin has climbed another notch higher, gaining local support on the dips to the previous resistance level at $63.5K.

The RSI index on the BTCUSD daily charts remains impressively far from overbought. The 50-day moving average is coming off the same degree of the slope we saw about a year ago.

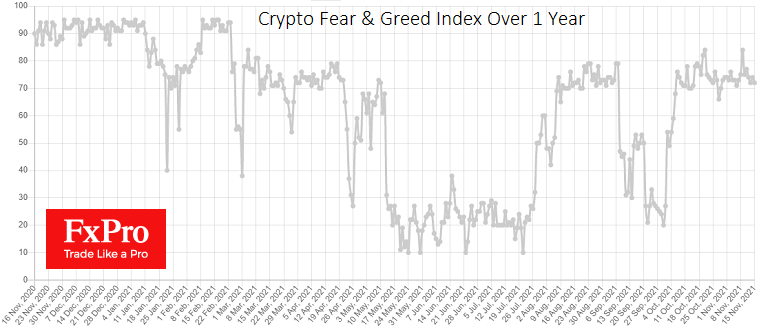

The cryptocurrency Fear & Greed Index remains at 72, exhibiting a truly narrow and persistent sideways trend, deviating weakly from this level in the last five weeks. The index’s resilience on the edge of overheating is a healthy sign of a bull market.

Overall in cryptocurrencies, the past seven days have seen profit-taking processes or investors jumping from one coin to another. The total capitalisation of the crypto market has been virtually unchanged over the past seven days, remaining near $2.87 trillion with Bitcoin and $1.62 trillion excluding it.

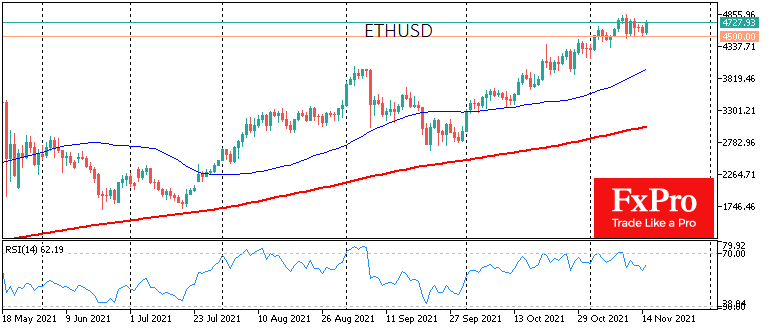

Ethereum steadily gained support last week on a decline towards $4,500, failing to confirm a move into a correction after an impressive rise since early September.

In recent months, major cryptocurrencies, which have become an integral part of investment portfolios, not just crypto enthusiasts, are becoming more correlated with the mood of the stock market.

For example, we see pullbacks after highs have been updated, a more pronounced correlation of risk appetite in equity markets and cryptocurrencies, similar chart patterns and laws of technical analysis.

While the cryptocurrency market remains in its bullish phase, the tendency towards consolidation is worrisome, shaping the market’s advance in small steps.

Short-term sentiment markers for cryptocurrencies could be the exit of Ether and Bitcoin from their mini ranges, $4500-4800 and $63500-68000, respectively. The direction of the breakout could be a call to action for the entire crypto market.

The FxPro Analyst Team