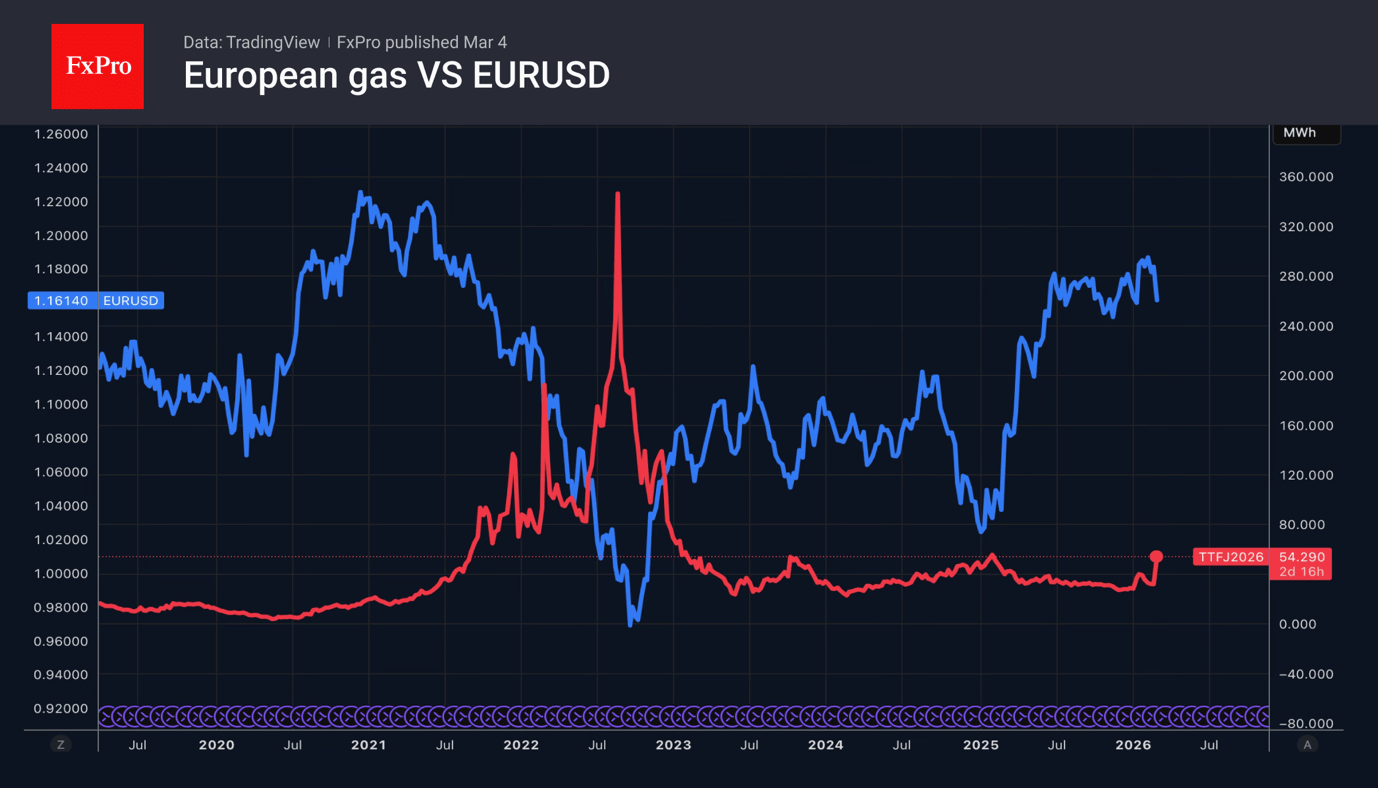

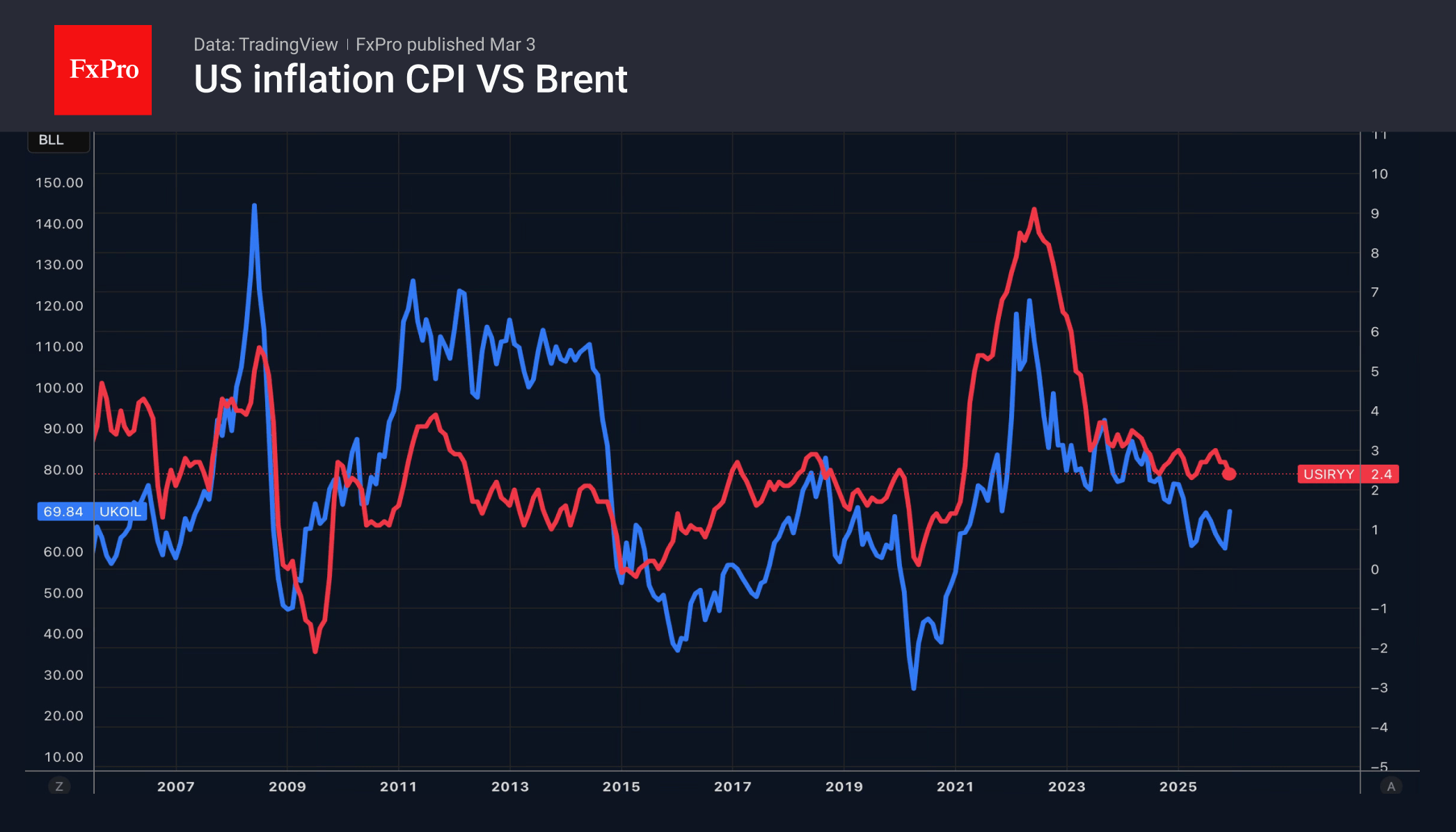

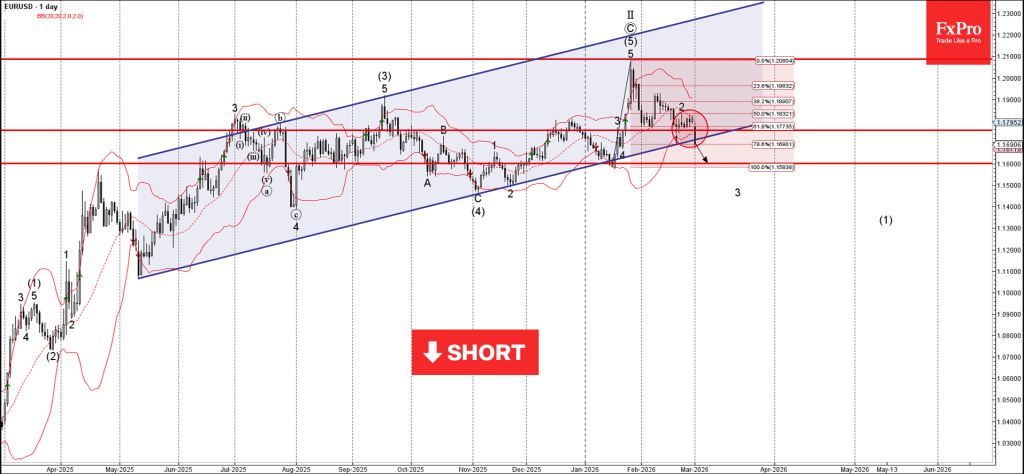

The dollar strengthened against the backdrop of US successes and growing demand, while Europe faces the threat of stagflation and rising energy prices.

