Altcoins Gain Momentum

November 18, 2024 @ 11:22 +03:00

Market Picture

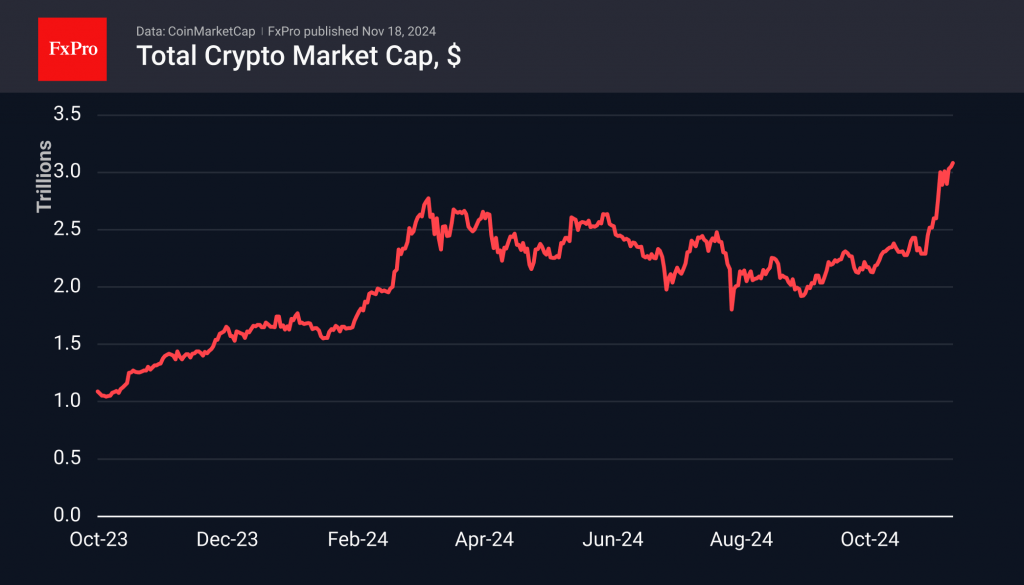

The crypto market capitalisation hit a new high of $3.09 trillion on Monday morning (+1% in 24 hours), driven by altcoins. The Cryptocurrency Fear and Greed Index reached 90 over the weekend, with the index only higher in late 2020 and early 2021. By Monday, the index had fallen back to 83, still consistent with extreme greed.

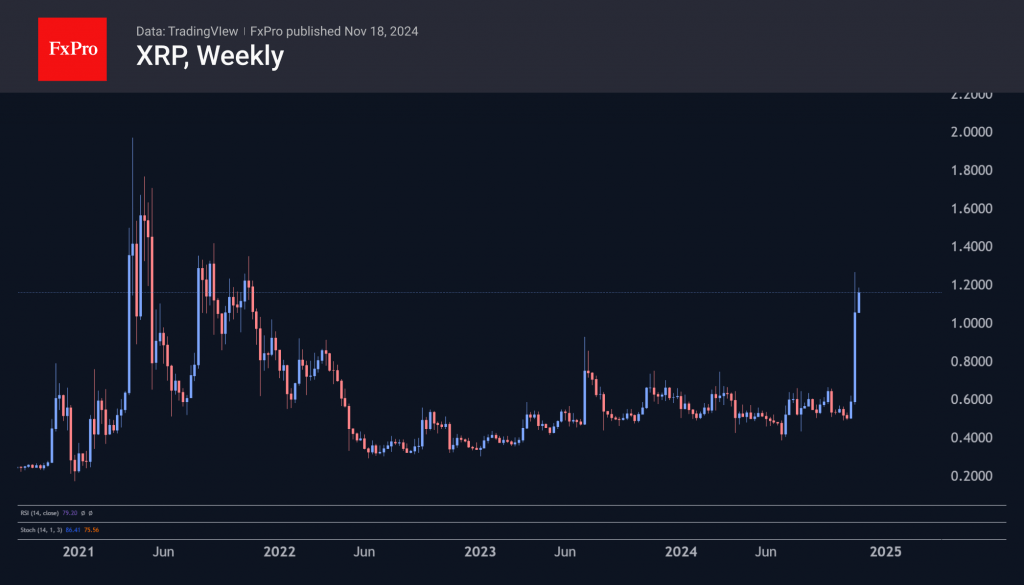

The Altcoin Season Indicator has now risen from 23 on 4th November to 42, thanks to optimism around XRP and Dogecoin. Cardano is also gaining momentum.

