$1.3 million rules the crypto market

June 22, 2020 @ 14:53 +03:00

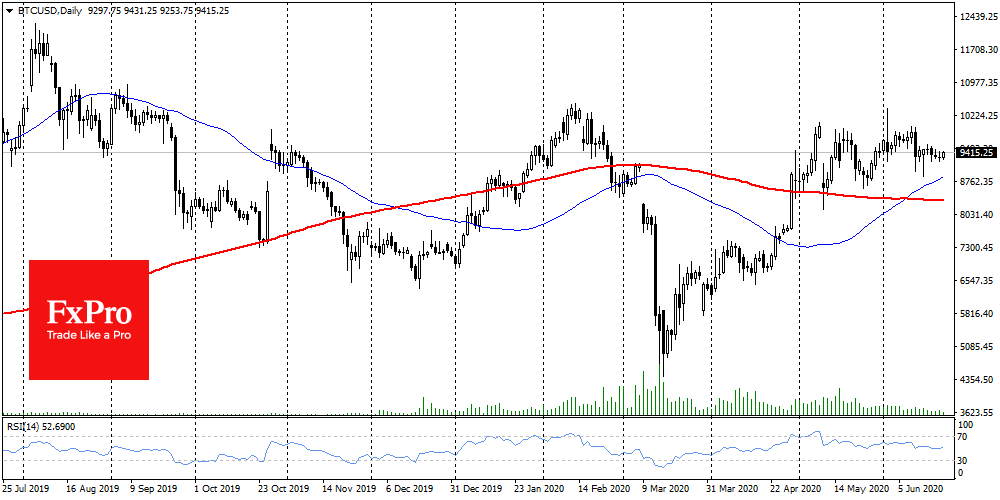

The last 10 days Bitcoin has been locked into a narrow price range of around $9,500. Judging by the ongoing processes, the situation is more like a compressed spring ready to jump aside. Technical indicators, including Crypto Fear & Greed Index and RSI, are in “neutral gear”. Nobody wants to rush to buy or sell the asset instead of waiting for new impulses from the traditional financial market. The ability to stay above $9,400 will increase the chances of further purchases. If the level does not survive, you can expect a decline first to $9K and then to $8,750.

As for large asset movements, we can note a transaction in the Ethereum network (ETH) between several whales. A hundred thousand ETHs (about $23 million) were put in motion, but judging by the movement addresses, the coins may stay inside the “close circle” of whales. This practice is used from time to time in the Bitcoin ecosystem. The recent movement of around $2.2 billion worth of Bitcoins was associated with the updating of the Bittrex cold wallets structure.

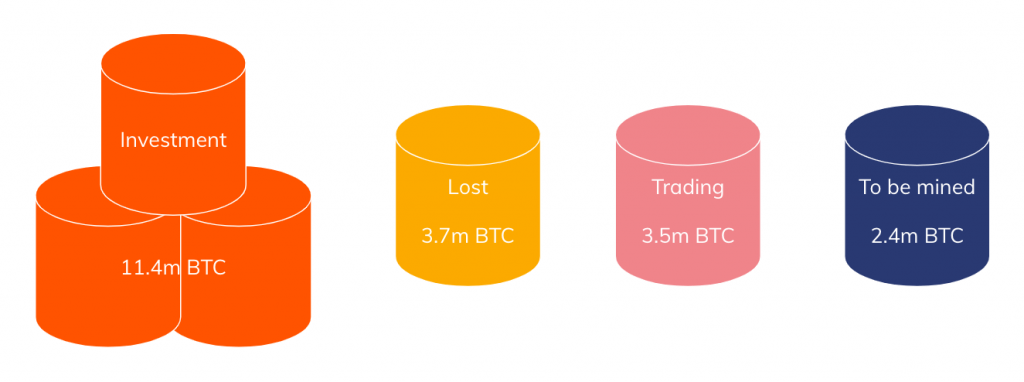

Recently, all Bitcoin fluctuations have been associated with what is happening in the traditional market, and the influence of institutional investors is considered increasingly strong. Recall that as of June 2020, 18.6 mln BTC were mined. The Chainalysis concluded that almost 60% of this amount belongs to companies and is considered a long-term investment. Another 20% were motionless for over 5 years and are considered lost.

There are still 3.5 million coins in circulation that are used in trading. Retail investors (deposits below $10K) account for 96% of transactions. However, the remaining minority accounts for the main liquidity contribution. Up to 85% of all liquidity that goes to the stock exchanges belongs to such a small number of institutional investors, which drives the entire market. This situation is similar to the oil market, where a small (5-10%) share of exchange turnover forms trends.

We can hardly call such a situation conducive to healthy market development, as 60% of the “sleeping” bitcoins do not participate in circulation. We are witnessing the centralization of both hash rate and trading volume due to the relatively small size of this market. In this case, a long sideways trend may reflect the position of an extremely small number of institutional investors.

From time to time we see “overestimation” due to the existing trading volumes in the community. However, in the end, everyone wants to believe that Bitcoin really has the potential for growth. And if you put all the data together, you get a very sad picture, where a very small group of investors can manipulate Bitcoin and the entire market without much difficulty.

The FxPro Analyst Team