March 04, 2026 @ 16:57 +03:00

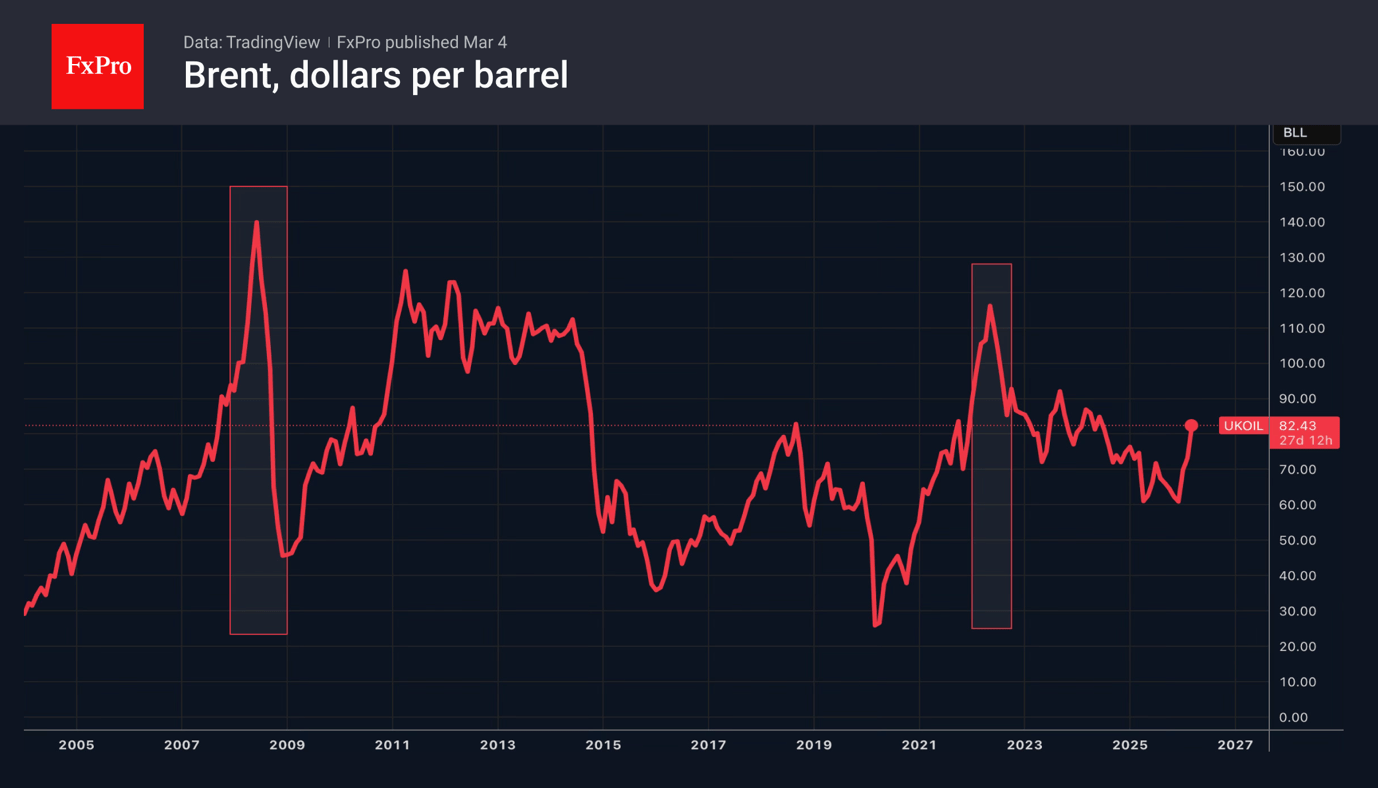

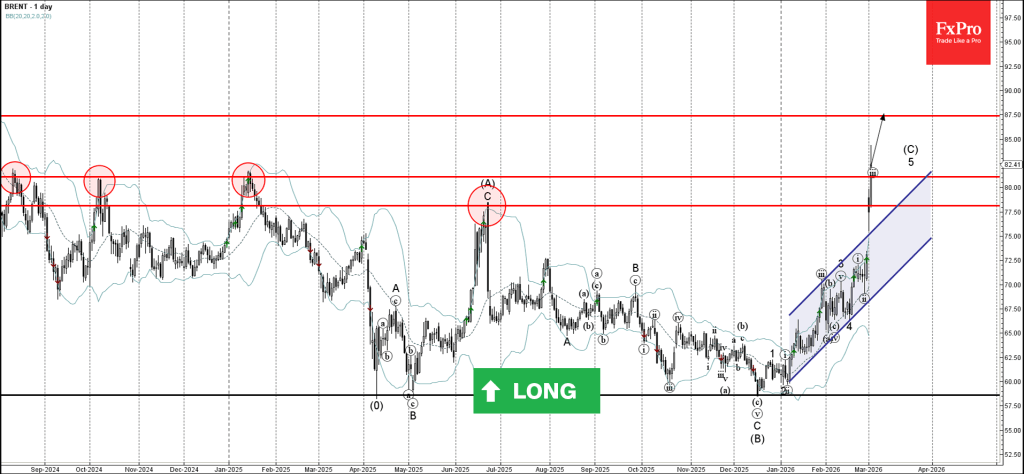

Rising Hormuz tensions lift Brent toward $100, but ample reserves and US shale limit recession risks; even prolonged disruption is unlikely to trigger a crisis.

5h ago

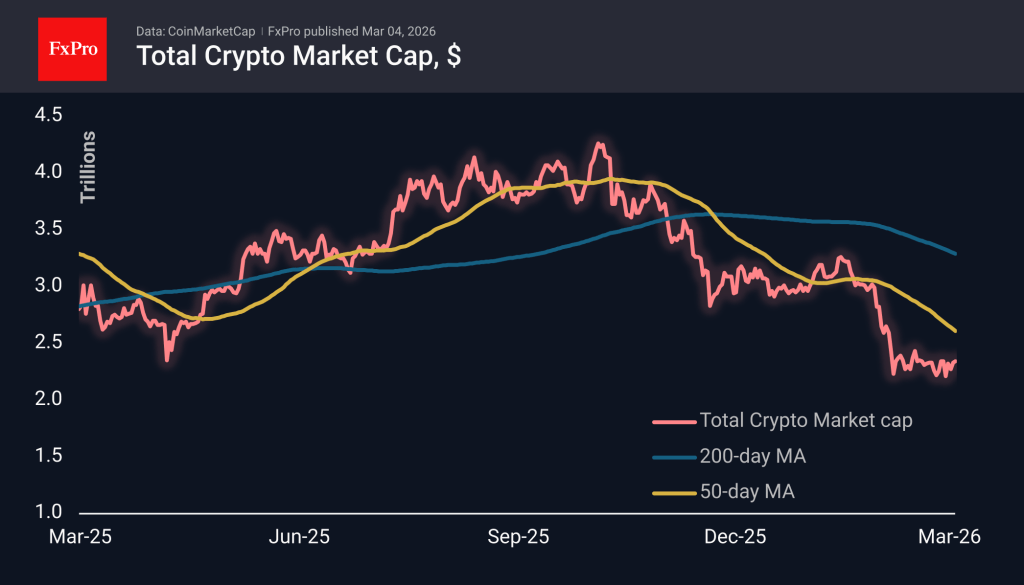

Cryptocurrencies have recovered better than stocks: Bitcoin is stable, growth is expected, miners are switching to AI, and Visa is expanding the implementation of stablecoin cards.

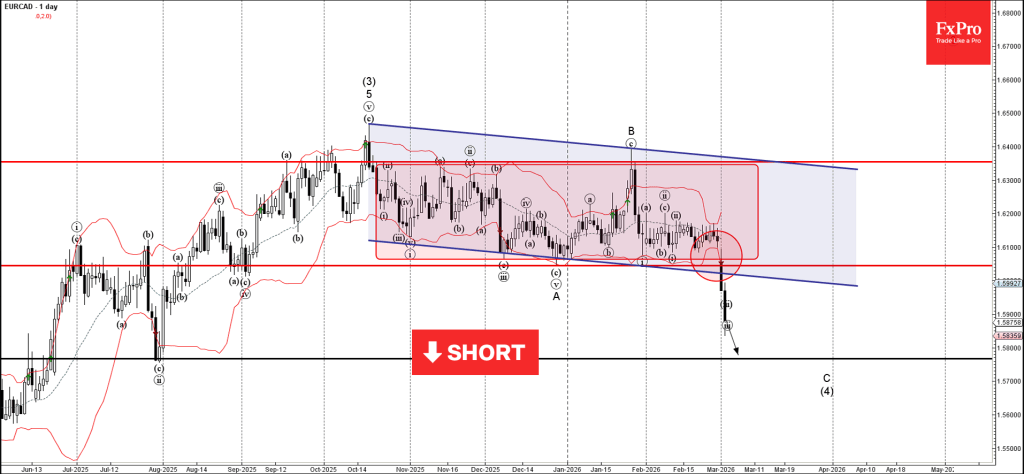

EURCAD: ⬇️ Sell – EURCAD broke support zone – Likely to fall to support level 1.5765 EURCAD currency pair recently broke the support zone between the support level 1.6045 (which has been reversing the price from August) and the support trendline.