XRP topped $1 for the first time in three years. On Saturday, the token climbed above $1.2, as it is sensitive to Gary Gensler’s possible departure. Under his leadership, Ripple has been in a constant legal battle with the SEC.

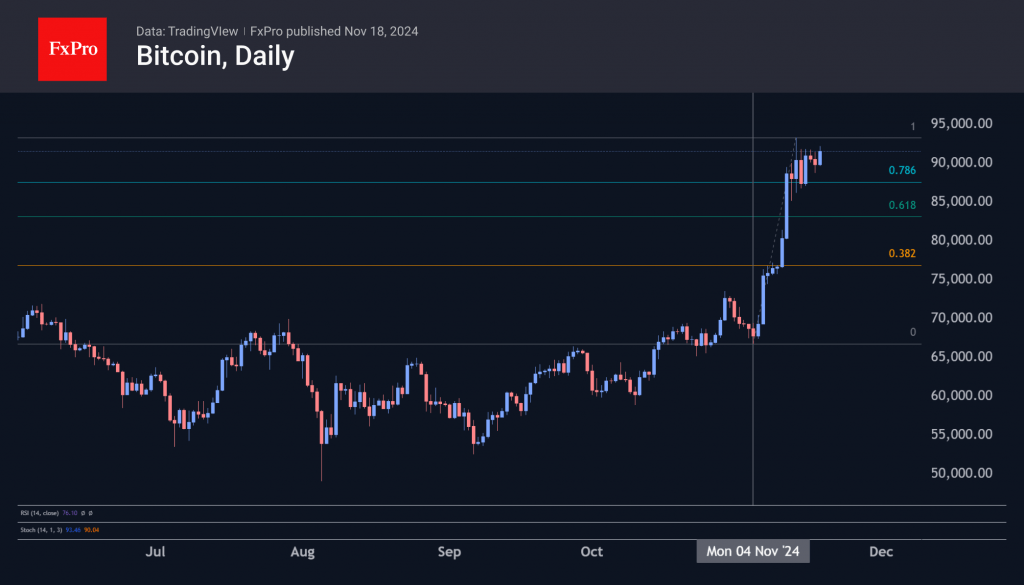

Bitcoin drifted down 3% on Saturday and Sunday, but on Monday, a 4% surge above $91,500 took it above this consolidation area. Institutional traders are activating at a time when retail traders are starting to lock in profits in Bitcoin and moving into altcoins.

Cryptocurrencies are perhaps the most notable market where retail is profiting at the expense of institutional rather than the other way around.

News Background

According to SoSoValue, net inflows into US spot Bitcoin ETFs totalled $1.67 billion last week, marking the sixth consecutive week of net inflows. Cumulative inflows since the launch of bitcoin ETFs in January rose to $27.46 billion.

Ethereum ETFs saw net inflows of $515.2 million last week, a record high since the funds were approved on 23rd July, which brings the total net inflows since the product launch to $178.4 million.

The distribution of implied volatility in the Bitcoin options market suggests a high probability of trading at lower levels. “The deleveraging risk could be significant,” Blofin warned.

A bill to create a Bitcoin reserve is up for a vote in the US Congress. It involves purchasing 1 million BTC (up to 200,000 BTC per year for five years). The Fed’s gold reserves will be used for this purpose. Speculation on this issue could be an important driver of Bitcoin’s rise against gold.

Solidion Technology, a manufacturer of electric batteries and components, announced that it will convert some of its cash reserves into bitcoin. The company plans to use 60% of its excess cash, all of its money market interest income and some of its future capital raising to buy the first cryptocurrency.

The FxPro Analyst Team