U.S. equities fell as investors took a cautious approach to a week full of central bank activity. Treasuries edged lower and gold retreated. The S&P 500 slipped for a second day after Friday’s blow-out jobs report altered market calculus for Federal Reserve rate cuts. Tech and health-care shares led decliners, with Apple Inc. falling 2.1% after a downgrade. U.S.-listed shares of BASF SE tumbled more than 5% after the German company cut its forecast. Shorter-term Treasuries fell and gold slipped fell for a third day, while the dollar edged higher versus major peers.

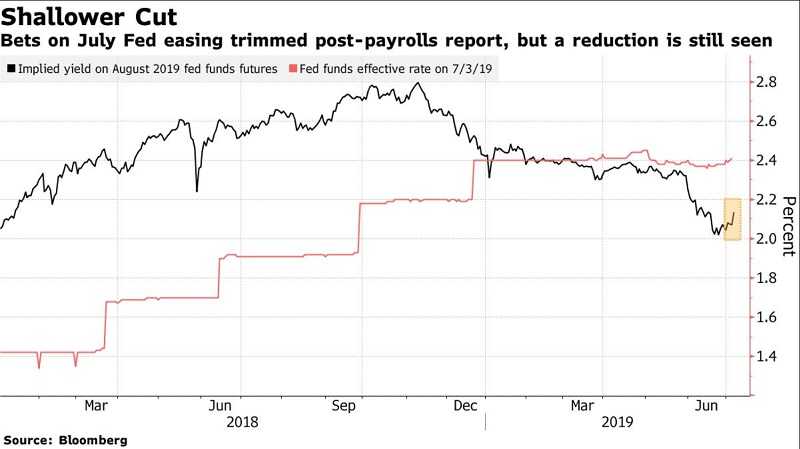

The main focus for markets this week looks to be Fed Chairman Jerome Powell, who will testify in Congress just days after the latest payroll report signaled that the American economy remains on track. U.S. stocks hit a record last week and a bond rally took yields to multiyear lows amid expectations the Fed will lower interest rates by at least a quarter of a percentage point at its July meeting. Joe “JJ” Kinahan, the chief market strategist at TD Ameritrade, sees a high likelihood of a July cut.

The Stoxx Europe 600 Index slipped, with Deutsche Bank AG surrendering earlier gains as traders weighed a plan to cut its workforce by one-fifth. The euro fell after German industrial-production data saw a slight pick-up in May. Greek bonds rose amid hope a new government elected over the weekend will prove to be market-friendly.

The S&P 500 Index decreased 0.5% as of 4 p.m. New York time. The Nasdaq 100 lost 0.7% and the Dow Jones Industrial Average fell 0.4%. The Stoxx Europe 600 Index declined 0.1%. Germany’s DAX Index dipped 0.2%. The MSCI Emerging Market Index fell 1.3%, the biggest fall in more than six weeks. The Turkish lira declined 1.9% to 5.7392 per dollar, the biggest decrease in two months. The yield on 10-year Treasuries rose more than one basis point to 2.05%. The two-year rate rose three basis points to 1.89%, while 30-year yields fell two basis points to 2.53%.