March 04, 2026 @ 13:02 +03:00

Cryptocurrencies have recovered better than stocks: Bitcoin is stable, growth is expected, miners are switching to AI, and Visa is expanding the implementation of stablecoin cards.

March 03, 2026 @ 13:09 +03:00

The crypto market remains range-bound. Bitcoin faces resistance at $70K, with potential for a drop to $63K. Major investors accumulate BTC and ETH; Ethereum eyes key network upgrades.

Tue

Fri

Wed

Tue

Fri

Thu

March 03, 2026 @ 23:23 +03:00

EURCAD: ⬇️ Sell – EURCAD broke support zone – Likely to fall to support level 1.5765 EURCAD currency pair recently broke the support zone between the support level 1.6045 (which has been reversing the price from August) and the support trendline.

March 03, 2026 @ 23:22 +03:00

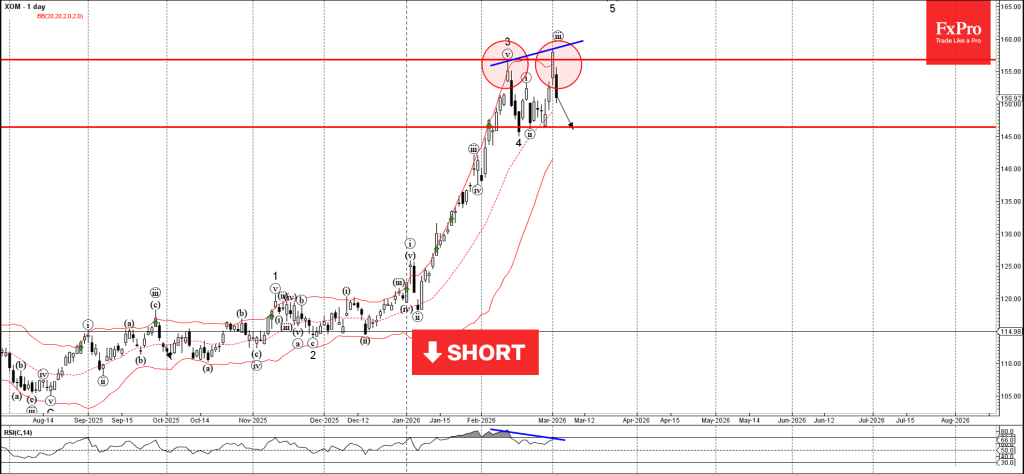

Exxon Mobil: ⬇️ Sell – Exxon Mobil reversed from resistance zone – Likely to fall to support level 146.45 Exxon Mobil recently reversed down from the resistance zone between the resistance level 156.80 (which stopped wave 3 at the start of.

March 03, 2026 @ 20:20 +03:00

Brent Crude Oil: ⬆️ Buy – Brent Crude Oil broke key resistance levels – Likely to rise to resistance level 87.500 Brent Crude Oil has been rising sharply in the last few trading session breaking through the key resistance levels – 78.20.

March 03, 2026 @ 20:19 +03:00

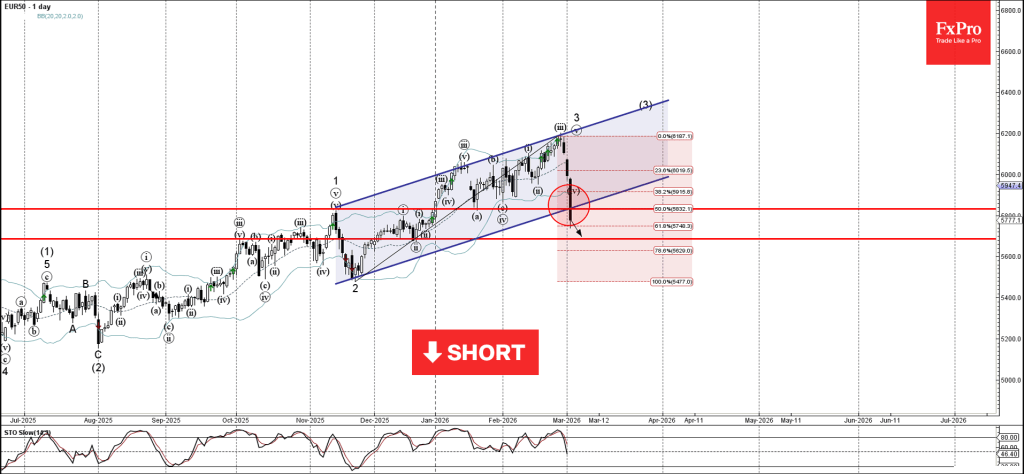

EUR50 Index: ⬇️ Sell – EUR50 Index broke support zone – Likely to fall to support level 5685,00 EUR50 Index recently broke the support zone between the support level 5830,00 (former resistance from November and the support from January), 50% Fibonacci correction.

March 03, 2026 @ 01:20 +03:00

EURUSD: ⬇️ Sell – EURUSD broke support zone – Likely to fall to support level 1.1600 EURUSD currency pair recently broke the support zone between the key support level 1.1755 (former resistance from October and December), support trendline of the daily up.

March 03, 2026 @ 01:19 +03:00

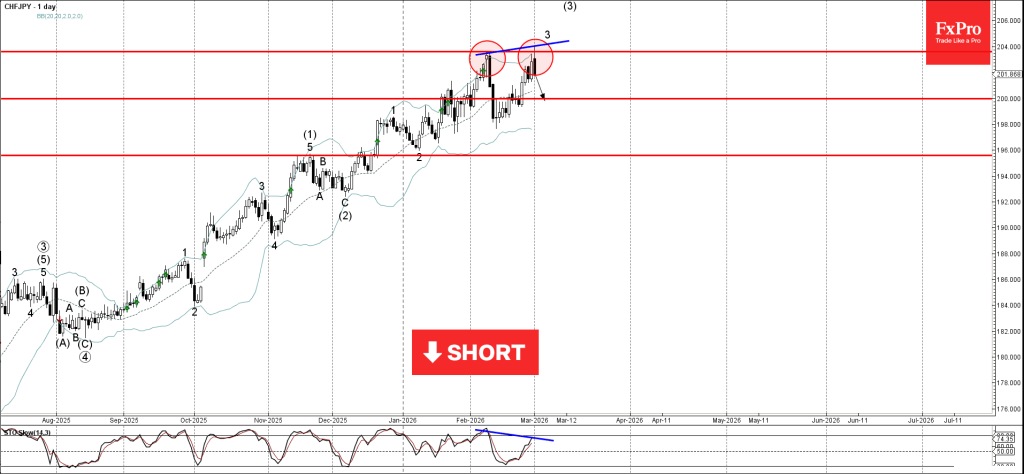

CHFJPY: ⬇️ Sell – CHFJPY reversed from resistance zone – Likely to fall to support level 200.00 CHFJPY currency pair recently reversed from the resistance zone between the strong resistance level 203.60 (which formed the daily Evening Star at the start of.

February 27, 2026 @ 00:35 +03:00

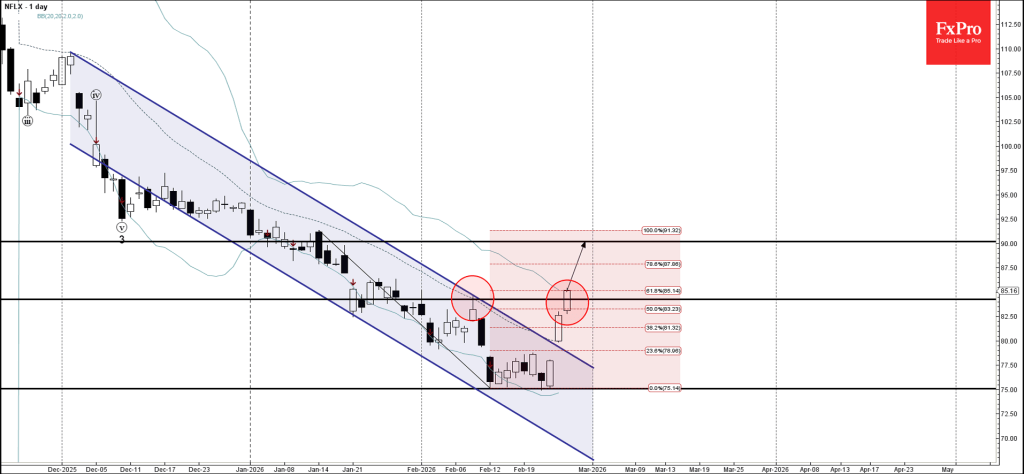

Netflix: ⬆️ Buy – Netflix reversed from support zone – Likely to rise to resistance level 90.00 Netflix recently reversed up from the support zone between the key support level 75.00 (which also reversed the price at the start of February).

