U.S. equities rallied Thursday after China indicated it wouldn’t immediately retaliate against the latest American tariff increase. Treasuries edged down, while a dollar gauge hit a two-year high. Every sector in the S&P 500 Index advanced after a spokesman for China’s commerce ministry said that escalating the trade war won’t benefit either side and that it was more important to discuss removing the extra duties. Stocks across Asia trimmed declines on the remarks, while the the Stoxx Europe 600 Index closed higher.

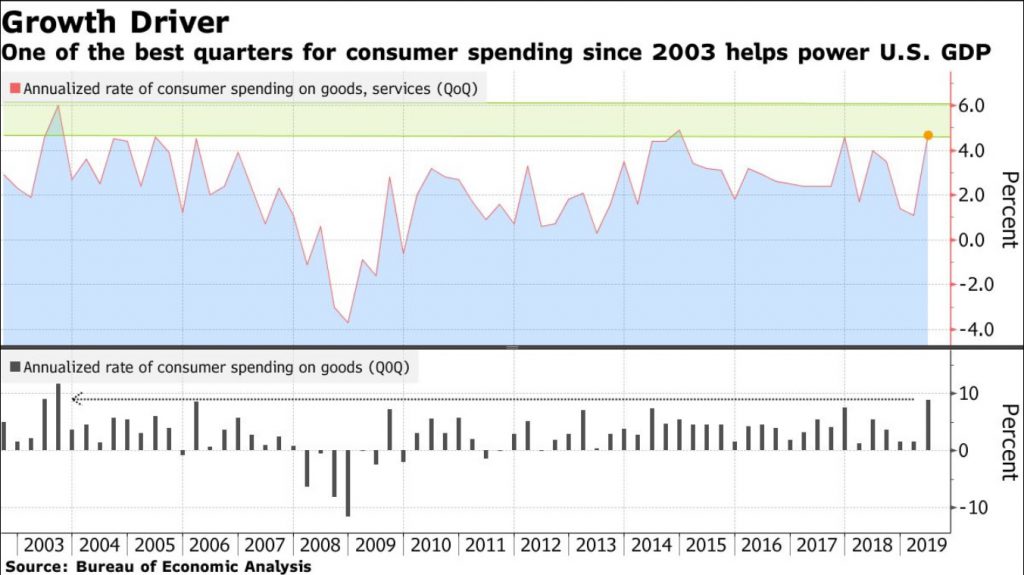

Market sentiment remains delicate after President Donald Trump’s recent pronouncements on trade and as investors try to sustain optimism for a resolution. U.S. economic growth slowed in the second quarter by more than initially reported, on weaker readings for categories including exports and inventories. Still, consumer spending remained robust, topping forecasts.

The S&P 500 Index increased 1.3% as of 12:31 p.m. New York time. The Stoxx Europe 600 Index increased 1% to near a four-week high. The U.K.’s FTSE 100 Index rose 1%. The MSCI Emerging Market Index increased 0.5%. The yield on 10-year Treasuries gained three basis points to 1.51%. The yield on two-year Treasuries advanced two basis points to 1.52%. Germany’s 10-year yield increased two basis points to -0.69%. Britain’s 10-year yield fell one basis point to 0.436%. West Texas Intermediate crude increased 1.6% to $56.66 a barrel. Gold fell 0.4% to $1,533.09 an ounce.