Bearish lull in the crypto market

February 16, 2026 @ 15:19 +03:00

Market Overview

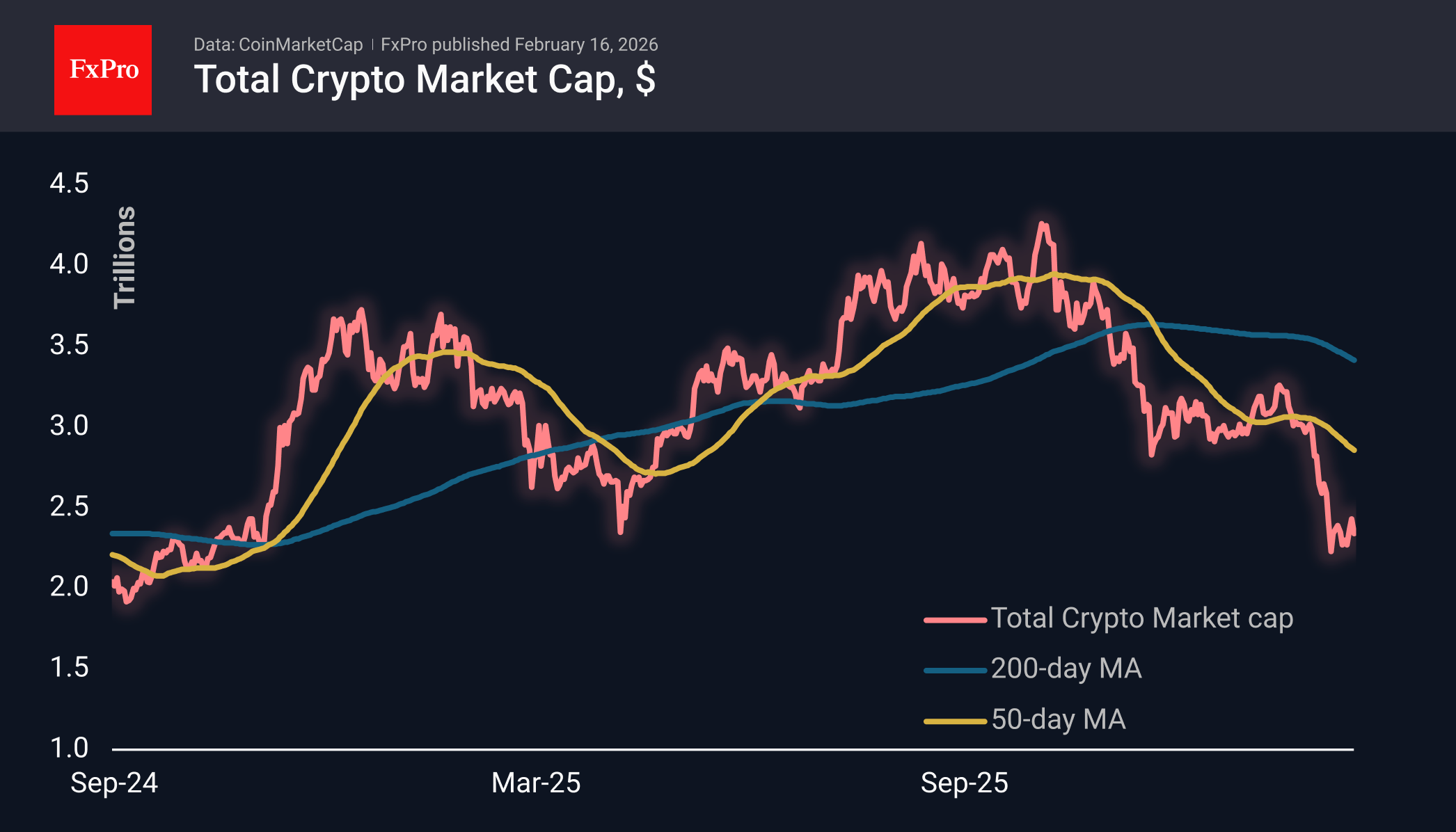

The crypto market has been in a consolidation phase for the past 10 days, trading mainly in the $2.30-2.40T range, as market forces pull it back. As a result, the total capitalisation is now roughly at the same level as a week ago, $2.35T. On closer inspection, a slight upward trend can be seen over the last few days, but it seems too fragile to rely on.