February 27, 2026 @ 00:35 +03:00

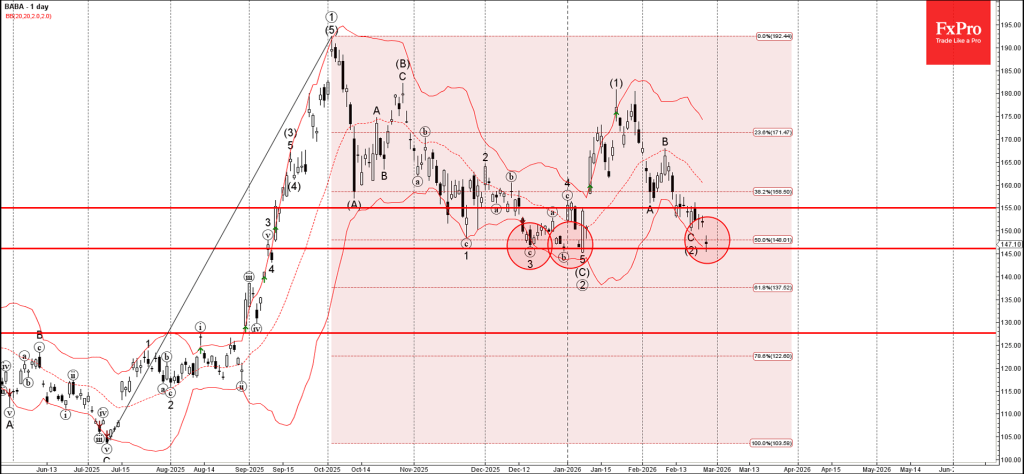

Alibaba: ⬆️ Buy – Alibaba reversed from support zone – Likely to rise to resistance level 155.00 Alibaba recently reversed up from the support zone between the key support level 146.15 (which has been reversing the price from December) and the.

February 27, 2026 @ 00:34 +03:00

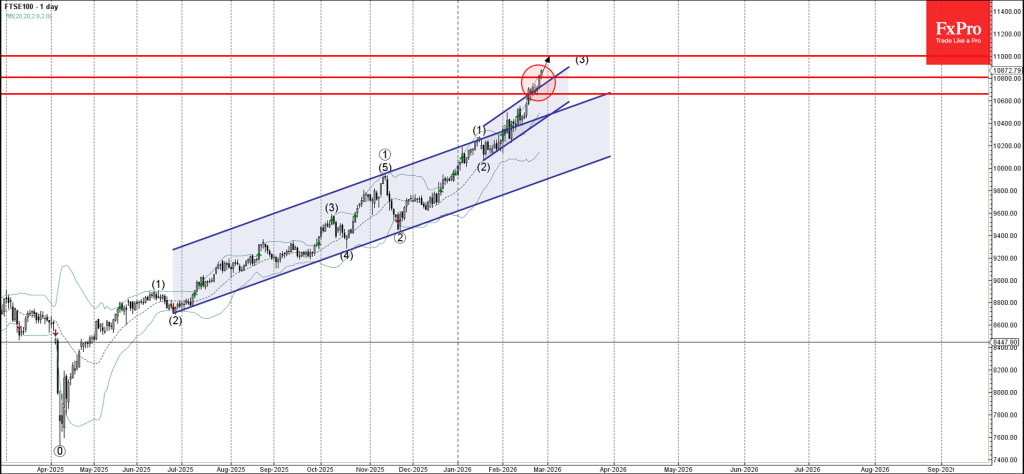

FTSE 100: ⬆️ Buy – FTSE 100 broke resistance level 10800.00 – Likely to rise to resistance level 11000.00 FTSE 100 index under the bullish pressure after the price broke above the key resistance level 10800.00 intersecting with the resistance.

February 27, 2026 @ 00:33 +03:00

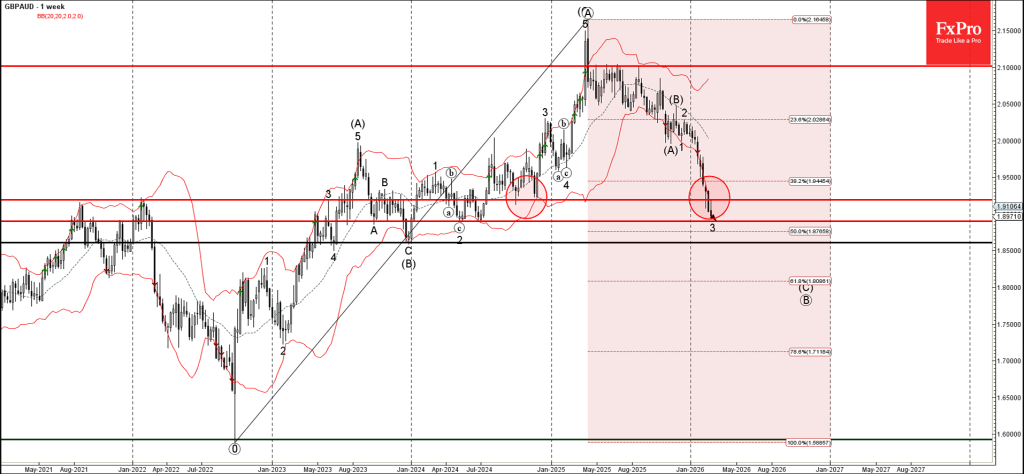

GBPAUD: ⬇️ Sell – GBPAUD broke support zone – Likely to fall to support level 1.8900 GBPAUD currency pair under the bearish pressure after the price broke the support zone between the support level 1.91950 (former strong support from 2024).

February 25, 2026 @ 19:33 +03:00

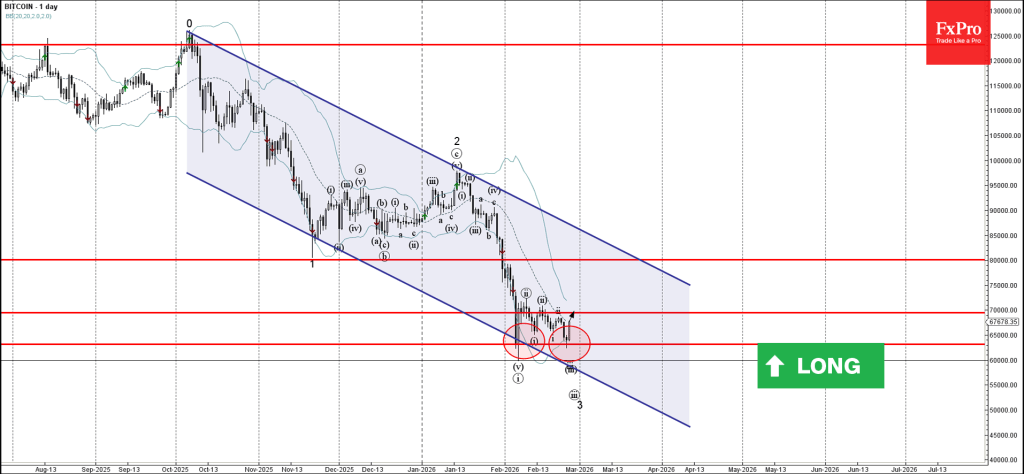

Bitcoin: ⬆️ Buy – Bitcoin reversed from support zone – Likely to rise to resistance level 70000.00 Bitcoin cryptocurrency recently reversed from the support zone between the support level 63155.00 (which stopped earlier impulse wave i at the start of.

February 25, 2026 @ 19:33 +03:00

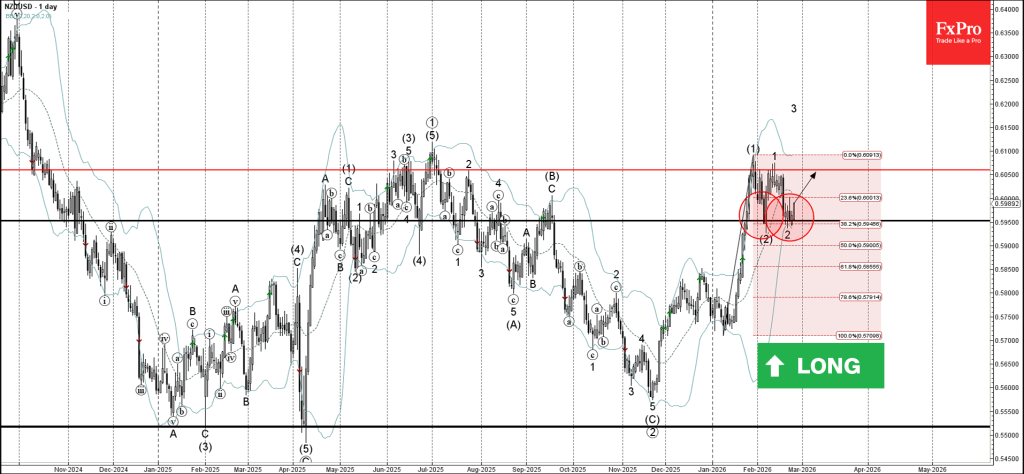

NZDUSD: ⬆️ Buy – NZDUSD reversed from support zone – Likely to rise to resistance level 0.6060 NZDUSD currency pair recently reversed from the support zone between the support level 0.5950 (which stopped earlier correction (2)) and the lower daily.

