Altcoins are pulling away from boring Bitcoin

November 24, 2021 @ 18:23 +03:00

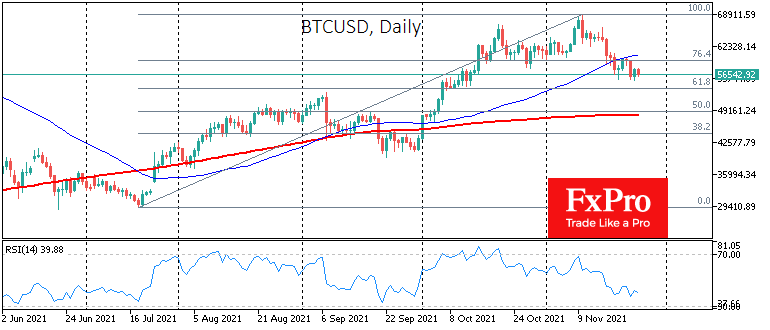

Bitcoin has lost 2.5% on Wednesday, returning to $56.3K. It seems that after a lull of a day-long, sellers’ pressure on the first cryptocurrency has continued. Meanwhile, the cryptocurrency market manages to remain positive, adding 0.3% in capitalisation over the past 24 hours.

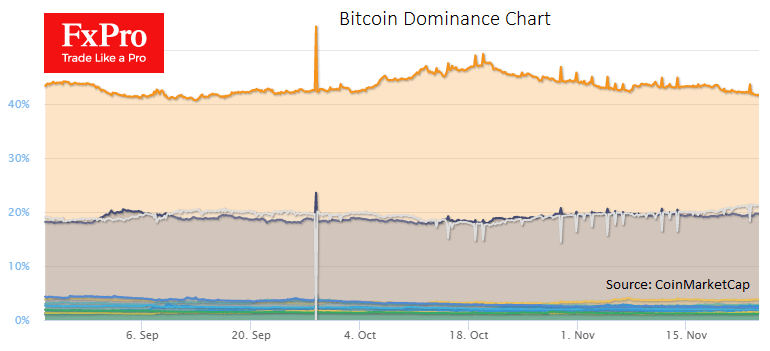

A little over a month ago, Bitcoin’s share of total crypto market capitalisation trended downwards. From a peak of 49.2% on October 19th, its share has fallen to 41.7%. Optimistic market participants point to impressive demand for altcoins, which is shaping the trend.

On the other hand, pessimists point out that without the market’s flagship Bitcoin, cryptocurrencies are more likely to reverse sooner rather than later, recalling the situation in late 2017 and early 2018.

Behind the pressure on bitcoin is a reduction in risk traction in traditional finance, while retail investors continue to look to cryptocurrencies for insurance against devaluation and speculative/investment potential. In addition, the way retail investors participate in cryptocurrencies has changed over the past five years since the previous cycle.

Cryptocurrency ICO and trading have migrated to crypto exchanges, minimising some of the fraud risks of cryptocurrency creators. However, the investment risks have not gone anywhere.

Of course, Bitcoin’s steady downward trend is eating away at crypto enthusiasts’ optimism. Still, a smooth pullback like this acts as an incentive for the market to look for new names, leaving Bitcoin to conservative finance. The latter has only begun to regularly allocate a share of their portfolio to crypto this year, filling it predominantly with Bitcoin. At the same time, the leading edge of investors already views the first cryptocurrency as too conservative and boring.

The FxPro Analyst Team