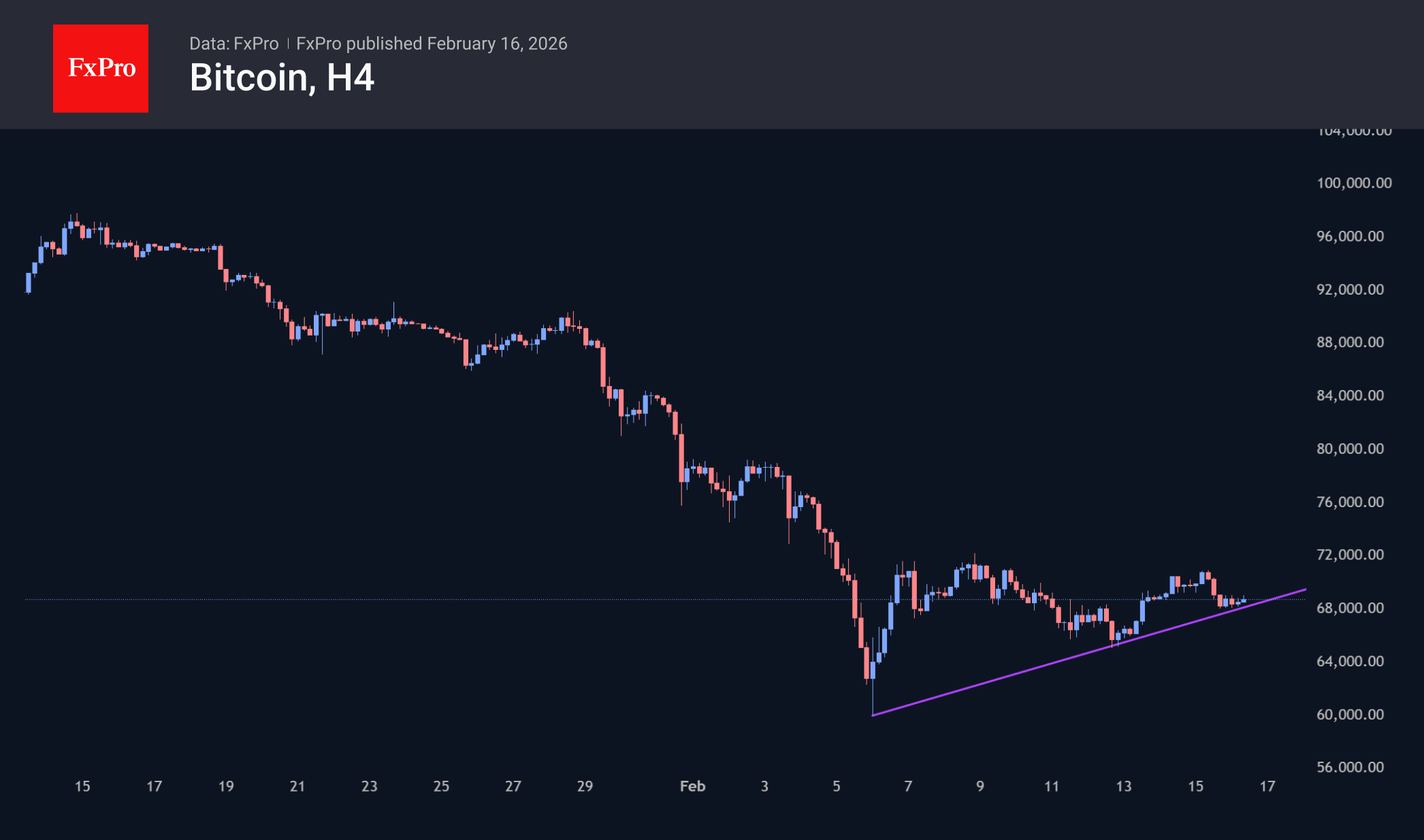

Bitcoin is trading below $69K, but since the start of the day on Monday, it has made several attempts to climb above this resistance. Taking a step back to larger ranges reveals upward support over the last 10 days, with another rebound on Monday morning and resistance at the horizontal level of $71K. Despite a series of higher highs, we view this as a bearish pause due to the weak rebound after a massive decline. Consolidation in such conditions only removes short-term oversold conditions, paving the way for further declines.

News Background

Losses for short-term Bitcoin holders over the past seven days have reached $2.3 billion, one of the largest since the 2021 crash, according to CryptoQuant. On-chain metrics do not yet confirm the formation of a structural bottom. At the same time, BTC has come close to the so-called undervaluation zone.

The crypto market is gradually laying the groundwork for a breakout from the bearish trend, according to Bitwise. The development of real asset tokenisation (RWA) and the influx of corporate investors into decentralised finance (DeFi) could be the main drivers of the cryptocurrency recovery.

Bitcoin investors should be patient, as the bullish trend will come later than expected, said Morgan Creek co-founder Anthony Pompliano. In his opinion, BTC volatility may increase in the near future due to the tense global economic situation.

The Bhutanese authorities are selling bitcoins from their reserves for the third week in a row, Arkham notes. The latest sale of 100 BTC brought in approximately $6.8 million, and the kingdom’s Arkham-identified wallets still hold ~5,600 BTC.

The largest American crypto exchange, Coinbase, reported a net loss of $667 million for the fourth quarter. The main reason for the losses is the negative revaluation of the crypto portfolio and strategic investments.

Darknet platforms are switching en masse to the anonymous cryptocurrency Monero, according to TRM Labs. The trend reversal is happening despite the mass delisting of the asset on centralised platforms.

The FxPro Analyst Team