February 25, 2026 @ 00:58 +03:00

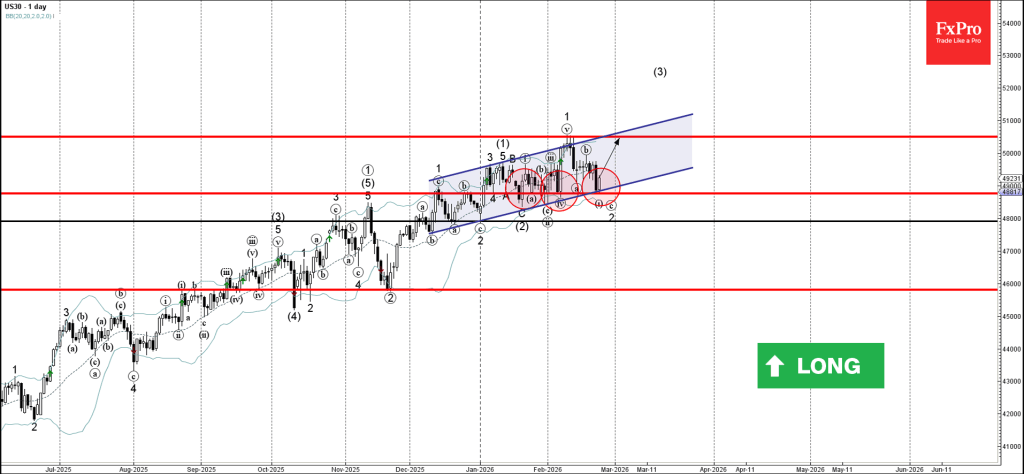

Dow Jones: ⬆️ Buy – Dow Jones reversed from support zone – Likely to rise to resistance level 50500,00 Dow Jones index recently reversed up from the support zone between the key support level 48760,00 (which has been reversing the.

February 25, 2026 @ 00:57 +03:00

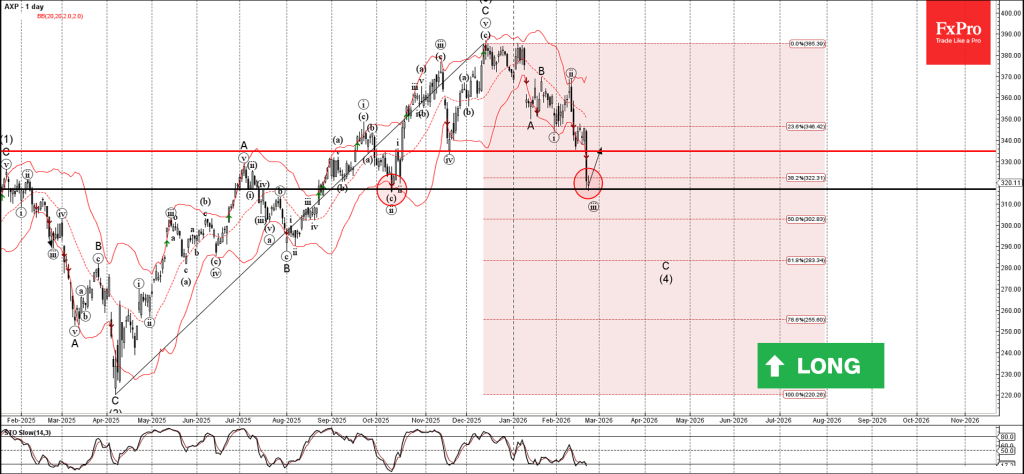

American Express: ⬆️ Buy – American Express reversed from support zone – Likely to rise to resistance level 334.70 American Express recently reversed from the support zone between support level 316.85 (former multi-month low from October), lower daily Bollinger Band.

February 25, 2026 @ 00:56 +03:00

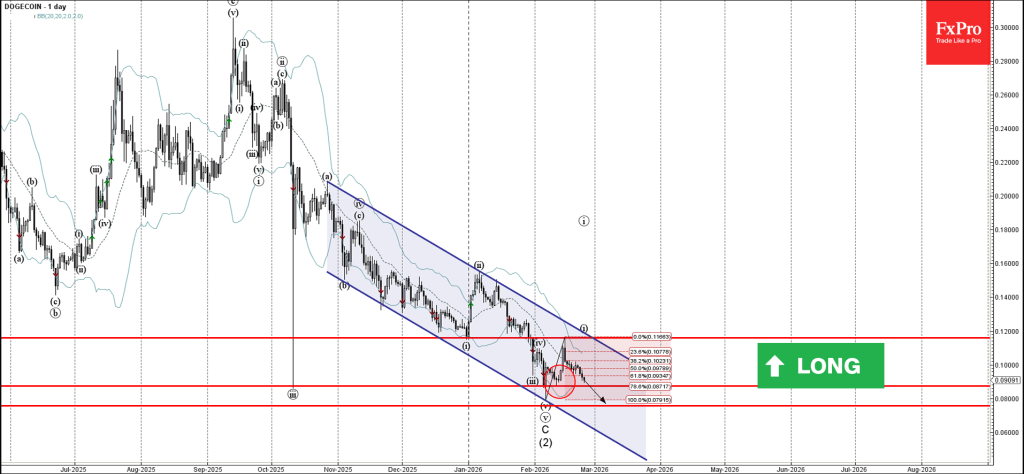

Dogecoin: ⬇️ Sell – Dogecoin approaching key support level 0.0875 – Likely to fall to support level 0.0790 Dogecoin cryptocurrency has been under the bearish pressure lately after the price failed to break above the resistance level 0.1160 (former strong.

February 25, 2026 @ 00:55 +03:00

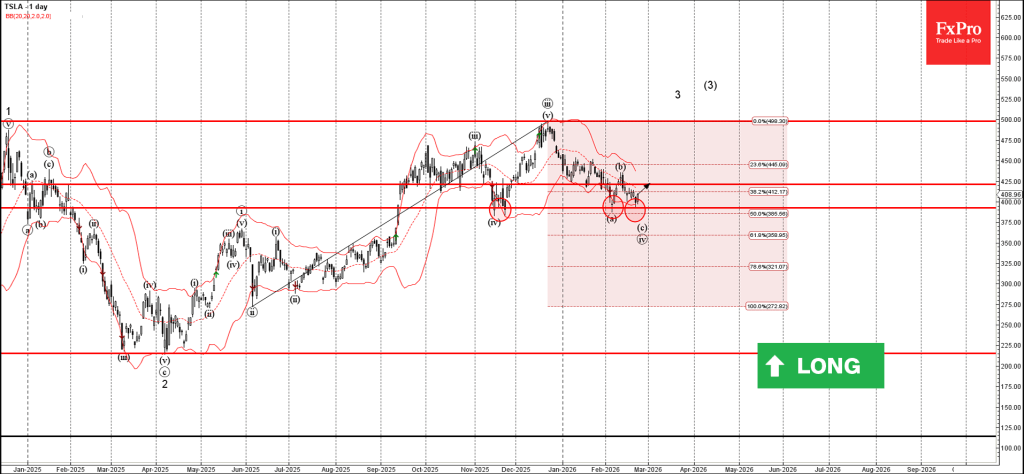

Tesla: ⬆️ Buy – Tesla reversed from pivotal support level 392.30 – Likely to rise to resistance level 425.00 Tesla recently reversed from the support zone between pivotal support level 392.30 (which has been reversing the price from November), lower.

February 24, 2026 @ 12:10 +03:00

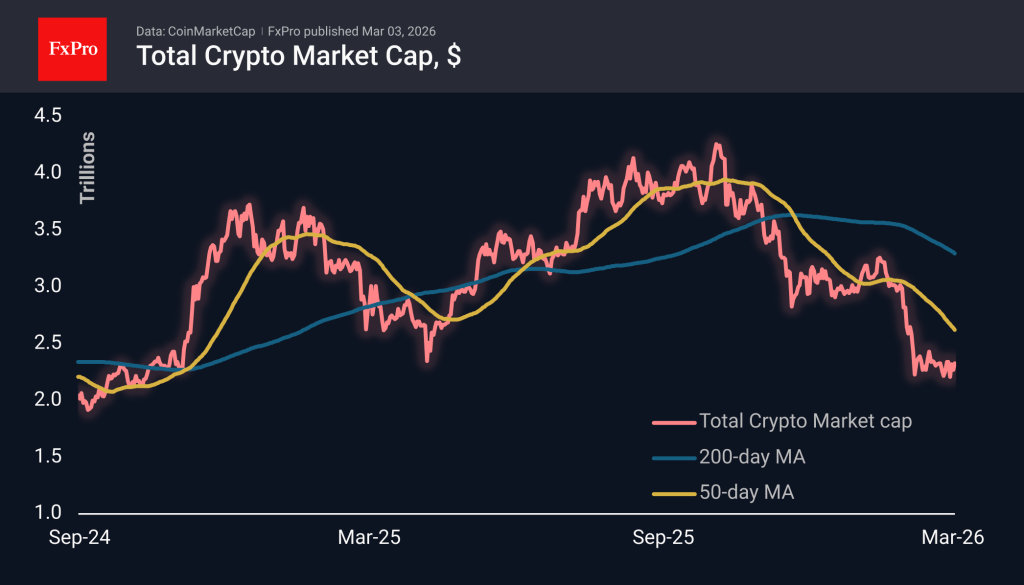

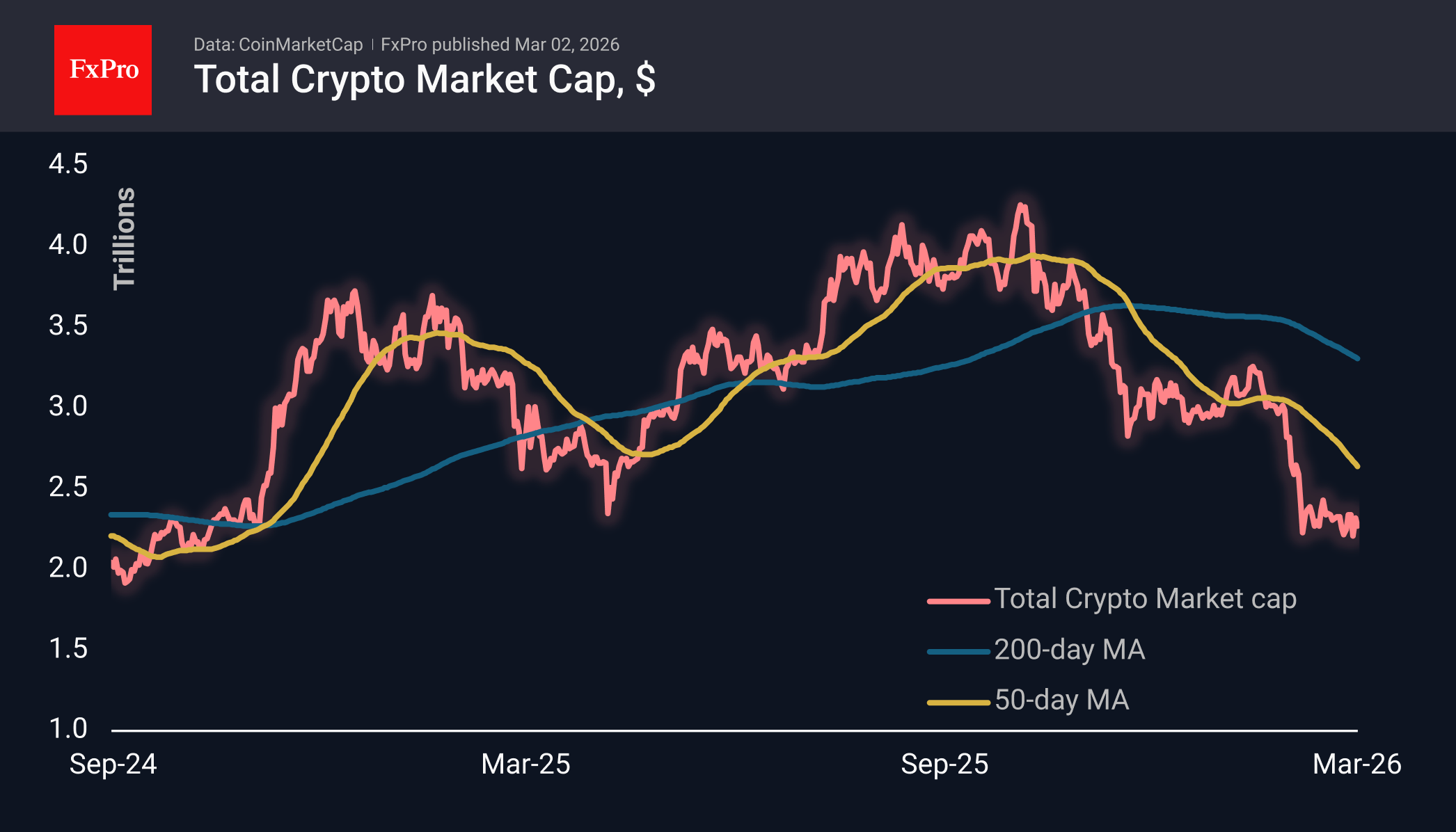

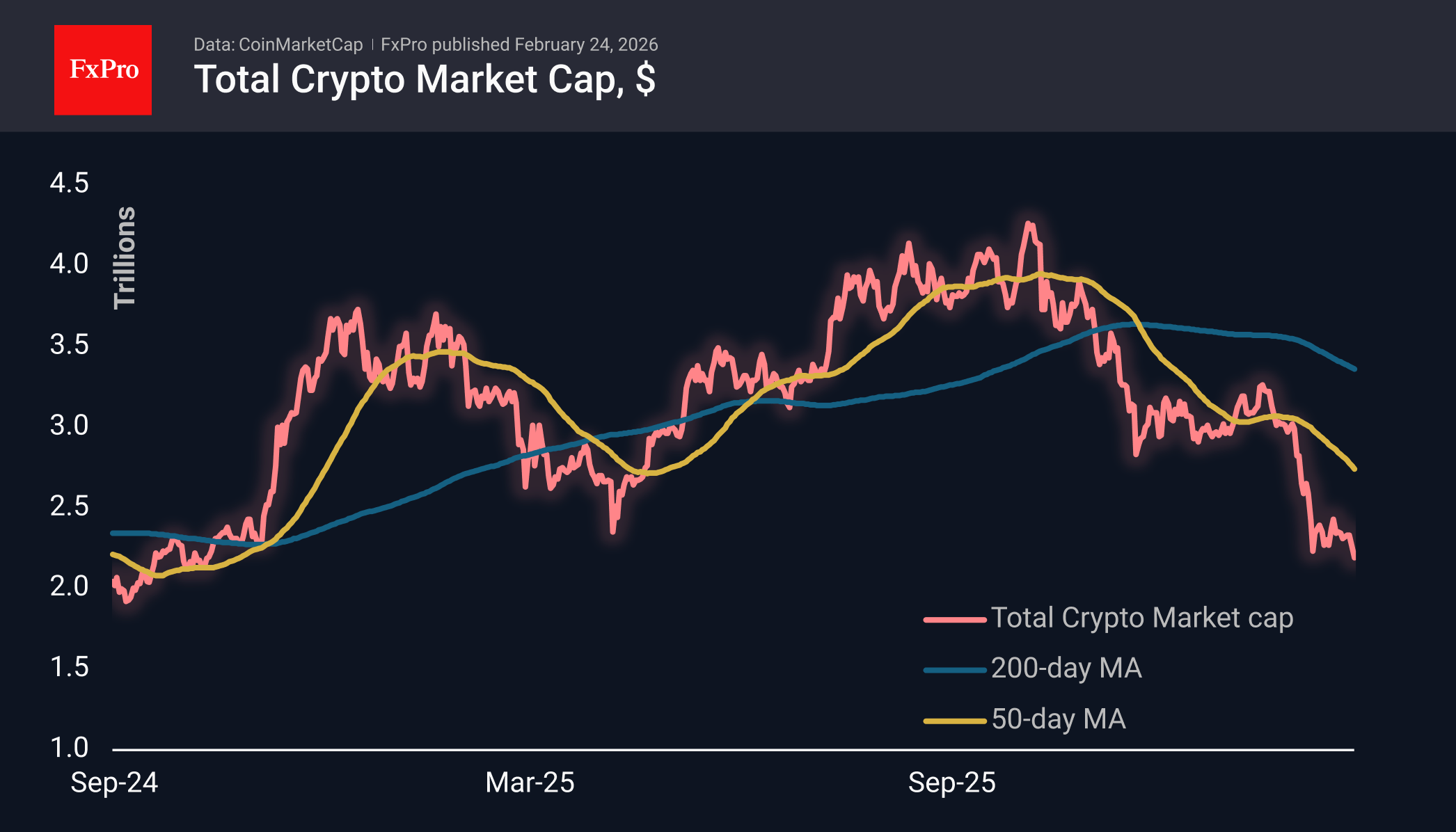

Market Overview The crypto market cap continues to decline, losing nearly 5.5% over the past 24 hours to $2.19 trillion, practically repeating the extremes of early February. The last time the market was consistently lower was in September 2024. If.

February 24, 2026 @ 01:35 +03:00

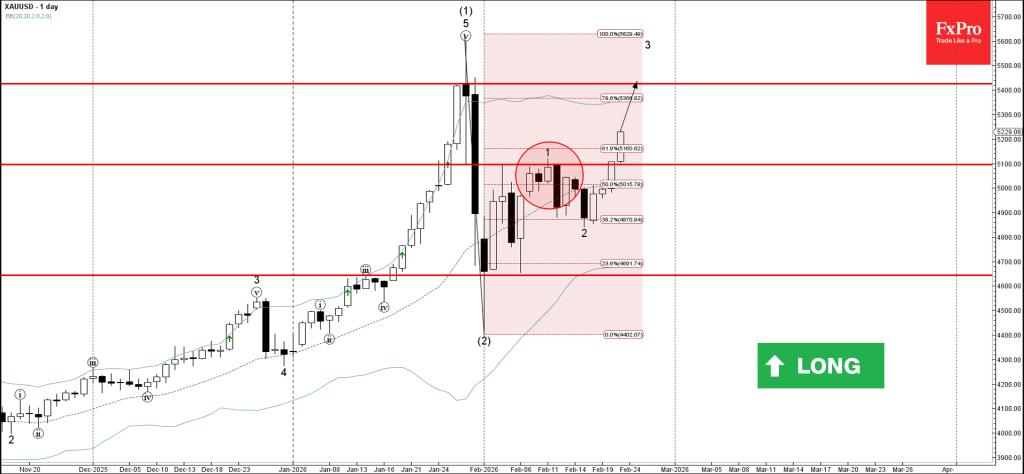

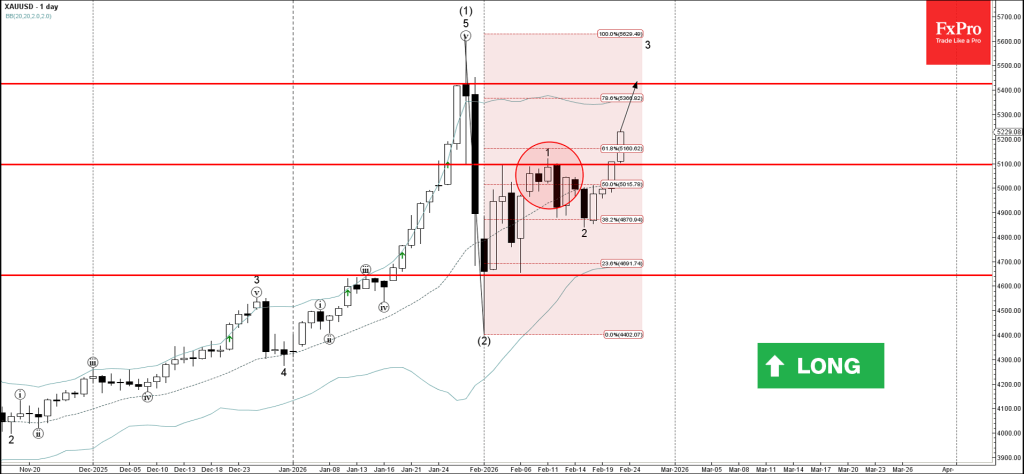

Gold: ⬆️ Buy Gold recently broke the resistance zone between resistance level 5100.00 (which stopped the earlier impulse wave 1) and the 61.8% Fibonacci correction of the downward ABC correction (2) from January. The breakout of the resistance level 5100.00.

February 24, 2026 @ 01:34 +03:00

Silver: ⬆️ Buy – Silver broke resistance zone – Likely to rise to resistance level 92.50 Silver recently broke the resistance zone between resistance level 86.9 (which stopped the earlier correction from the start of February) and the 38.2% Fibonacci.

February 20, 2026 @ 23:12 +03:00

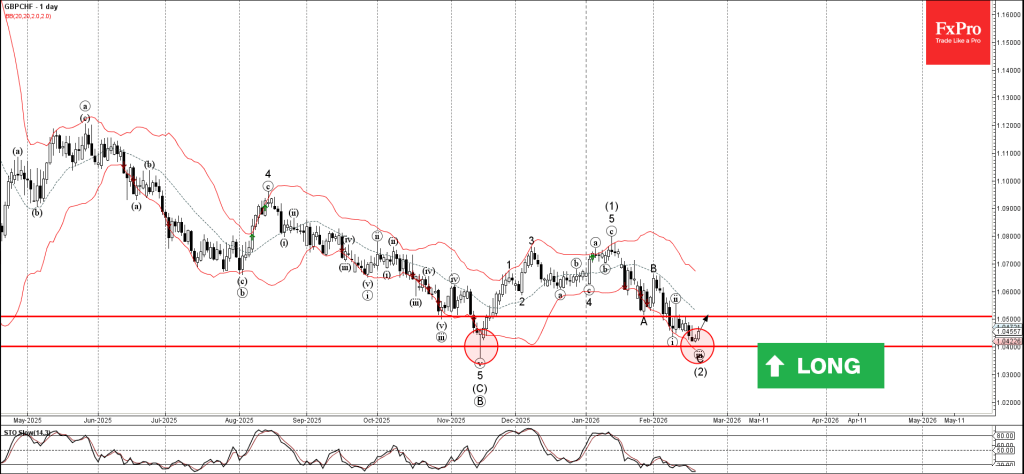

GBPCHF: ⬆️ Buy – GBPCHF reversed from support zone – Likely to rise to resistance level 1.0500 GBPCHF recently reversed up from the support zone between strong support level 1.0400 (which stopped the daily downtrend with the daily Hammer in.

February 20, 2026 @ 23:12 +03:00

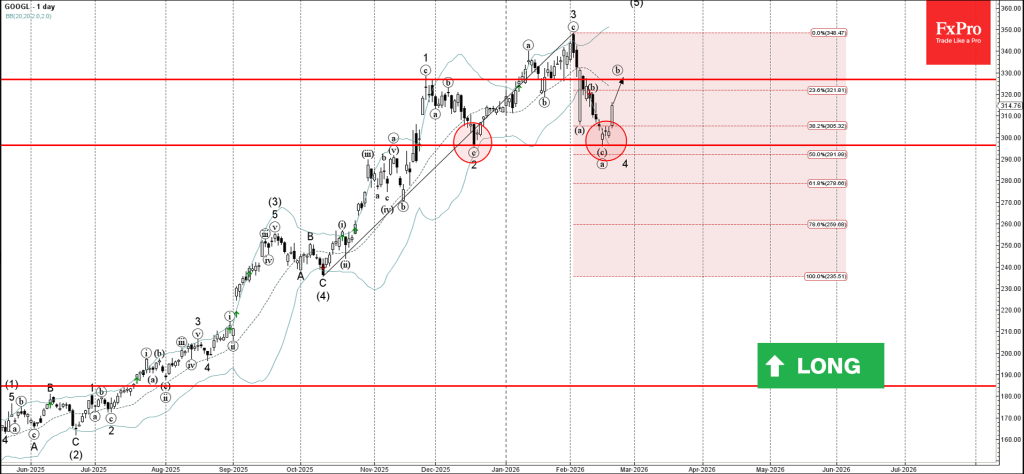

Google: ⬆️ Buy – Google reversed from key support level 296.40 – Likely to rise to resistance level 326.70 Google recently reversed up from the key support level 296.40 (former monthly low from December, which stopped earlier wave 2). The.

February 20, 2026 @ 00:19 +03:00

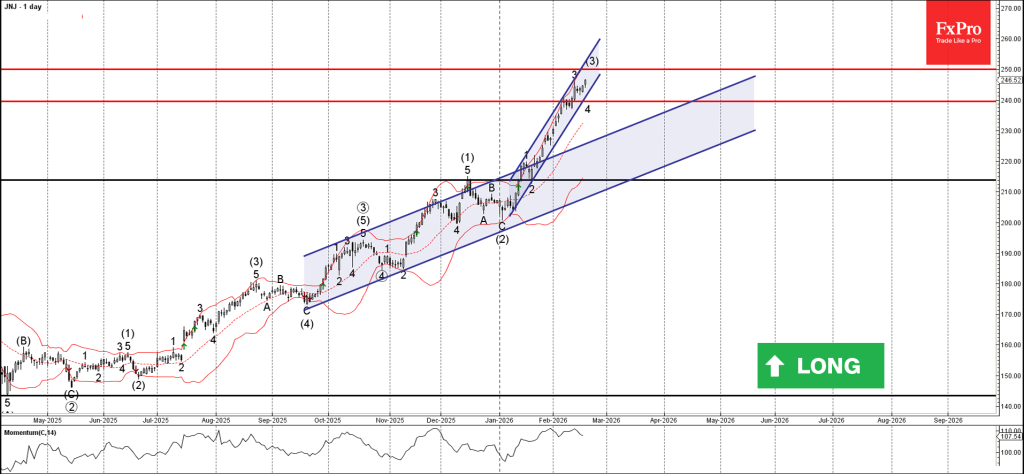

Johnson & Johnson: ⬆️ Buy – Johnson & Johnson broke resistance level 240.00 – Likely to rise to resistance level 250.00 Johnson & Johnson recently broke through the resistance level 240.00 (which has been reversing the price from the start.

February 20, 2026 @ 00:19 +03:00

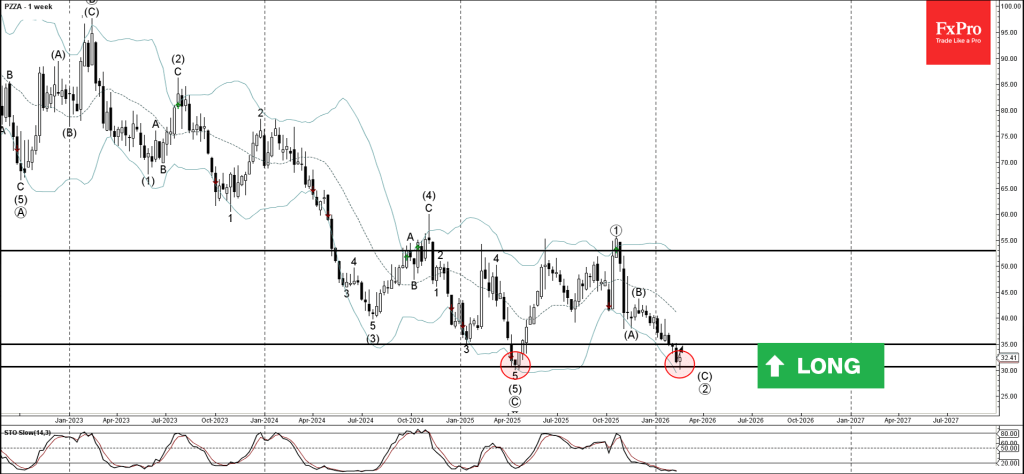

Papa John’s: ⬆️ Buy – Papa John’s reversed from long-term support level 30.60 – Likely to rise to resistance level 35.00. Papa John’s recently reversed from the strong support area between the long-term support level 30.60 (former yearly low from.

February 19, 2026 @ 23:09 +03:00

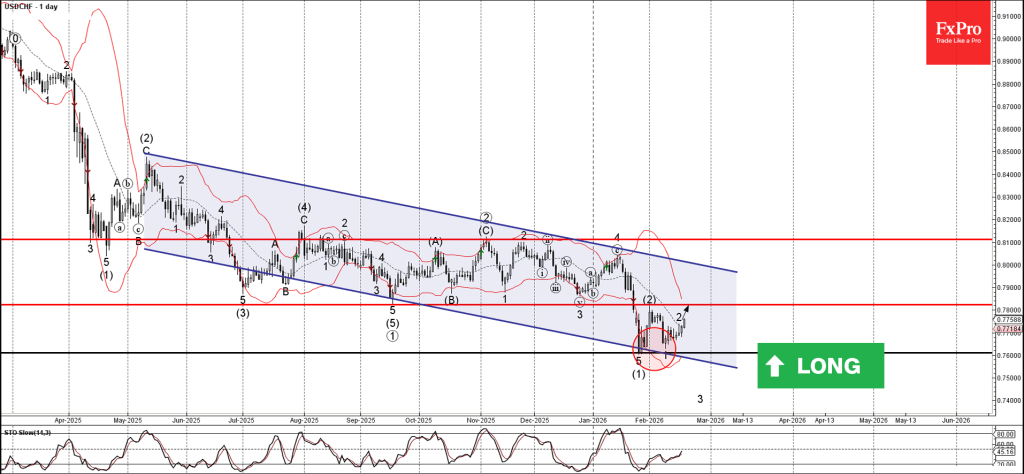

USDCHF: ⬆️ Buy – USDCHF reversed from support area – Likely to rise to resistance level 0.7800 USDCHF currency pair recently reversed from the support area between the key support level 0.7600 (which stopped earlier impulse wave (1) in December).

February 19, 2026 @ 23:08 +03:00

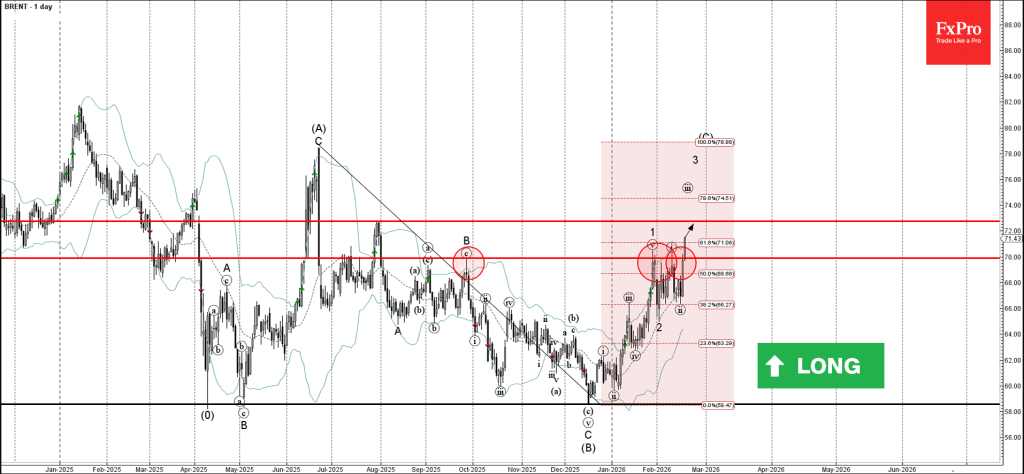

Brent Crude oil: ⬆️ Buy – Brent Crude oil broke the resistance area – Likely to rise to resistance level 72.75 Brent Crude oil recently broke the resistance area between the round resistance level 70.00 (which has been reversing the.

December 22, 2025 @ 18:54 +03:00

Medline officially began trading on Nasdaq after raising billions in a blockbuster listing that quickly became the standout IPO of the year.

November 13, 2025 @ 10:57 +03:00

Netflix, Inc. (Nasdaq: NFLX) has announced a 10-for-1 forward stock split approved by its Board of Directors. Each shareholder of record as of November 10, 2025, will receive nine additional shares for every share held after the close of trading.

March 22, 2021 @ 10:15 +03:00

The deep anger among some pro-British unionists in Northern Ireland over post-Brexit trade barriers that cut it off from the rest of the United Kingdom is emblazoned along the road from Belfast to the mainly Protestant port town of Larne..

January 06, 2021 @ 11:04 +03:00

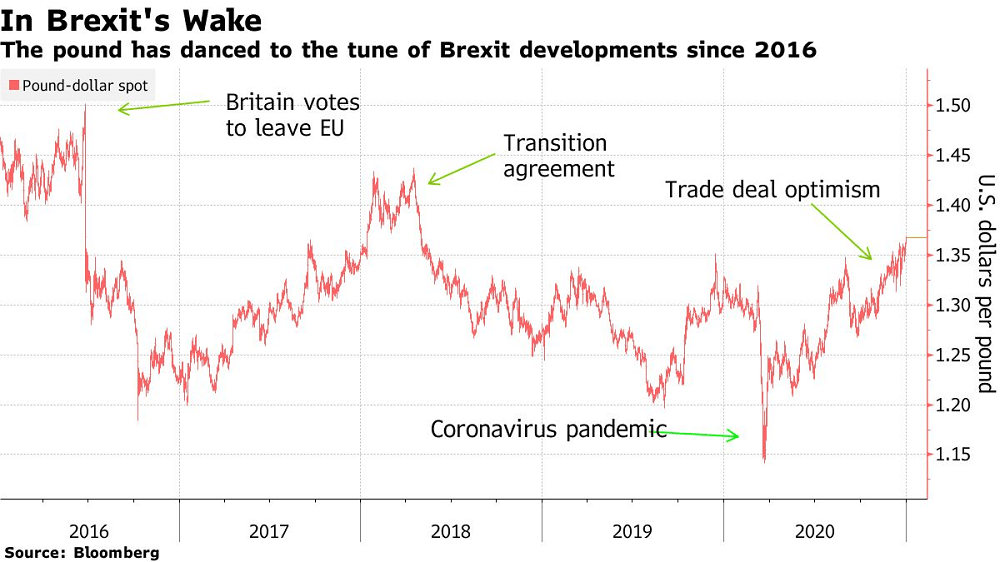

The pound’s Brexit deal honeymoon looks well and truly over, with the currency off to the worst start to the year among its Group-of-10 peers. Allianz Global Investors has taken a short position on sterling against the euro, citing the.